- Crude oil rises to the highest level in a year

- Oil stocks rise- Sector rotation

- The Brazilian economy is commodity-centric

- Petrobras returns to profitability

- Levels to watch in PBR

Crude oil futures have been climbing a bullish staircase since early November 2020 when nearby NYMEX futures fell to $33.64, and Brent futures reached a low of $35.73 per barrel. At the end of last week, the prices were on either side of 75% higher, with the NYMEX futures at $59.47 and the Brent nearby contract at $62.43.

Over the past month, shares of oil-producing companies have moved higher with the price of the energy commodity. After over two years of lagging the stock market, the energy sector has made a substantial comeback on a percentage basis. However, the stock market is at an all-time high, while oil companies remain at a fraction of their record peaks.

Petroleo Brasileiro SA Petrobras (PBR - Get Rating) produces and sells crude oil and natural gas in Brazil and worldwide. The company prospects, drills, refines, processes, transports, and trades energy commodities. The Brazilian oil and gas come from on and offshore oilfields, shale, or other rocks that contain hydrocarbons. PBR also generates electricity via thermoelectric power plants and operates a fertilizer business. As Brazil is a substantial producer and exporter of agricultural products, domestic demand for fertilizers is a significant revenue vertical for the company.

At $10.55 per share on February 22, PBR was trading far from its all-time 2008 high of $77.61. As the crude oil price rises, we could see a substantial recovery in Petrobras over the coming weeks and months.

Crude oil rises to the highest level in a year

Active month April NYMEX crude oil futures hit bottom on November 2, 2020, at $35.53 per barrel. Since then, the energy commodity has made higher lows and higher highs, rising by over 75% at last week’s high.

Source: CQG

Source: CQG

Last week, the crude oil price climbed above the $60 per barrel level for the first time since early January 2020. Nearby April WTI futures reached $62.29 and settled at the $59.26 level on Friday, February 19.

The total number of open long and short positions in the NYMEX futures market increased from just above two million contracts in early November to over 2.52 million at the end of last week. Rising open interest and price appreciation tend to be a technical validation of a bullish trend in a futures market.

Daily price momentum and relative strength indicators have risen to overbought readings before crossing lower as the energy commodity corrected below $60 last Friday. Daily historical volatility was trending low as bottomed at just over 18%, reflecting the slow and steady ascent of the energy commodity. The price variance metric fell from nearly 54% in early November after the price hit its November 2 low. At the end of last week, it turned high and was at the 28.75% level.

The trend is always your friend in markets, and it remains higher in the crude oil futures arena as of last Friday. The next upside target in WTI futures stands at the 2020 high of $65.65 per barrel. However, a correction could take the energy commodity to a higher low.

Oil stocks rise- Sector rotation

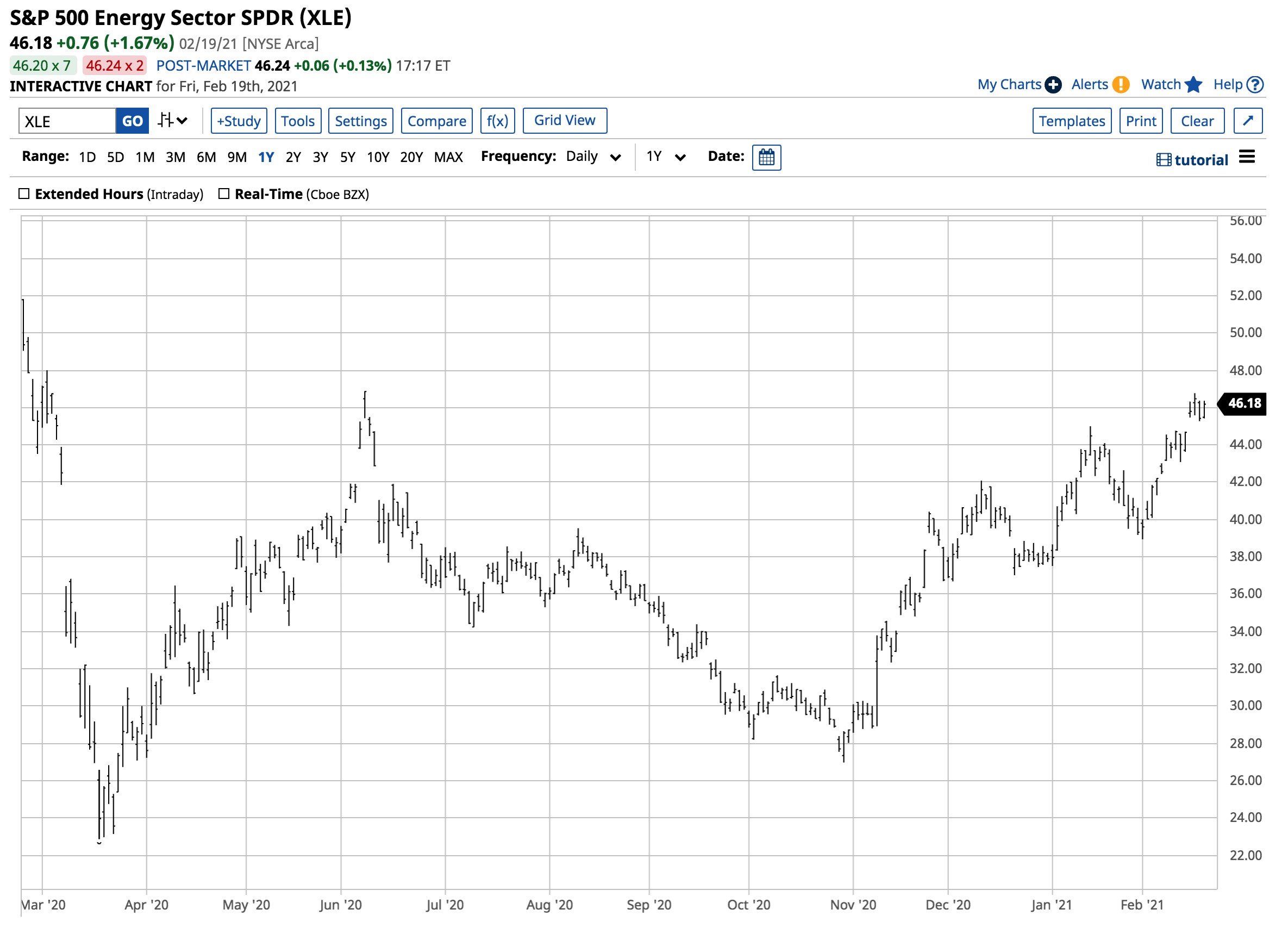

Shares of fossil fuel producers had been under pressure long before the beginning of the global pandemic. The S&P 500 Energy Sector SPDR (XLE - Get Rating) holds shares of many top US oil and gas producing and related companies. While the pandemic sent crude oil lower from the $65.65 level, the descent of energy stocks began in 2014, the last time the energy commodity traded at over $100 per barrel. The energy shares picked up a head of downside steam in 2018.

Source: Barchart

Source: Barchart

The chart shows that the XLE reached an all-time peak of $101.52 in June 2014, the last time NYMEX crude oil futures traded above the century mark. The XLE made a lower high in 2018 at $79.42. Even though the overall stock market continued to climb, the XLE fell sharply, reaching a low in March 2020 at $22.88 per share. Since then, the XLE has recovered.

Source: Barchart

Source: Barchart

The XLE closed last week at the $46.18 level, over double the level at the March 2020 low as sector rotation in the stock market and a recovery in crude oil lifted the US energy shares.

The Brazilian economy is commodity-centric

Brazil is a country with many natural resources. The most populous South American nation with the continent’s leading economy produces agricultural products, metals and ores, and energy. Brazil is one of the leading ethanol producers worldwide and has substantial onshore and offshore oil and gas reserves.

Higher commodity prices tend to support Brazil’s currency as they increase corporate profits and tax revenues.

In 2011, when commodity prices hit multi-year and all-time highs, the exchange rate between Brazil’s real and the US dollar reached a peak.

Source: CQG

Source: CQG

The monthly chart illustrates the exchange rate reached a high of $0.65095 in 2011. Bearish price action in commodities and economic and political issues facing Brazil sent the currency to a low of $0.1673 in May 2020. The real recovered to around the $0.18475 level against the dollar at the end of last week. As commodity prices continue to rise, we could see a delayed reaction in the Brazilian currency over the coming weeks and months.

Higher oil prices and a rising Brazilian real would support Petrobras’ shares, Brazil’s leading oil and gas producer.

Petrobras returns to profitability

At the $10.05 level on February 19, PBR had a market cap of just below $66 billion. The shares trade an average of over 23.5 million per day. PBR pays shareholders a $0.29 dividend, translating to a 2.89% yield on the stock.

Source: Yahoo Finance

Source: Yahoo Finance

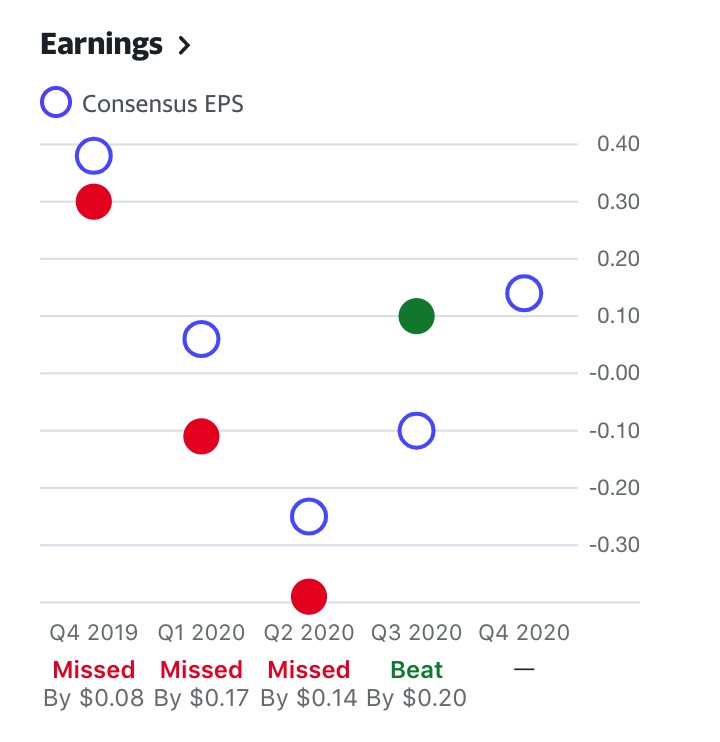

The chart shows that 2020 was a challenging year for Petrobras. In Q4 2019, the company reported EPS of 30 cents per share, but it missed consensus forecasts. In Q1 and Q2 2020, PBR reported respective losses of 11 cents and 39 cents per share.

The situation improved in Q3 2020 as the company climbed back into profitability with EPS of ten cents, beating the average forecast by twenty cents. The market expects PBR to earn 14 cents in Q4. Another beat in EPS would likely push PBR’s share price higher.

Levels to watch in PBR

In 2008, when WTI crude oil hit its all-time peak at over $147 per barrel, PBR shares reached a record high of $77.61.

Source: Barchart

Source: Barchart

The chart shows that last March, the shares fell to a seventeen-year low of $4.01. As the crude oil price has recovered to over the $60 per barrel level, another positive earnings report could send PBR shares towards a challenge of its critical technical resistance level at the March 2019 $17.90 high. Above there, the next target would be $20.94, the peak from 2014.

PBR could offer energy bulls value if the recovery continues to take prices high over the coming months. Late last week, Brazilian President Jair Bolsonaro fired Petrobras’ chief, which weighed on the stock. The stock was moving significantly lower on Monday as it fell below the $8 level, which could be setting up a long-term opportunity. I would be a scale-down buyer of PBR.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the 2021 Stock Market Bubble

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

PBR shares rose $0.36 (+4.53%) in premarket trading Tuesday. Year-to-date, PBR has declined -25.11%, versus a 3.01% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PBR | Get Rating | Get Rating | Get Rating |

| XLE | Get Rating | Get Rating | Get Rating |