To say the market has started the year off on the wrong foot is an understatement. This is especially true in the high beta NASDAQ growth names. The Nazzy is now off to the worst start to a year since 2008.

Nervousness about the markets is evident. Both the VIX and VXN -or VIX of the NASDAQ- are near the highest levels of the past 12 months. Volatility is at an extreme. Important to remember, however, that volatility begets opportunity. Warren Buffett said as much when he stated “Be Greedy When Others Are Fearful”. Time to get a little greedy and add some lower risk, lower beta exposure names to the portfolio at lower prices.

2022 may finally be the year when value stocks outperform growth. This is especially true given that the Fed will be raising rates for the first time since 2018 plus begin to taper in earnest. Rising rates not only pressure profit margins for corporations but also compress valuation multiples such as P/E and P/S. Stocks like Microsoft will no longer be valued at 13x on a P/S basis.

This is a great time to sift through the recent rubble to uncover value stocks that look poised to be potential outperformers in this market environment. One name that fits the bill is Intel.

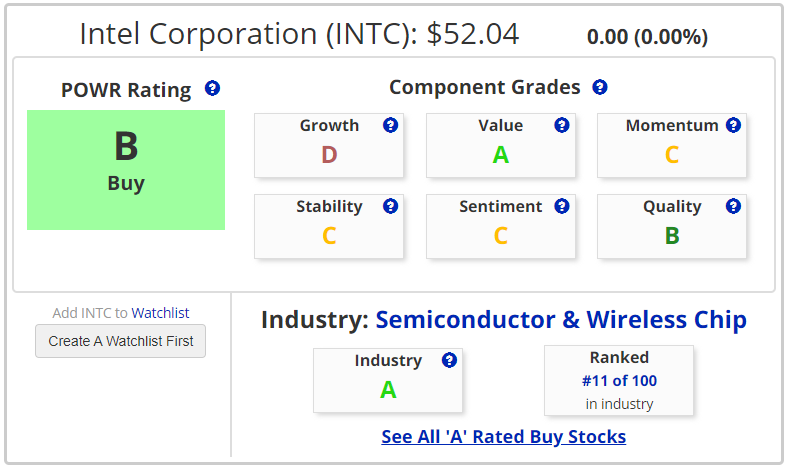

INTC has a POWR Rating of B – Buy. It is in the A Rated Semiconductor and Wireless Chip Industry and ranks a solid number 11 within the group of 100. The Value Grade is A while Growth is a D. This is ideal for the value beating growth thesis alluded to earlier.

Valuation View

Intel is certainly cheap from a fundamental perspective. Current P/E is just over 10 and well below the median of 12.73 seen over the past decade. Price/Sales well under 3 and nearing the lowest multiple since 2017.

INTC is also cheap on a comparative basis. A look at the table below shows just how much of a discount Intel is trading at compared to the rest of the peer group.

Technical Take

Shares of INTC are nearing oversold readings on a technical basis. The 9-day RSI is approaching 30 while MACD is now negative. Momentum is below zero while Bollinger Percent B is getting to that level as well. The stock is trading at a discount to the 20-day moving average.

Intel did hold the major support area at $52 and was unchanged on Friday while the overall market got clobbered. This further supports the value thesis.

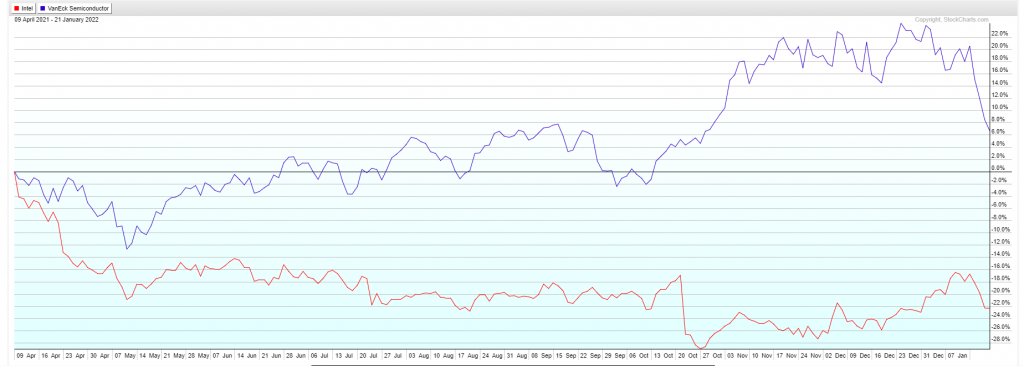

INTC is also looking good on a comparative technical basis. The stock had been a huge underperformer over the past 200 days to the other semiconductor stocks (SMH). That relative performance is beginning to revert to the mean. Look for INTC to continue to be an outperformer over the coming weeks.

Intel is also one of the Dogs of the Dow for 2022. This means it is the top ten for dividend yield of the 30 Dow stocks. The current yield is 2.67% with a low payout ratio of just 27%. This solid dividend payout will help serve to buffer volatility and add to overall return.

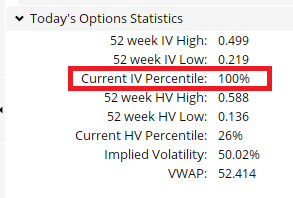

Volatility, and especially implied volatility, is at an extreme following the recent market carnage. INTC options are now trading at the 100th percentile. This means option prices in the past year haven’t been more expensive than they are now. It is also many times a reliable contrarian bullish signal given that the fear is getting to an extreme.

Investors looking to add the POWR Buy INTC to the portfolio may also want to take advantage of the uber-expensive option pricing by selling a covered call. This means you sell a call option versus every 100 shares of Intel stock you buy. Selling the call reduces your overall risk by the premium received while capping off upside gains at the strike price sold. It is an effective way to lower downside risk while still leaving room for upside appreciation.

For example, selling the January 2023 $55 call at $5.45 would reduce the cost of buying INTC stock at $52.04 by 11.5% to roughly $46.60 ($52.04 stock bought less than the $5.45 option sold). It does cap off the upside at $55 which would equate to an 18% return, plus dividends received along the way.

Earnings are due January 26 with a whisper number of $1.07 EPS on $18.39 billion in revenue.

Intel offers investors the rare combination of a cheap stock with expensive options. It may be time to get a little greedy and look to add INTC along with a covered call to your portfolio. In the words of the immortal Gordon Gekko, “Greed is Good”.

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

INTC shares were trading at $51.36 per share on Monday morning, down $0.68 (-1.31%). Year-to-date, INTC has declined -0.27%, versus a -9.69% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| INTC | Get Rating | Get Rating | Get Rating |

| SMH | Get Rating | Get Rating | Get Rating |

| NVDA | Get Rating | Get Rating | Get Rating |