Financial services company Intercontinental Exchange, Inc. (ICE - Get Rating) operates regulated exchanges, clearinghouses, and listings venues for commodity, financial, fixed income, and equity markets. The company operates through the three broad segments of Exchanges; Fixed Income and Data Services; and Mortgage Technology.

ICE expects its operating expenses for the second quarter to be in line with its last reported quarter. It expects its operating expenses to come in $900 – $910 million, compared with the first quarter’s $907 million. The company expects a non-operating expense between $135 – $140 million for the second quarter.

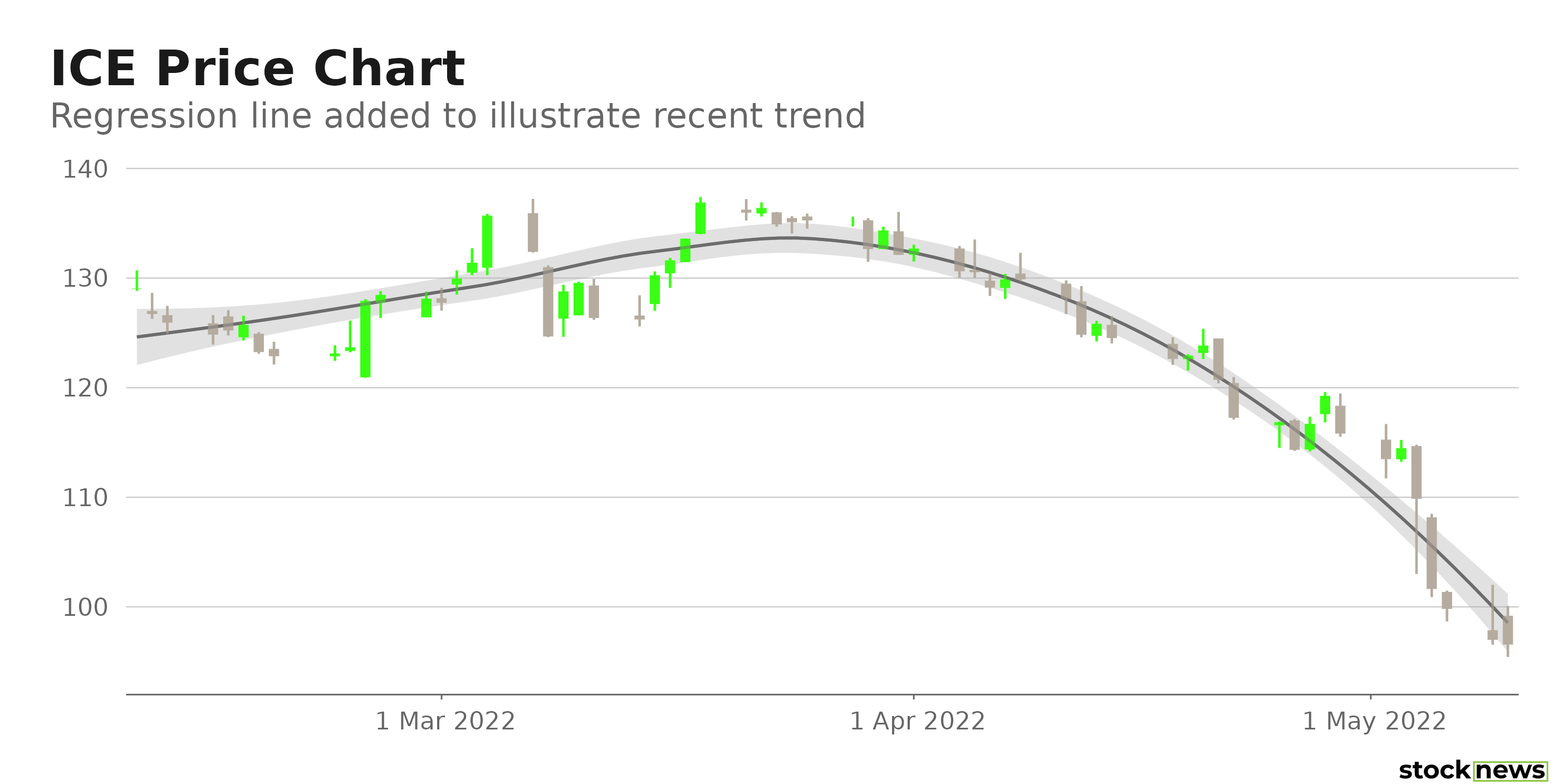

ICE’s stock has declined 15.5% in price over the past year and 29.1% year-to-date to close yesterday’s trading session at $96.99. It has declined 25.3% over the past month.

Here are the factors that could shape ICE’s performance in the near term.

Latest Acquisition

ICE, New York Stocks Exchange’s parent company, recently announced that it would acquire software and data analytics company Black Knight, Inc. (BKI) to support its mortgage servicing business. The acquisition is not cheap. The company bagged the deal for $13.10 billion. However, it may be some time before ICE realizes substantial gains from this venture, because the companies are not expected to close the transaction until the first half of 2023.

Stretched Valuations

In terms of its forward P/E, ICE is currently trading at 21.30x, which is 105.2% higher than the 10.38x industry average. The stock’s 9.34 forward EV/Sales multiple is 230.2% higher than the 2.83 industry average. In terms of its forward Price/Sales, ICE is trading at 7.27x, which is 150.9% higher than the 2.90x industry average. Its 2.27 forward Price/Book multiple is 105.4% higher than the 1.11 industry average.

POWR Ratings Reflect Bleak Prospects

ICE’s POWR Ratings reflect its bleak outlook. The stock has an overall D rating, which equated to Sell in our proprietary rating system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

ICE has a Value grade of D, which is in sync with its stretched valuations. The stock has a C grade for Stability, which is consistent with its 0.84 five-year monthly beta.

In the 12-stock Financial Marketplaces industry, ICE is ranked #11. The industry is rated F.

Click here to see the additional POWR Ratings for ICE (Growth, Momentum, Sentiment, and Quality).

View all the top stocks in the Financial Marketplaces industry here.

Bottom Line

ICE is expected to venture further into the digital mortgage business by acquiring BKI. However, that transaction is not likely to be completed before next year. Moreover, according to Investor Observer, ICE has an overall rank of #42 in its system, which means that 58% of stocks appear more favorable than ICE. Also, the stock looks overvalued at its current price. Hence, I think it might be better to avoid the stock now.

Want More Great Investing Ideas?

ICE shares were trading at $96.65 per share on Tuesday afternoon, down $0.34 (-0.35%). Year-to-date, ICE has declined -29.13%, versus a -15.65% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| ICE | Get Rating | Get Rating | Get Rating |