Headquartered in Israel, Nano Dimension Ltd. (NNDM - Get Rating) is an industry leader in Additively Manufactured Electronics (AME), Printed Electronics (PE), and Micro-Additive Manufacturing. It is known for its Dragonfly lights-out digital manufacturing system.

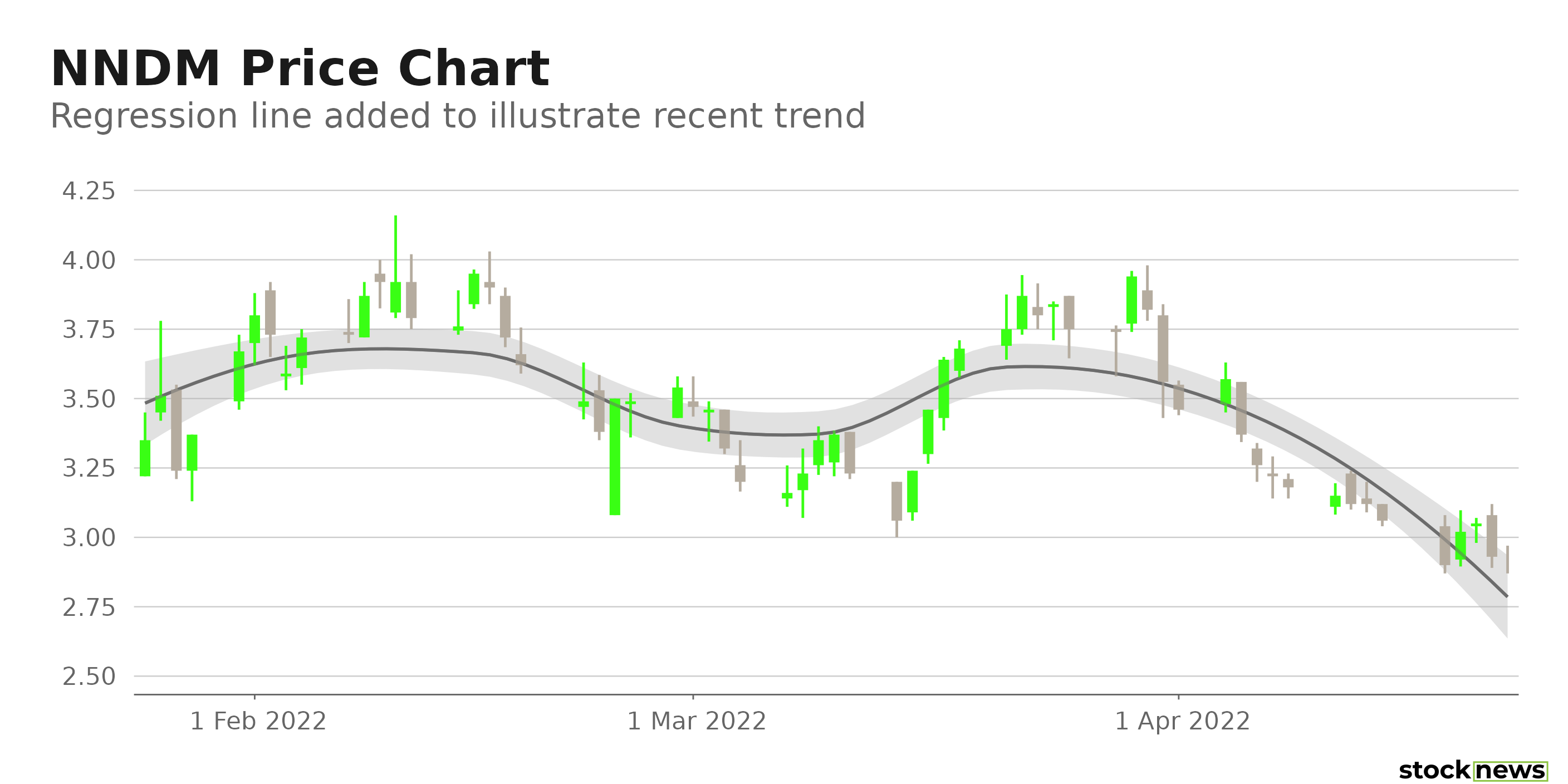

The stock is down 60% in price over the past year and 47.8% over the past six months to close Friday’s trading session at $2.9. In addition, it is currently trading 68.9% below its 52-week high of $9.33, which it hit on June 28, 2021.

While the company posted robust revenue growth in its last reported quarter, it faces stiff competition from its peers with the growing use of 3D printing technology in the automotive industry. In addition, the company’s poor bottom-line performance and negative profitability could further mar its growth.

Here is what could shape NNDM’s performance in the near term:

Poor Bottom line Performance

NNDM’s total revenue increased 282.1% year-over-year to $7.53 million for the three months ended Dec. 31, 2021. However, its operating loss increased 1883.8% from its year-ago value to $169.24 million. Its comprehensive loss grew 815.5% from the prior-year quarter to $159.65 million.

Poor Profitability

NNDM’s 45.4% trailing-12-months gross profit margin is 9.9% lower than the 50.4% industry average. Its trailing-12-months cash from operations stood at negative $42.58 million compared to the $87.74 million industry average. Also, its trailing-12-months ROA, levered FCF margin, and ROC are negative 14.5%, 153.2%, and 5.1%, respectively.

POWR Ratings Reflect Uncertainty

NNDM has an overall F rating, which equates to a Strong Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. NNDM has an F grade for Stability and a D for Quality. The 2.18 stock beta is consistent with its Stability grade. In addition, its poor profitability is in sync with the Quality grade.

Among the eight stocks in the F-rated Technology – 3D Printing industry, NNDM is ranked #7.

Beyond what I have stated above, one can view NNDM ratings for Value, Momentum, Growth, and Sentiment here.

Bottom Line

While the company reported strong revenue growth in its last earnings release, its negative profit margin could make investors wary of its long-term prospects. In addition, the stock is currently trading below its 50-day and 200-day moving averages of $3.45 and $4.80, respectively, indicating a downtrend. So, we believe the stock is best avoided now.

How Does Nano Entertainment Ltd. (NNDM) Stack Up Against its Peers?

While NNDM has an overall F rating, one might want to consider its industry peer, Materialise NV (MTLS - Get Rating), which has an overall B (Buy) rating.

Want More Great Investing Ideas?

NNDM shares fell $0.05 (-1.72%) in premarket trading Monday. Year-to-date, NNDM has declined -25.26%, versus a -10.63% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| NNDM | Get Rating | Get Rating | Get Rating |

| MTLS | Get Rating | Get Rating | Get Rating |