2019 US Investing champion Leif Soreide recently noted that certain biotechnology stocks tend to be unaffected by the ups and downs of the overall market, providing an opportunity for profitable trades even during challenging times. In this article, we’ll explore this concept by examining Moderna and Pfizer.

What is the Difference Between Moderna and Pfizer?

Many will be familiar with Moderna and Pfizer through their COVID-19 products. However, one key difference is that while Moderna and Pfizer are both biotechnology companies that specialize in developing innovative treatments and therapies, the methods they use to develop these treatments and therapies vary. Moderna specializes in messenger RNA (mRNA) technology, which uses genetic material to instruct cells to produce disease-fighting proteins, and relies exclusively on this technology. On the other hand, Pfizer has utilized mRNA technology – but also focuses more on small molecule drugs, which are designed to bind to a specific protein and disrupt its normal function.

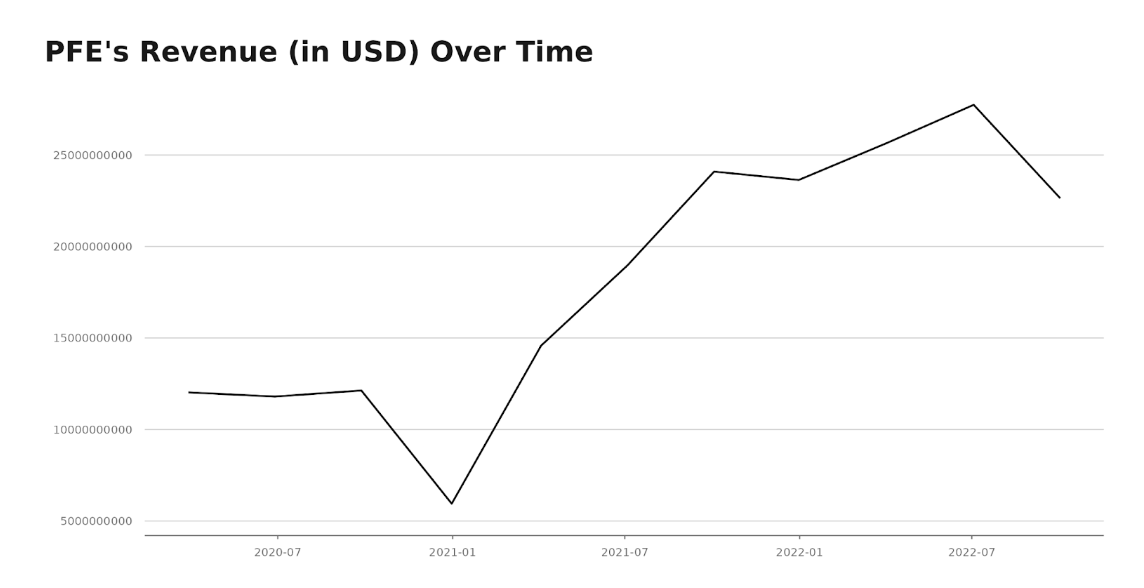

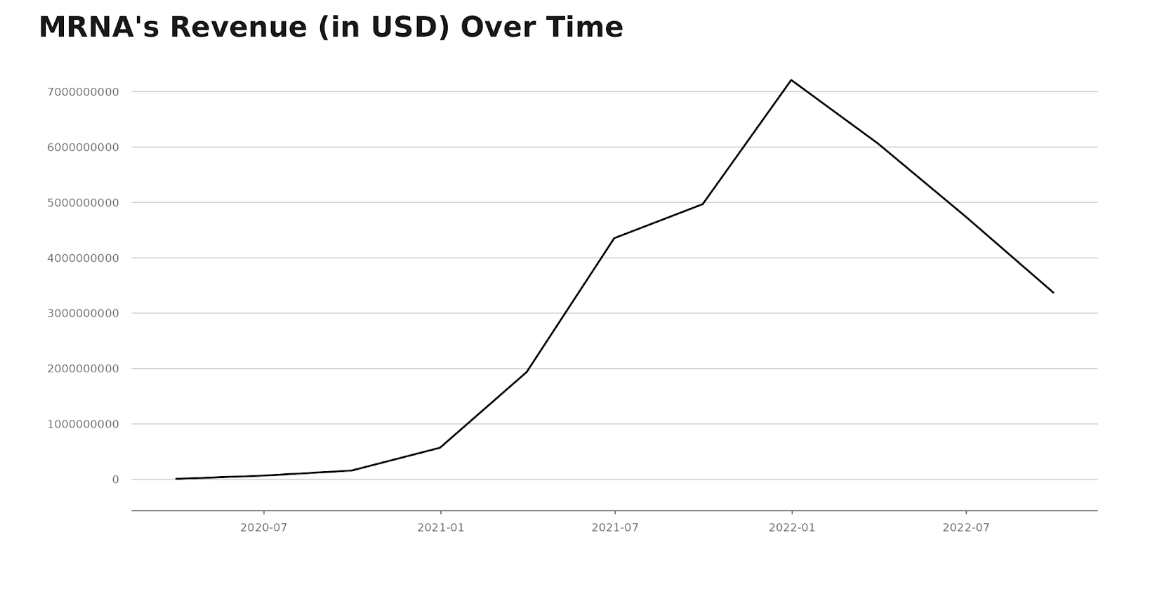

Comparing Moderna and Pfizer’s Revenue

As one might expect, revenue (in USD) of both PFE and MRNA has increased significantly since the start of the COVID-19 pandemic. From March 2020 to October 2022, PFE’s quarterly revenue has grown from just over $12 billion to over $22 billion, representing a growth of approximately 88%. Meanwhile, Moderna’s quarterly revenue grew from over $8.3 million to $33.6 million, demonstrating an increase of nearly 400%. With that said, it is worth noting that both firms saw decline in their quarterly revenue in the most recent quarter – especially Moderna. If this is indicative of what happens to the revenue of these companies as booster uptake rates remain low, then that may be a cautionary signal for investors.

Below is a chart of Pfizer’s quarterly revenue:

And here is Moderna’s quarterly revenue over time.

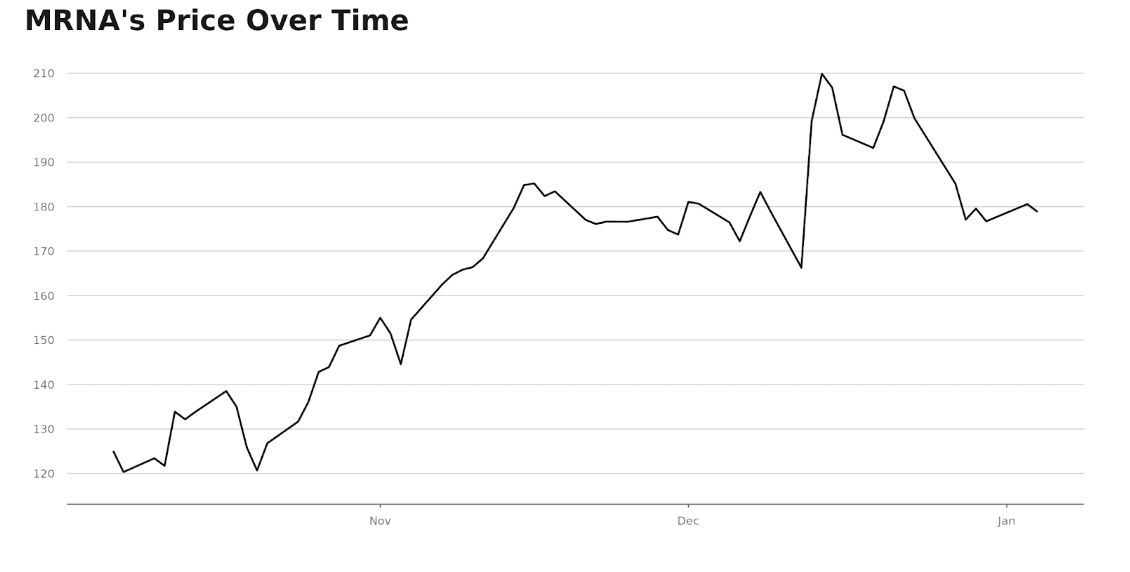

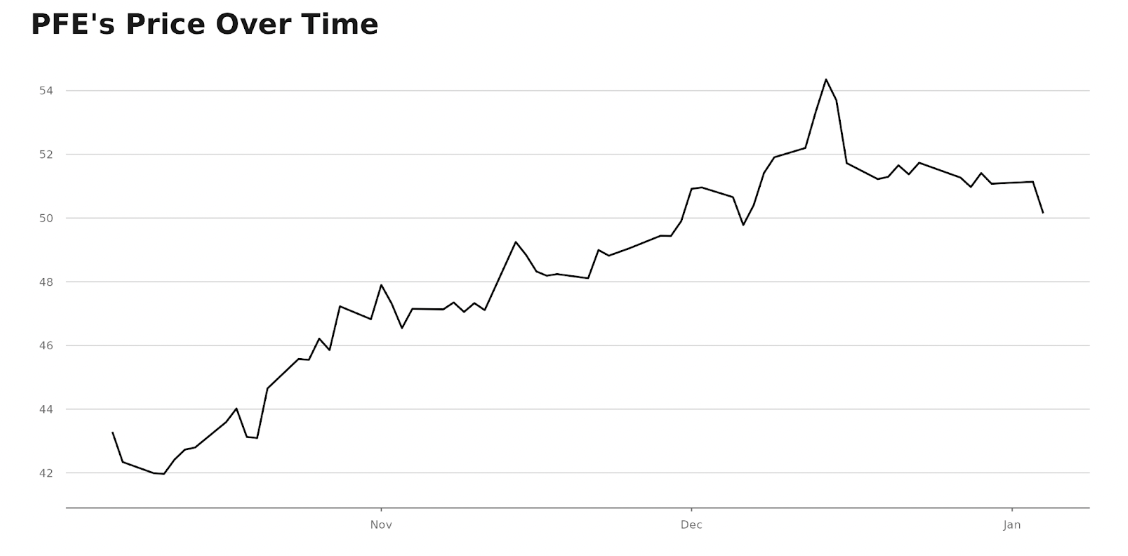

What is Momentum Telling Us?

In spite of lackluster revenue, the trend of MRNA’s share price has been generally increasing over the past 90 days. Price began near $125 and is currently near $178, representing an increase of approximately $53. The greatest jump in the share price was between December 13, 2022 and December 14, 2022, where it increased from just over $199 to a bit over $209, representing a $10 – or 5% – increase. Here is a chart of MRNA’s price over the past 90 days.

Similarly, the trend in PFE’s share price is an upwards one. On October 6, 2022, the price was around $43.29; from there it increased to about $54.35 on December 14, 2022, just a little over two months later. After that, there was a decrease and the price maintained around $51 throughout December and January of 2023. Here is a chart of PFE’s price over the past 90 days.

Momentum May Look Good, But Revenues are Declining

At first glance, price momentum for MRNA and PFE look good over the past 90 days, validating the comment about biotech stocks made by Leif Soreide. But, note that these gains – which are slowing – are occurring against falling revenue, and a potentially dim outlook for mRNA injections in the immediate future.

Want More Great Investing Ideas?

shares were trading at $379.17 per share on Thursday morning, down $4.59 (-1.20%). Year-to-date, has declined -0.85%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Simit Patel

Simit Patel has 2 decades of investing experience applying a top-down approach starting with macroeconomics followed by price action technical analysis to find more winning trades. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MRNA | Get Rating | Get Rating | Get Rating |