One of my favorite tools in the POWR Stocks toolbox is the Stock Screener. It does much of the heavy lifting that is crucial in my daily trade selection and construction process. As an option trader and analyst, I look to combine the elements of fundamental, technical and volatility analysis along with the POWR Screener to try and identify trade ideas with a probabilistic edge.

A walk through of one of the most recent potential trade ideas will shed some light on how to better harness the power of the POWR Stock Ratings.

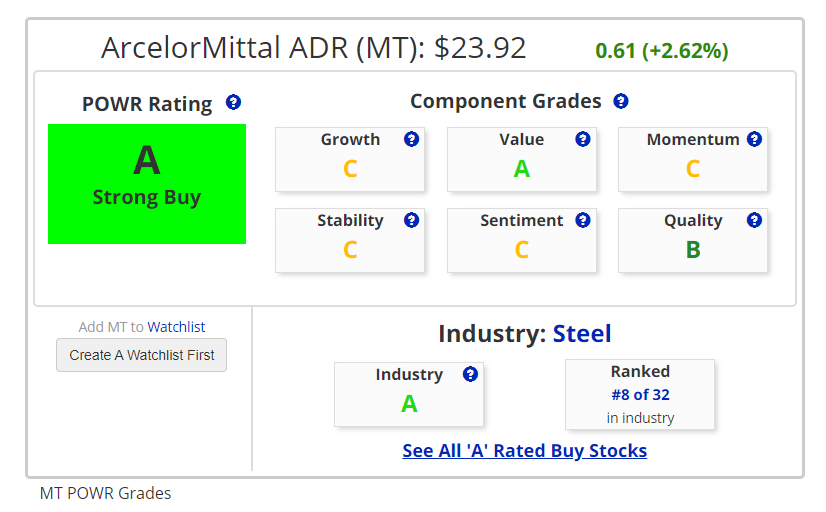

I set up the POWR Stock Screener to identify only A Rated – Strong Buy- stocks in A Rated -Strong Buy- industries. Additionally, the screen included just those stocks that carried a Value component grade of A. Finally, I wanted to see just those stocks trading below their 20-day moving average.

The thought process was to lower risk by focusing more on Value and stocks that haven’t rallied too hard given the recent pop in the overall market the past several days. Chasing performance is usually not a good idea, especially in this market environment.

This narrowed my list of potential trade candidates down to 18. Since we are looking for potential option trades, low-priced stocks aren’t nearly as viable for option strategies. $20 is the minimum level I would consider for a bona-fide beneficial option strategy versus buying the stock outright.

That left only six candidates. Five of those six really didn’t have enough option volume to justify trading options on that stock. Always important to consider liquidity in option trading. For example, Veritiv (VRTV) traded just 8 option contracts on Friday and had enormously wide bid-ask spreads.

That left us one potential candidate – our old friend ArcelorMittal (MT). The POWR Options Portfolio has traded MT options four times in the past with solid success.

After identifying this A Rated stock in an A rated industry with a Value Grade of A that is trading below the 20-day moving average, it is always a good idea to layer in some technical analysis.

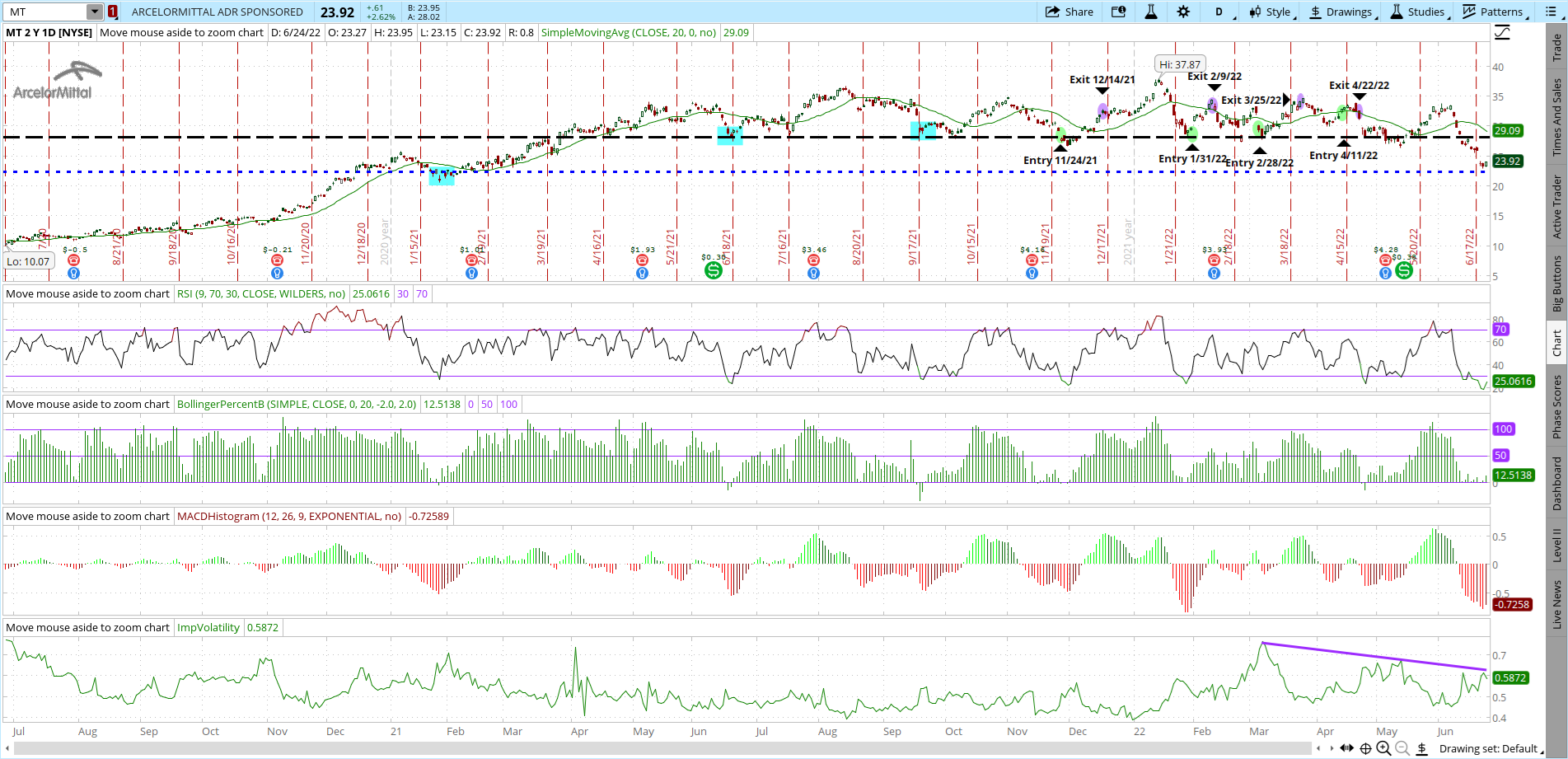

MT stock is the most oversold it has been in the past two years. 9-day RSI went below 20 but has improved. MACD reached an extreme as well before turning higher. Bollinger Percent B printed negative then regained positive territory. Shares are trading at a massive discount to the 20-day moving average. There is looming support at $22.50.

Previous times all these indicators aligned in a similar fashion marked significant short-term lows in MT stock (highlighted in aqua). I also added in the prior four times the POWR Options Portfolio took a position in MT calls.

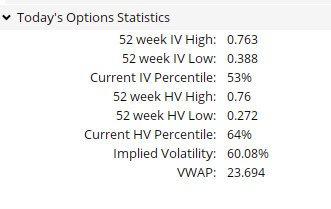

Interesting to note on the chart that Implied Volatility (IV) is now well below the highs over the past several months. This means option prices are comparatively less expensive, a good thing when looking to buy options.

IV stands at the 53rd percentile, meaning option prices are about average in price. They are cheap, however, when compared to the actual, or Historic Volatility (HV), at 64%.

It is useful to do some peer group analysis as well. The POWR Stock Industry Ratings are another very useful tool for traders and investors alike. The Steel Industry is ranked number 5 overall and is at the 96th percentile. MT stands near the top of the list at number 11.

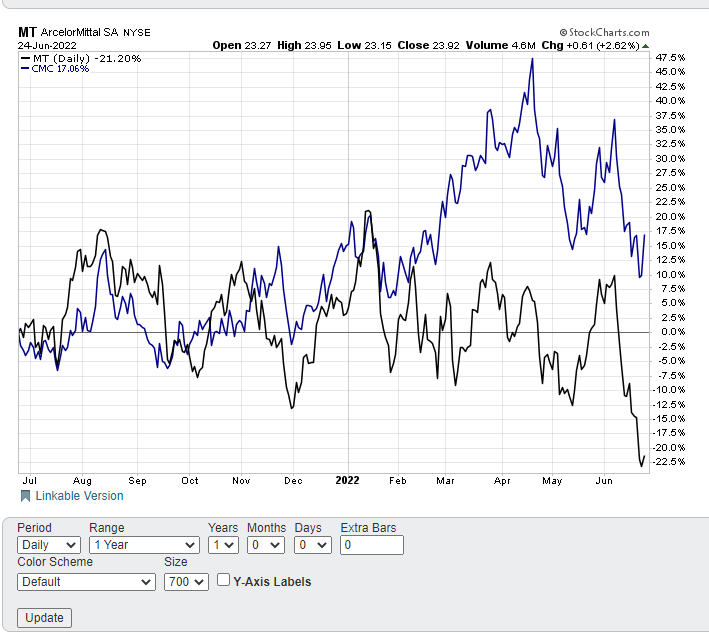

By comparison, Commercial Metals (CMC) is just a C Rated – Neutral -stock. It ranks near the low end at number 26 within steel stocks.

Yet CMC has been a big out-performer to MT over the past few months. Over the past year CMC is up 17% while MT is down just over 21%. Prior to February both stocks where highly correlated. Makes sense since they are both steel stocks. Since then, however, CMC has moved higher by about 5% while MT has fallen over 32%.

Look for this divergence to begin to converge with the Strong Buy MT being a relative out-performer to the Neutral CMC over the coming weeks. We very well may be adding some MT calls to the POWR Options Portfolio very soon.

Combining the POWR Stock Screener along with additional analysis can create a comprehensive trade identification system to help find the edge and put the odds in your favor. That’s what we look to do everyday with the POWR Options Portfolio. Remember, trading is about probability and not certainty.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

MT shares closed at $23.92 on Friday, up $0.61 (+2.62%). Year-to-date, MT has declined -23.94%, versus a -17.26% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MT | Get Rating | Get Rating | Get Rating |

| CMC | Get Rating | Get Rating | Get Rating |