Nucor Corporation (NUE - Get Rating) manufactures and sells steel and steel products under the Steel Mills; Steel Products; and Raw Materials segments. The company serves heavy equipment, infrastructure, construction, automotive, energy, and agriculture sectors.

In June, NUE announced that its Towers & Structures business unit would construct its second utility structures production facility in Crawfordsville, Indiana. This is expected to help the company meet the rising demand for utility structures from renewable energy projects.

This should also drive the company toward incorporating more sustainable practices in its operations. In the same month, NUE signed an agreement with ExxonMobil Corporation (XOM - Get Rating) to capture, transport, and store carbon from the company’s Direct Reduced Iron (DRI) plant in Convent, Louisiana, aligning with the company’s decarbonization efforts.

While sustainable practices should boost NUE’s long-term prospects, it might be long before the company realizes these gains. For example, its collaboration project with XOM is expected to start no earlier than 2026.

Hence, let’s look at the trends of some of NUE’s key financial metrics to understand why it could be wise to wait for a better entry point in the stock.

Analyzing Nucor Corporation’s (NUE) Financial Performance from 2020 to 2023

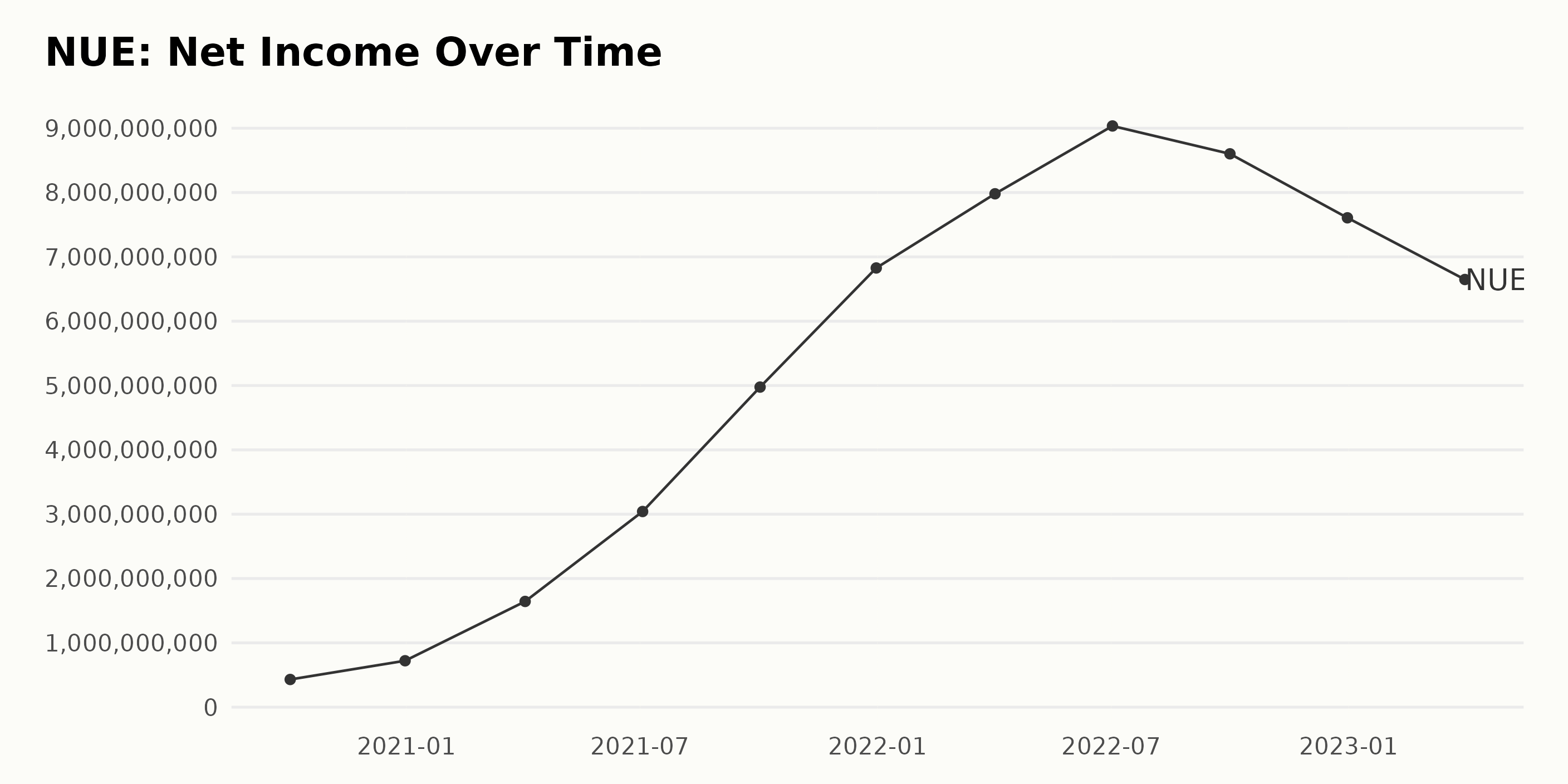

Observing the trailing-12-month net income of NUE from 2020 through to 2023, a clear overall upward growth trend is indicated. The net income figures show considerable fluctuations within this period but note a significant escalation in recent years. More specifically:

- In October 2020, the net income stood at $430.45 million. There was a marked increase to $721.47 million by December 2020.

- This upward trend continued reaching $1.64 billion, $3.04 billion, and $4.98 billion in April 2021, July 2021, and October 2021, respectively.

- An even higher surge was noted by the end of 2021 when the net income reached an impressive value of $6.83 billion.

- The increasing pattern also remained predominant the next year, reaching up to $7.98 billion in April 2022 and $9.03 billion in July 2022.

- However, a noticeable decline is observed, with the net income falling to $8.60 billion in October 2022 and continuing to reduce towards the end of 2022 with a closing figure of $7.61 billion.

- This downturn carried into 2023, with the net income for April standing at $6.64 billion.

In terms of growth rate, between October 2020 and April 2023, the net income shows an approximate increase of nearly 1,445%. Though it should be noted that there was a visible decrease in recent months, the general pattern for the given period still signals a substantial increment in the net income. Despite these fluctuations, NUE’s profitability has generally shown promising growth within this timeframe.

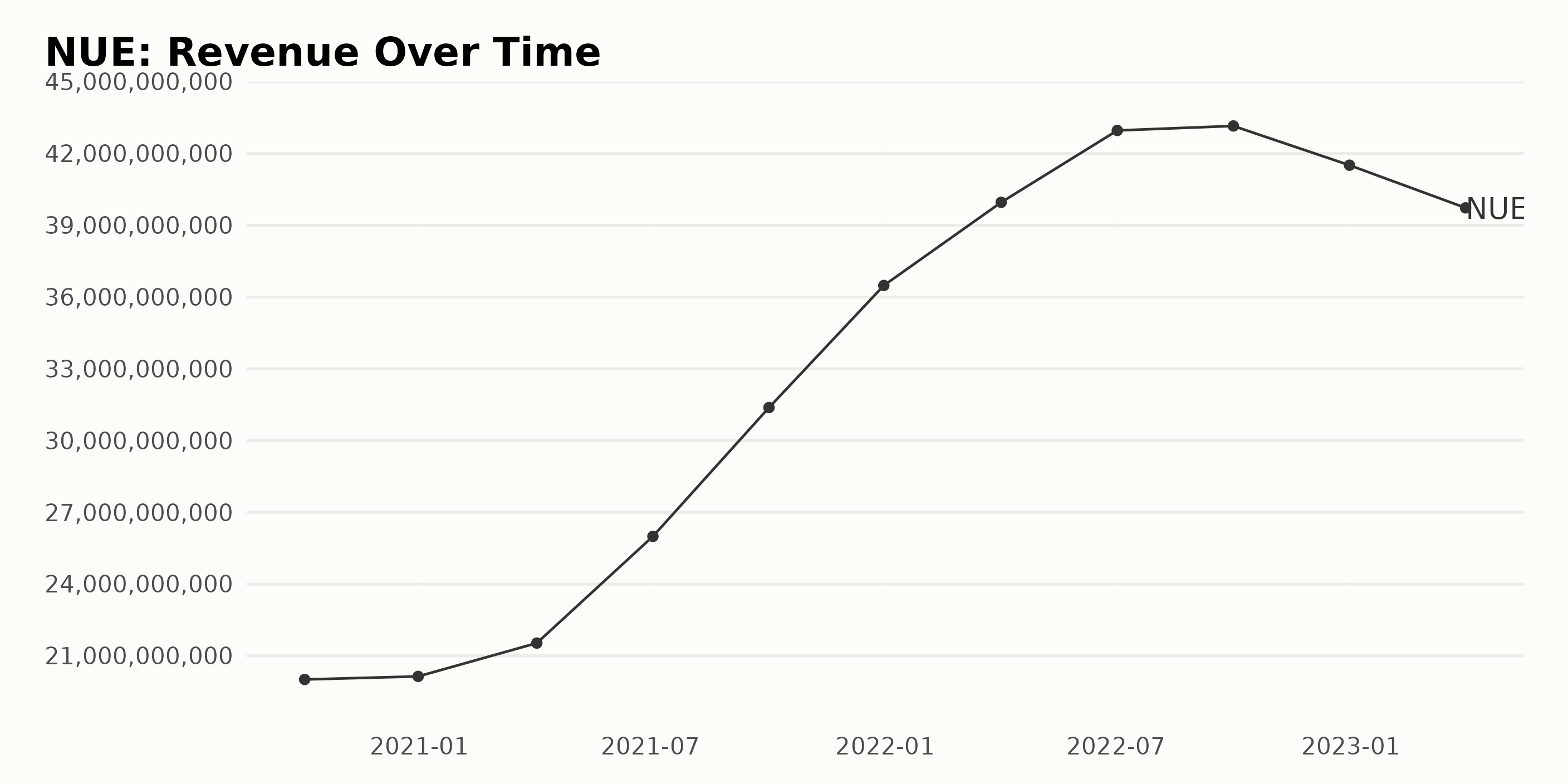

NUE has shown a significant and steady rise in its trailing-12-month revenue over the past years, with a few minor fluctuations. Below are the key highlights:

- On October 3, 2020, the revenue stood at $20.01 billion.

- Through the end of 2020 and into 2021, there was a consistent growth trend, reaching its peak in October 2021 at $43.15 billion.

- However, the revenue began to decline after the October 2021 peak, dropping to $41.51 billion by the end of 2022.

- The most recent value, as of April 1, 2023, further decreased to $39.73 billion.

Calculating the growth rate from October 2020 to April 2023, there is approximately a 99% increase. It’s crucial to highlight the volatility in NUE’s last recorded revenues, showcasing an ongoing downward trend since the late 2022 peak.

Despite this recent downturn, the company’s revenue growth over the last two and a half years remains undeniably robust.

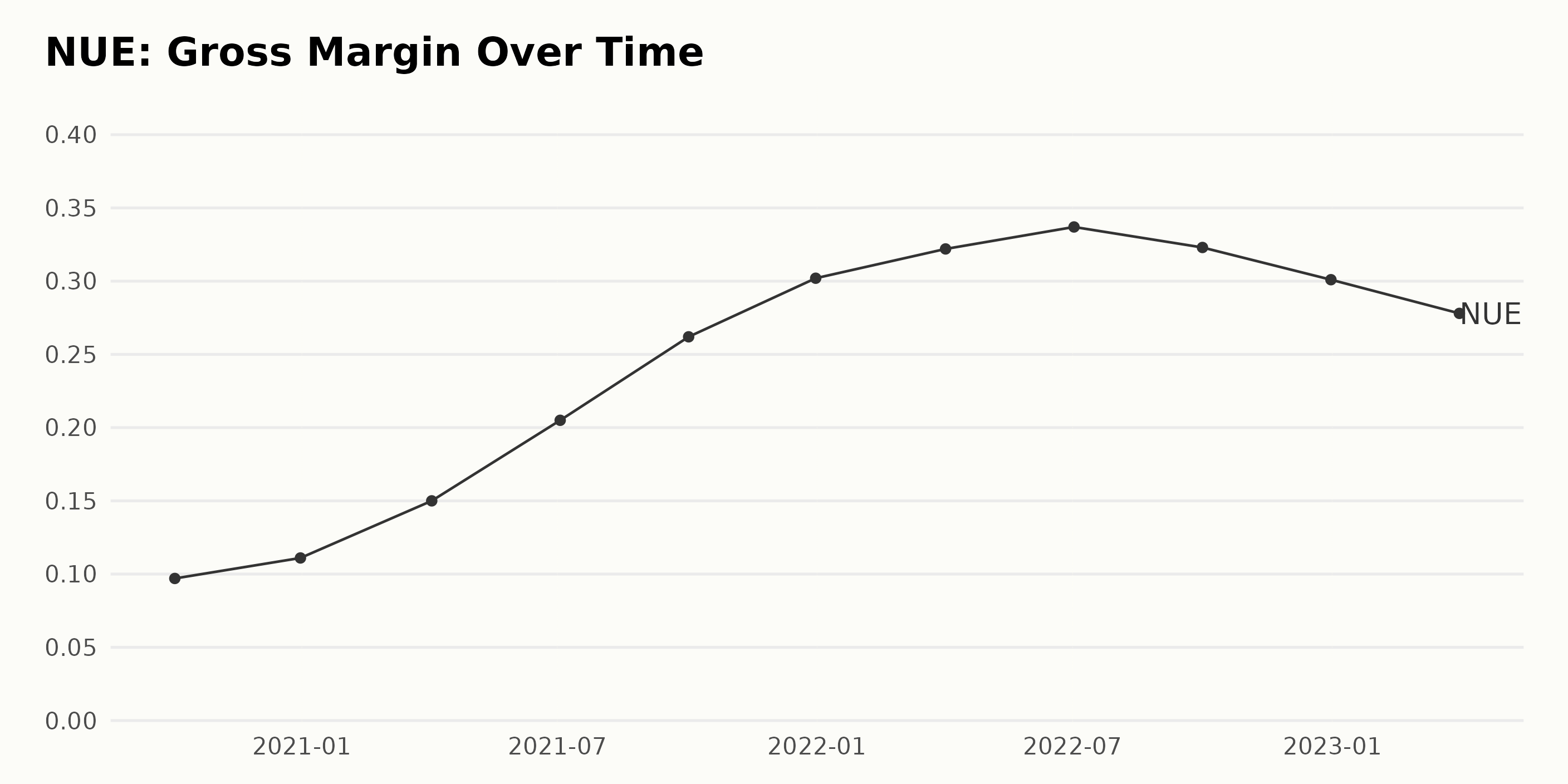

The gross margin data of NUE has shown a fluctuating trend over the course of three years, from October 2020 through to April 2023.

- Starting at 9.7% in October 2020, it exhibited consistent growth.

- The gross margin increased significantly by 13.8 percentage points to 23.2% by April 2022, representing a growth rate of approximately 142.27%, based on the comparison with the initial value.

- However, the subsequent values indicated a slight retreat from this peak.

- December 2022 saw a lower gross margin of 30.1%, followed by a slight further decrease to 27.8% in April 2023. This shows a general downward trend in the most recent quarter, although these figures are still significantly higher than those reported in 2020 and early 2021.

Key Observations:

- The highest value of gross margin was recorded in July 2022 at 33.7%, after which there was a definite downturn for subsequent periods.

- The overall growth from October 2020 to April 2023 is 18.1 percentage points, accounting for an approximate 187% increase.

This data indicates that while NUE experienced substantial growth in its gross margin over the period evaluated, the most recent data points show a tapering off of this positive increment, necessitating careful consideration for future projections.

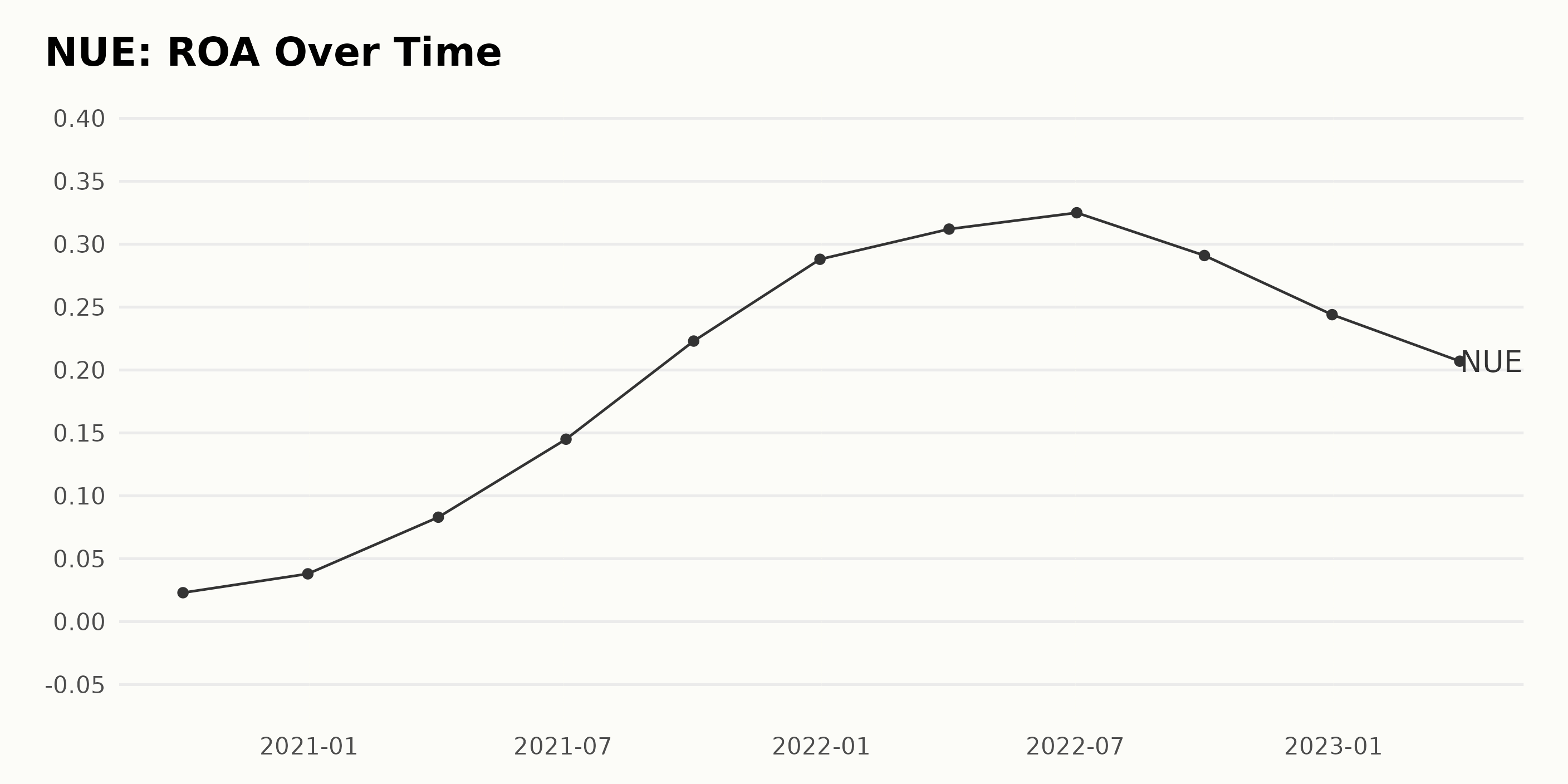

The series data shows the trend and fluctuations in NUE’s Return On Assets (ROA) from October 2020 to April 2023.

- In October 2020, the ROA stood at 0.023, marking the beginning of the observation period.

- The ROA experienced a steady increase over the subsequent quarters, with a significant leap between December 2020 (0.038) and April 2021 (0.083).

- This upward trend continued until it peaked at 0.325 in July 2022.

- Interestingly, the last quarter of 2022 saw a trend reversal, with a drop to 0.291 in October and further down to 0.244 by the end of December 2022.

- The data of April 2023 confirms this downward trajectory, with NUE’s ROA being reported as 0.207.

By measuring the last value from the first value, NUE has achieved an overall growth rate of approximately 900%, despite the recent downward trend in early 2023. The most recent data points signify a necessary area of attention due to their potential implications on the company’s profitability.

The company might need to review its investment strategies or operational efficiencies to stem this decline in order to maintain the strong growth it demonstrated for much of this period.

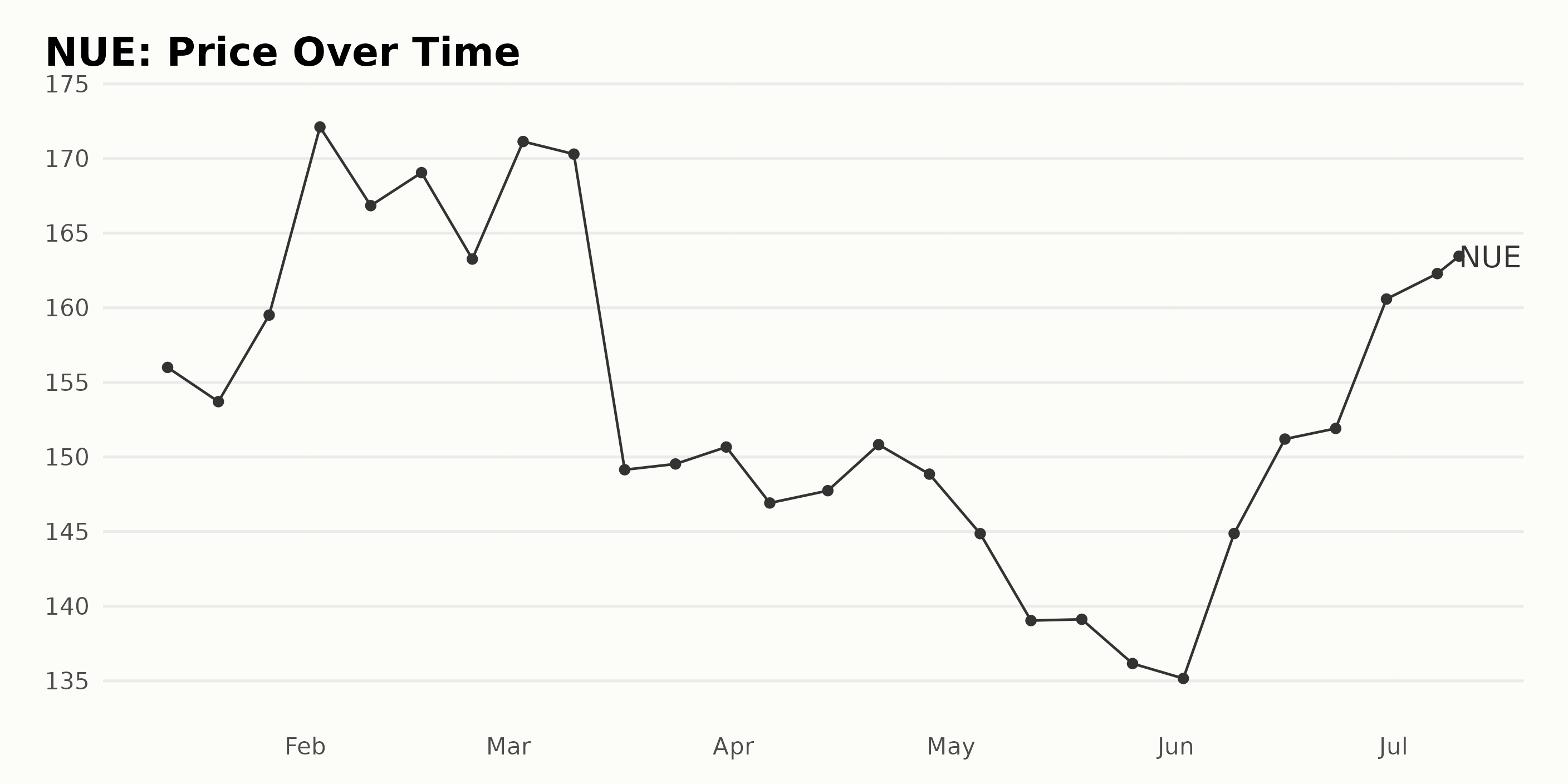

An Analysis of Nucor Corporation’s Resilient Share Price Fluctuations in 2023

The share prices of NUE in the given data exhibit some variability but overall show a general trend of growth followed by a decline and then another growth phase.

- Starting on January 13, 2023, at $156.00, there was a minor dip to $153.71 on January 20, 2023. By January 27, the price had already increased to $159.51.

- In February 2023, the share prices show signs of an ascending trend, peaking at $172.12 on February 3. This upward trend was not sustained, with the price declining gradually to $163.27 by the end of the month.

- The prices ascended slightly through early March 2023, peaking at $171.14 on March 3, followed by a slight decline. However, there was a sharper decrease to $149.15 by March 17, ending the month at $150.67.

- In April 2023, the share prices remained fairly stable, fluctuating between $146.92 and $150.83, ending the month at $148.85.

- A more significant downtrend is noticeable in May 2023, starting from $144.87 and hitting a low of $136.16 toward the end of the month.

- However, this downward trend reversed at the beginning of June with a gradual increase to $144.88. The share price kept climbing to reach a new high of $151.92 by June 23, finally closing the period at a high of $164.16 on July 10, 2023.

The trajectory of Nucor Corporation’s share price over this period appears to have regular fluctuations, indicating periods of both growth and decline. There seems to be no clear accelerating or decelerating trend. The share price does, however, recover after each decline, suggesting resilience in the face of such fluctuations. Here is a chart of NUE’s price over the past 180 days.

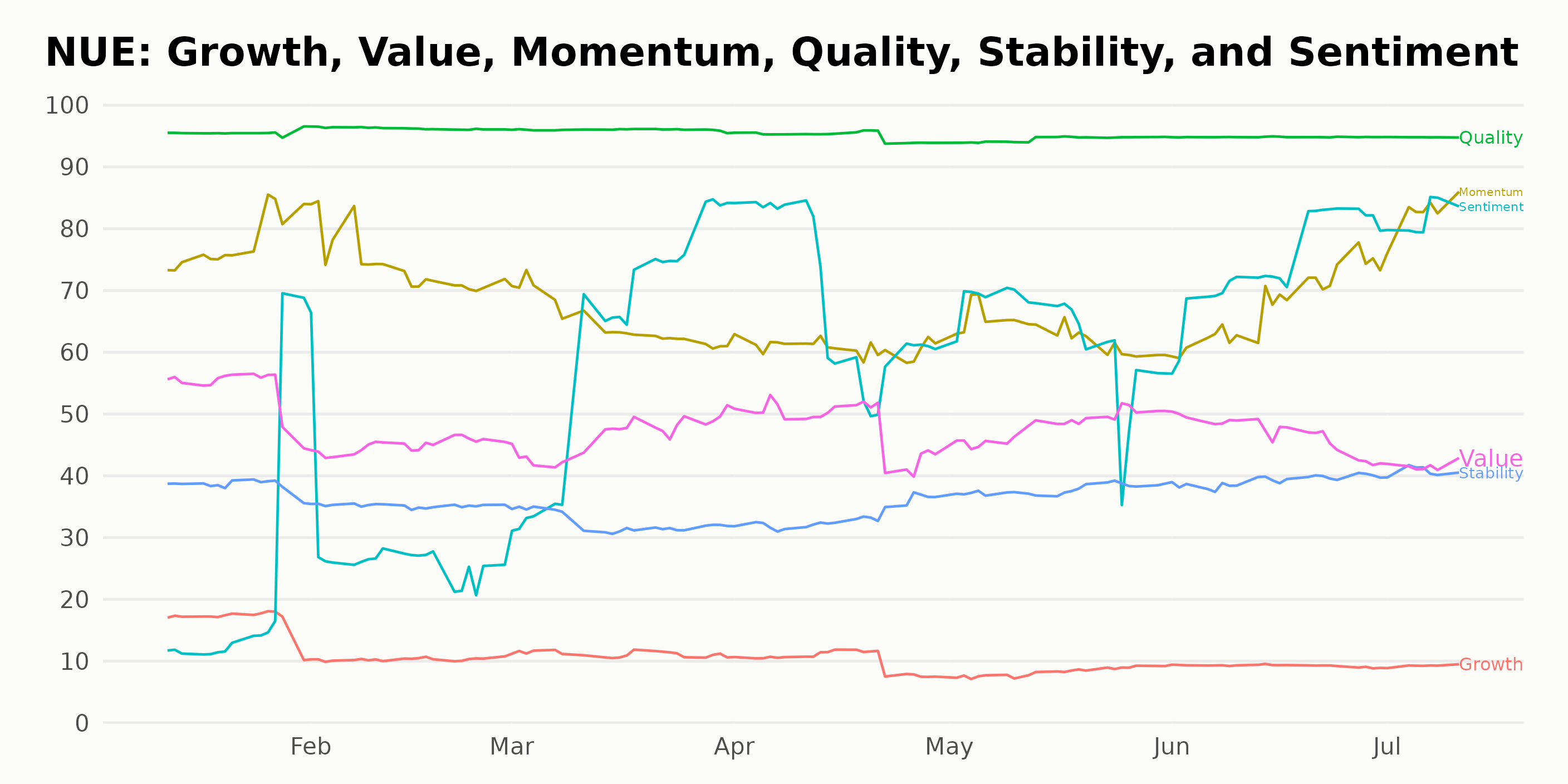

Analyzing Nucor Corporation’s POWR Ratings: Quality, Momentum, and Sentiment

NUE, which operates in the Steel category with a field of 33 total stocks, has demonstrated fluctuating POWR Ratings grades and ranks within its category over time. Analyzing the latest data, particularly the value assigned for the week ending July 8, 2023, provides some valuable insights:

- The POWR grade for NUE on the week ending July 8, 2023, is C (Neutral). This is noteworthy as the C grade remained constant throughout several previous weeks. The only exception was observed in the week of April 8, 2023, when it momentarily elevated to a B (Buy) before reverting to C (Neutral).

- In terms of rank within the Steel category, it registered a rank of #18 out of 33 for the week ending July 8, 2023. It can be seen that NUE’s rank within the category has been generally improving over the past few months, falling from positions in the low twenties in January 2023 to its present position.

Therefore, based on the POWR grade and category rank as of July 11, 2023, NUE maintains a consistent C (Neutral) POWR grade and a rank of #19, showing a slight improvement in its ranking position within the category over time.

The POWR Ratings for NUE reflect its strengths along six dimensions. Out of these, the three most significant for our analysis are Quality, Momentum, and Sentiment.

Quality – In January 2023, NUE scored a high 96 in Quality. This rating remains consistently high through June 2023, only marginally dropping to 95 by July 2023.

Momentum – The Momentum rating starts with an impressive 78 in January 2023, showing strong momentum for NUE. However, there is a gradual decline over the following months, reaching 65 by March 2023. Interestingly, the Momentum grade picks up again in July 2023, increasing to 82 from 68 in June 2023.

Sentiment – The Sentiment rating begins at 21 in January 2023, indicating comparably low investor confidence. The next few months show a remarkable upward trend, peaking at 81 by July 2023.

Note: These ratings do not provide a comprehensive picture of NUE’s potential and should be analyzed with other financial data.

How does Nucor Corporation (NUE) Stack Up Against its Peers?

Other stocks in the Steel sector that may be worth considering are Voestalpine AG (VLPNY - Get Rating), Acerinox, S.A. (ANIOY - Get Rating), and Nippon Steel Corporation (NPSCY - Get Rating) – they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

Want More Great Investing Ideas?

NUE shares were trading at $167.62 per share on Tuesday afternoon, up $3.46 (+2.11%). Year-to-date, NUE has gained 28.01%, versus a 16.19% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| NUE | Get Rating | Get Rating | Get Rating |

| XOM | Get Rating | Get Rating | Get Rating |

| VLPNY | Get Rating | Get Rating | Get Rating |

| ANIOY | Get Rating | Get Rating | Get Rating |

| NPSCY | Get Rating | Get Rating | Get Rating |