CarMax Inc. (KMX): Price and Financial Metrics

KMX Price/Volume Stats

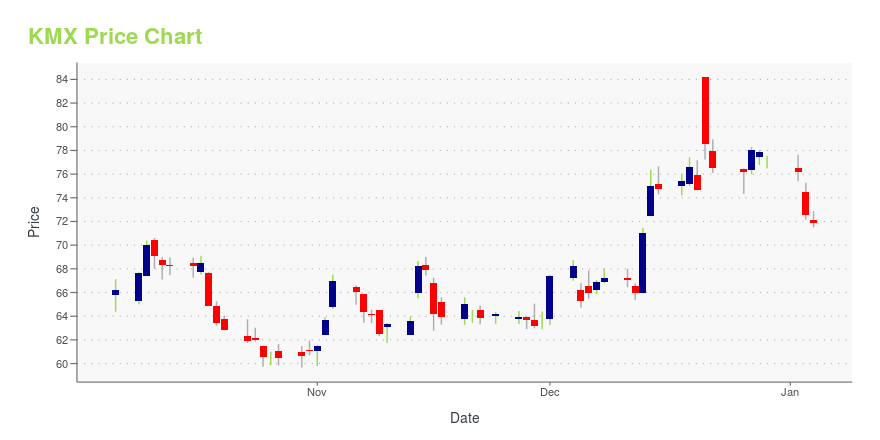

| Current price | $83.02 | 52-week high | $88.22 |

| Prev. close | $81.55 | 52-week low | $59.66 |

| Day low | $82.12 | Volume | 1,002,712 |

| Day high | $83.63 | Avg. volume | 1,995,096 |

| 50-day MA | $73.78 | Dividend yield | N/A |

| 200-day MA | $72.35 | Market Cap | 12.96B |

KMX Stock Price Chart Interactive Chart >

CarMax Inc. (KMX) Company Bio

CarMax is a used vehicle retailer based in the United States. It operates two business segments: CarMax Sales Operations and CarMax Auto Finance. The corporate entity behind the formation of CarMax was Circuit City Stores, Inc. The first CarMax retail location opened in September 1993 in Richmond, Virginia. As of May 2021, CarMax operates 225 locations. (Source:Wikipedia)

Latest KMX News From Around the Web

Below are the latest news stories about CARMAX INC that investors may wish to consider to help them evaluate KMX as an investment opportunity.

Auto Roundup: KMX Beats on Q3 Earnings, CMI to Pay $1.7B in Fines & MoreCarMax (KMX) surpasses fiscal third-quarter 2024 earnings estimates. Cummins is set to pay a penalty of roughly $1.7 billion for the violation of the Clean Air Act. |

Results: CarMax, Inc. Beat Earnings Expectations And Analysts Now Have New ForecastsIt's been a good week for CarMax, Inc. ( NYSE:KMX ) shareholders, because the company has just released its latest... |

CarMax, Inc. (NYSE:KMX) Q3 2024 Earnings Call TranscriptCarMax, Inc. (NYSE:KMX) Q3 2024 Earnings Call Transcript December 21, 2023 CarMax, Inc. beats earnings expectations. Reported EPS is $0.52, expectations were $0.43. KMX isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here). Operator: Ladies and gentlemen, thank you for standing by, […] |

3 Growth Stocks Ready for a 2024 BreakoutInvestors would be smart to take positions in these growth stocks for 2024, each of which has breaking news currently. |

CarMax (KMX) Tops Q3 Earnings Expectations, Lags Sales MarkWhile CarMax's (KMX) bottom line improves year over year and surpasses estimates, the top line contracts year over year and misses the Zacks Consensus Estimate. |

KMX Price Returns

| 1-mo | 14.15% |

| 3-mo | 19.30% |

| 6-mo | 18.41% |

| 1-year | 1.17% |

| 3-year | -38.49% |

| 5-year | -8.94% |

| YTD | 8.18% |

| 2023 | 26.03% |

| 2022 | -53.24% |

| 2021 | 37.87% |

| 2020 | 7.74% |

| 2019 | 39.76% |

Continue Researching KMX

Here are a few links from around the web to help you further your research on Carmax Inc's stock as an investment opportunity:Carmax Inc (KMX) Stock Price | Nasdaq

Carmax Inc (KMX) Stock Quote, History and News - Yahoo Finance

Carmax Inc (KMX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...