The S&P 500 has managed a strong 22% YTD rally, fueled by both trade deal optimism and rate cut euphoria. But the US economy is monstrously complex and since the Great Recession ended over 10 years ago economic/market permabulls and bears have crowded the financial media with plausible-sounding predictions of either a continued rally or catastrophic impending recessionary crashes.

However, as one of my favorite financial columnists, Morgan Housel recently wrote

“You don’t get on TV, or invited to industry conferences, or big book deals, for predicting average outcomes. Pundits get paid for sitting three standard deviations away from sane analysts. Take away that incentive and you’d find that many extremists – even respected ones – are merely opportunists.” – Morgan Housel (emphasis added)

So let’s take a balanced look at the actual state of the US economy, both the good and bad, and see what that most likely means for interest rates and the stock market in the second half of the year.

The Good News About the Economy

In Q1 2019, we saw 3.1% GDP growth, mainly due to one time factors like unsustainably high inventory build-ups. The adjusted growth rate that excluded these was 1.5% and so in Q2 the consensus was for much slower growth of 1.8% to 2.0%.

The actual first estimate of Q2 GDP growth was 2.1%, slightly beating low expectations.

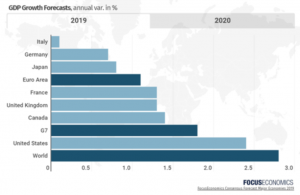

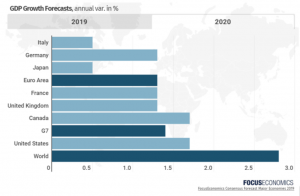

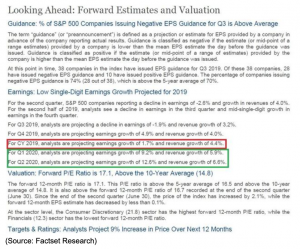

As you can see the current consensus estimates for US growth seem to support the current “goldilocks” interest rate euphoria scenario that has helped the market achieve its impressive (and low volatility) rally so far this year.

The Fed is mostly focused on slowing global growth (about 1% less than last year) created by the trade war. But overall US growth appears to be coming in strong, or at least much stronger than growth in the EU or Japan. This creates a tailwind for US Treasury bonds which set overall interest rates for our economy. That’s because a stronger US economy (relative to other economies) means a stronger dollar and more incentive for foreign bond investors to keep buying US treasuries and thus driving our yields down, or at least keeping them near their current 2% levels (on 10-year yield).

At least this quarter this state of affairs might help keep stocks at their current levels (forward PE of 17.3 vs 16.2 25-year average). However, there is also bad news to consider.

The Bad News About the Economy

Q2’s relatively strong growth was due to consumer spending rising 4.3% YOY and government spending rising 5%. Business investment fell 5.5% (trade war effects) and inventories dragged down GDP growth by 0.9%.

According to the Fed’s data, US manufacturing has fallen into a mild recession (off 2018’s record highs) with Q2 contraction of 2.2% YOY. Fortunately, manufacturing is just 12% of our economy, and consumers are staying optimistic and spending strongly due to the continued tight job market.

However, the bad news is that consumer sentiment is fickle and might turn quickly should we get a major economic shock, such as the final China tariff round going into effect. This might happen as early as mid-September should trade talks (which restarted this week) don’t produce significant progress (by Trump’s definition).

The growth we’ve seen this year has been impressive and shows the resilience of the US economy, which is so diversified that even the guttings of certain industries (like agriculture or natural gas producers) can still be overcome by strong growth in services driven by consumer spending (70% of our economy).

Next year, assuming no trade deal occurs, the consensus is for much slower US growth, with global growth remaining under 3% (3.5% to 4% has been the recent norm). US growth would still be near the top of the G7, but not that much better than our major developed rivals.

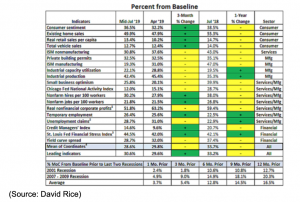

As things stand now, there is very little risk of either a 2019 or 2020 recession. The 19 leading economic indicators David Rice has tracked for years on EconomicPI.com, currently indicate that it would take at least 18 months before we fall into the recessionary danger zone. Or at least that’s what would happen if the trade war recession were like the last two.

In reality, we haven’t seen a trade war-induced recession in almost 90 years, so the economic deterioration might be more rapid than current models predict. So what does this mean for interest rates and stocks?

What It Likely Means for Interest Rates and Stocks for the Rest of the Year

For good or ill how the stock market does for the rest of the year is largely going to depend on the Fed and how many rate cut it gives us. As I’ve been warning for months now, investors need to be very careful about this TINA (there is no alternative) rate cut rally.

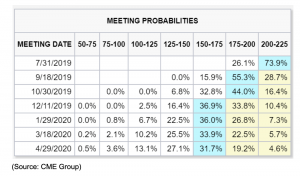

That’s because there are no certainties on Wall Street, but right now bond futures are pricing in a 100% probability of a rate cut on Wednesday, and a 55% probability of at least three rate cuts by the end of the year.

What actual FOMC members have said in recent weeks is that we’re likely to get 50 bp of cuts as insurance against a recession but then the Fed plans to take a wait and see approach. Those two cuts are likely to be spaced out in July and September.

In order for three rate cuts to happen US economic data would need to get weaker, which doesn’t appear to be likely (NY Fed’s real-time economic model is expecting 2.2% growth in Q3 based on latest data).

And there is one other thing to consider about the current rate cut rally.

Factset reports on Thursday’s and factoring in the Friday rally of 0.5%, the forward PE on the S&P 500 is at 17.3. That’s 7% above the 25-year average of 16.2, which either requires earnings to come in stronger than expected over the next 12 months or the Fed to deliver on the expected rate cuts (with long-term rates following suit).

I just explained why interest rates might disappoint, but stock prices are ultimately a function of earnings and cash flows. Analysts remain very optimistic about next year, likely due to weak comps (EPS growth started the year at 10% and is now basically flat) as well as a trade deal.

But China has said numerous times that it won’t agree to any deal that doesn’t immediately end recent tariffs and President Trump has said he won’t agree to that. So it’s very possible a trade deal doesn’t happen this year or even by the election.

That would blow up the 11% EPS growth analysts currently expect in 2020 and result in the forward PE of the market steadily rising even if stocks stay flat.

The good news is that the damage the trade war is doing means that it will EVENTUALLY end, the question is just the timing and whether or not it’s President Trump that ends it.

But as far as the short-term action of the market, well there you have to protect yourself. I recently highlighted 10 high-yield defensive blue chips trading at fair value or better (most are deeply undervalued) that are a good place for conservative income investors to put their money.

These are not guaranteed to go up during a future correction (both Goldman and Merril Lynch estimate a 60% chance of a correction within three months), but they are likely to outperform the broader market in a downturn.

And don’t forget that rebalancing your portfolio periodically (every six to 12 months is a good rule of thumb, I personally do it every 12 months in the first week of July) is a good idea. A 22% YTD rally might mean that you are now overweight equities, which might feel great for as long as the “goldilocks” rate cut rally persists.

But as December 2018 and May 2019 showed us, stocks are NEVER bond alternatives and if you own too much of them that can result in some unpleasant volatility that can cost you sleep. More importantly, if you need to sell assets within the next three to five years to meet expenses (retirees on some form of the 4% rule) improper asset allocation can make you a forced seller at precisely the wrong time.

Which is why my personal capital allocation plan (what I do with new discretionary savings) is based on recession risk and I’m currently putting 60% of my monthly savings into undervalued blue-chip stocks and 40% into bonds (equal weighting of MINT, SCHZ, and SPTL).

What I’m buying is about evenly split between cyclical and defensive companies. This is my low-risk way of hedging between no recession (the 65% probability outcome) and a recession that sends almost all equities plunging and creates sensational buying opportunities. I don’t actually need to own bonds (due to my age, time horizon and various other unique financial characteristics). But the bond ETFs I’d own would give me stable or appreciating assets to sell during a bear market to buy three stocks per week.

- 1 super SWAN (level 11/11 quality):

- 1 high-yield deep value stock (could be trading at truly insane valuations)

- 1 tech stock

- Possibly QQQ, the Nasdaq ETF (to be sold opportunistically during future overdone rallies and used to fund undervalued dividend-paying purchases)

I don’t have a firm rule for what I buy each week (other than it has to be above average quality and deeply undervalued) but is based on the best risk-adjusted opportunities I see right now.

Bottom Line: The Economy Is Fine For Now, So Stocks Might Stay In Their “Goldilocks zone” Rally, but Hope is Not a Good Long-Term Investing Strategy

Because of the high stakes involved with people’s life savings and retirement plans, the media LOVES wild predictions, pitched with high conviction and sometimes 100% certainty. But there are no guarantees on Wall Street, where the probable sometimes doesn’t happen and the “impossible” occurs with alarming regularity.

Anyone who tells you they are 100% certain they can predict what the economy, interest rates, or stock market is going to do in the short-term is either ignorant (of the probabilistic nature of this business), an idiot (is aware of but ignores the probabilistic nature of this business) or a liar.

What I can tell you, based on the latest economic data is that, despite the trade war-induced hit to manufacturing, the US economy continues to look relatively strong, especially compared to other developed countries.

That might change relatively quickly if the final tariff round against China goes into effect as early as September. But as long as things don’t get worse on the trade war front it appears that the risks of a recession beginning within the next 9 to 12 months are 33% to 37%, and no downturn is likely in 2020. A recession MIGHT begin in 2021 but would require the trade war to continue through then, which isn’t likely no matter who wins the 2020 election.

As for interest rates, the Fed is likely to give us two “insurance” cuts, in July and September, and then take a wait and see approach. The market might not be too happy about that (stocks and bonds are pricing in three to four cuts) which is why it’s likely a good idea to use the current rate cut rally to rebalance your portfolio before December’s meeting.

Always remember that while financial media pundits might make every bit of economic, earnings or trade news SEEM like a big deal, ultimately it’s mostly noise. The long-term thesis of a quality company, bought at a good to great price, will not often be shattered by short-term news.

If your reason for owning a company is dependent on one particular outcome occurring with 100% probability, then that’s speculation, not investing. That’s because such “bets” are based on hope, not a sound financial plan that is robust and includes the proper asset allocation and risk management needed to achieve your financial goals, no matter what the economy, interest rates or the stock market does in the short-term.

.INX shares were trading at $301.39 per share on Monday afternoon, down $0.62 (-0.21%). Year-to-date, .INX has gained 21.71%, versus a % rise in the benchmark S&P 500 index during the same period.

This article is brought to you courtesy of Stock News.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| .INX | Get Rating | Get Rating | Get Rating |