Petroleo Brasileiro S/A ADR (PBR): Price and Financial Metrics

PBR Price/Volume Stats

| Current price | $14.47 | 52-week high | $17.91 |

| Prev. close | $14.46 | 52-week low | $13.18 |

| Day low | $14.36 | Volume | 10,104,186 |

| Day high | $14.55 | Avg. volume | 18,692,996 |

| 50-day MA | $14.75 | Dividend yield | 6.22% |

| 200-day MA | $15.67 | Market Cap | 94.37B |

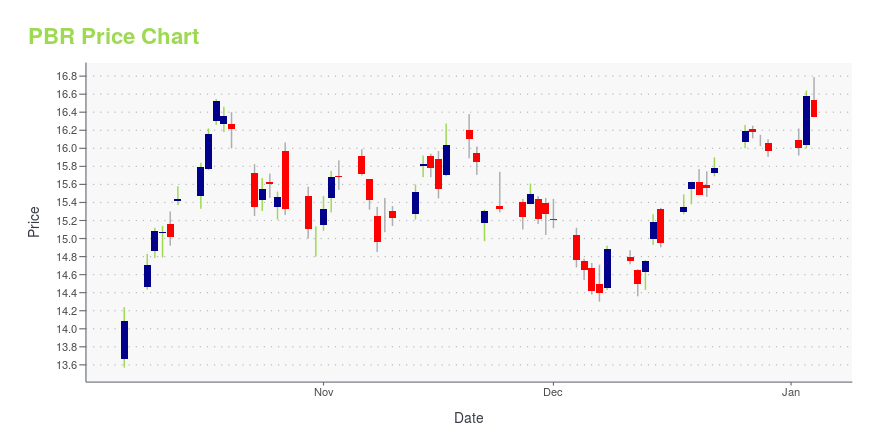

PBR Stock Price Chart Interactive Chart >

Petroleo Brasileiro S/A ADR (PBR) Company Bio

Petróleo Brasileiro S.A., better known by the acronym Petrobras (Portuguese pronunciation: [ˌpɛtɾoˈbɾas ]), is a state-owned Brazilian multinational corporation in the petroleum industry headquartered in Rio de Janeiro, Brazil. The company's name translates to Brazilian Petroleum Corporation — Petrobras. (Source:Wikipedia)

Latest PBR News From Around the Web

Below are the latest news stories about PETROBRAS - PETROLEO BRASILEIRO that investors may wish to consider to help them evaluate PBR as an investment opportunity.

The Year That Was: Analyzing 2023’s Top Performing Stocks and SectorsThe start of the new year is the perfect time to recap the stock market. |

Petrobras (PBR) Faces Roadblock in Carmopolis Assets SalePetrobras (PBR) faces hurdles as Carmo Energy, backed by Grupo Cobra, fails to make payment for oil assets on a $296 million installment, affecting the $1.1 billion assets sale. |

Petrobras (PBR) Starts Drilling Well in Equatorial MarginPetrobras (PBR) begins exploration in Brazil's Equatorial Margin, drilling Pitu Oeste well for oil and gas, investing $3.1 billion by 2028. |

12 Best Foreign Stocks With DividendsIn this article, we will take a detailed look at the 12 Best Foreign Stocks With Dividends. For a quick overview of such stocks, read our article 5 Best Foreign Stocks With Dividends. While markets are roaring amid the Fed’s indication that it’s ready to begin interest rate cuts next year, some analysts still advise caution and […] |

Petrobras Is in Talks With Mubadala for Stake in Bahia Refinery(Bloomberg) -- Brazil’s state oil company Petrobras said it’s in talks with Mubadala Capital to buy back a stake in a refinery it sold two years ago to the investment arm of Abu Dhabi’s sovereign wealth fund. Most Read from BloombergChina Is Softening Stance on Gaming After $80 Billion RoutEthiopia Fails to Pay Coupon, Becoming Latest African DefaulterBank of Russia Governor Says She Is Bracing for More SanctionsAsia Stocks Mixed, Currencies Gain in Thin Trading: Markets WrapManchester United Sa |

PBR Price Returns

| 1-mo | 1.83% |

| 3-mo | -10.58% |

| 6-mo | -9.51% |

| 1-year | 16.03% |

| 3-year | 136.06% |

| 5-year | 79.32% |

| YTD | -3.39% |

| 2023 | 66.78% |

| 2022 | 26.72% |

| 2021 | 15.48% |

| 2020 | -28.88% |

| 2019 | 24.20% |

PBR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PBR

Here are a few links from around the web to help you further your research on Petrobra's stock as an investment opportunity:Petrobra (PBR) Stock Price | Nasdaq

Petrobra (PBR) Stock Quote, History and News - Yahoo Finance

Petrobra (PBR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...