During the past nine months, CarMax (KMX) has formed a key level of resistance, which could lead to a breakout very soon.

CarMax (KMX - Get Rating) sells, finances, and services used and new cars through a chain of over 220 retail stores. As the company continues to improve the customer shopping experience and enhance its online shopping capabilities, revenue growth should follow. KMX’s temporary cost cutting initiatives should also provide relief in the near term.

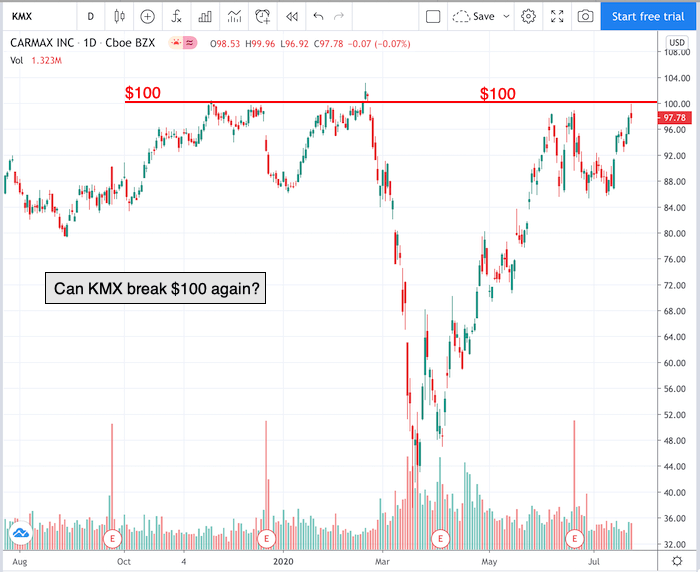

Take a look at the 1-year chart of KMX below with added notations:

Chart of KMX provided by TradingView

KMX has formed a key level of resistance to watch at the $100 (red) mark. The stock has tested that $100 level multiple times since the end of last year. Another close above that $100 level should lead to a breakout.

Have a good trading day!

Good luck!

Christian Tharp, CMT

@cmtstockcoach

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

Newly REVISED 2020 Stock Market Outlook

7 “Safe-Haven” Dividend Stocks for Turbulent Times

KMX shares were trading at $97.17 per share on Friday morning, down $0.61 (-0.62%). Year-to-date, KMX has gained 10.84%, versus a 0.69% rise in the benchmark S&P 500 index during the same period.

About the Author: christian

Christian is an expert stock market coach at the Adam Mesh Trading Group who has mentored more than 4,000 traders and investors. He is a professional technical analyst that is a certified Chartered Market Technician (CMT), which is a designation awarded by the CMT Association. Christian is also the author of the daily online newsletter Todays Big Stock. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| KMX | Get Rating | Get Rating | Get Rating |