- A massive package could be on the horizon

- A new New Deal under a new administration- The three Rs

- Construction requires commodities at a time they are already in bullish mode

- A suite of bullish prospects in the PICK ETF

- Lots of upside in Flour Corporation

The technology sector was by far the leader in the stock market in 2020. While all of the leading indices posted impressive gains since the March low and compared to the end of 2019, tech stocks led the way on the upside.

As we head into 2021, the global pandemic’s economic fallout will continue to be a dark cloud hanging over the economy. The incoming US administration will need to deal with high unemployment and many struggling individuals and businesses.

Over the past years, there has been bipartisan support in Washington, DC, for a program to rebuild the US’s crumbling infrastructure. However, Democrats and Republicans have not wanted to hand the opposition any victories going into November’s election for mostly political reasons.

The odds of a substantial infrastructure project that jumpstarts the economy and provides jobs should rise as Joe Biden becomes the forty-sixth President of the United States on January 20. Aside from providing jobs, a construction project will require the raw materials that are infrastructure’s building blocks.

The iShares MSCI Global Metals & Mining Producers ETF product (PICK) holds shares of companies that produce many building blocks like iron ore, steel, nonferrous metals, and energy.

A massive package could be on the horizon

For years, politicians in the United States have been campaigning and promising to rebuild, upgrade, and refresh the crumbling infrastructure. With roads, bridges, tunnels, railroads, airports, government buildings, schools, and many other parts of the infrastructure in an awful state of disrepair, a massive program is not a luxury; it is a necessity.

In 2016, the U.S. elected a real estate developer as its forty-fifth President. Political wrangling between Republicans and Democrats over the past four years prevented President Trump from beginning the program in the sweet spot of his expertise. While there is a bipartisan agreement for an infrastructure program, neither side of the political aisle wanted to give the other any victory.

In November 2020, the incumbent President lost his bid for reelection to Joe Biden, the former Vice President. The global pandemic likely cost the sitting leader the election. The current state of the US economy going into 2021 and high unemployment levels could present the best potential for an infrastructure program under the new Biden administration. A new President tends to receive support for his initial agenda.

Addressing the economy in the aftermath of the coronavirus will be one of the first tasks after vaccines create herd immunity. A massive government-funded program that rebuilds the U.S. while providing jobs and jumpstarting the economy will not result from politics or promises, but because of timing. The current time is perfectly suited for the government to spend trillions more for massive infrastructure upgrades and a facelift.

A new New Deal under a new administration- The three Rs

The last significant infrastructure package came in the 1950s when the Eisenhower administration built the interstate highway system. However, you have to go back to the 1930s and President Franklin Delano Roosevelt to identify what the U.S. economy requires in the aftermath of the pandemic. The New Deal came after the Great Depression.

After his election, FDR rolled out his RRR program that introduced relief, reforms, and recovery. Relief came in the form of programs for the unemployed. Reforms of capitalism came by way of regulatory legislation and the creation of new social welfare programs. Recovery was via federal spending and job creation.

The three Rs resonate with the Democrat’s latest 2020 platform and set the stage for a newer New Deal that copies FDR’s programs of almost a century ago. Infrastructure could be the perfect fit as Democrats and Republicans are likely to support rebuilding parts of the US’s infrastructure.

Construction requires commodities at a time they are already in bullish mode

A massive construction project requires two critical elements, raw materials, the infrastructure building blocks, and labor. Job creation fulfills one of the goals, government contracts for building companies would improve the economy as tax revenues would grow, and businesses would thrive.

Meanwhile, the commodities necessary for building have been moving higher since reaching lows in March and April 2020. Crude oil rallied from below zero on April 20 to over $48 per barrel on December 31, 2020. Copper, a base metal that is a leader of the industrial metals, moved from $2.0595 in March to over $3.50 per pound at the end of the year.

Lumber, another construction material, rallied from a low of $251.50 to over $700 per 1,000 board feet, after reaching a new record high of $1000 in September. Steel, a critical building material, rallied from $460 in April to over $900 per ton at the end of December on the HRC North America Platts price.

Commodity prices have moved appreciably higher on the back of Chinese demand, a falling US dollar, and inflationary pressures from the accommodative monetary and fiscal policies of central banks and governments worldwide.

The last time markets saw the results of a tidal wave of liquidity, historically low interest rates, and government stimulus was in the aftermath of the 2008 global financial crisis. By 2011, many raw material prices rose to multi-year or all-time highs.

While the 2008 crisis was far different than the 2020 pandemic, central banks and governments have used the same financial tools to stabilize the economy. The odds favor a continuation of rallies in commodity markets over the coming years. Increased demand for a US infrastructure package could only push prices higher over the coming years.

A suite of bullish prospects in the PICK ETF

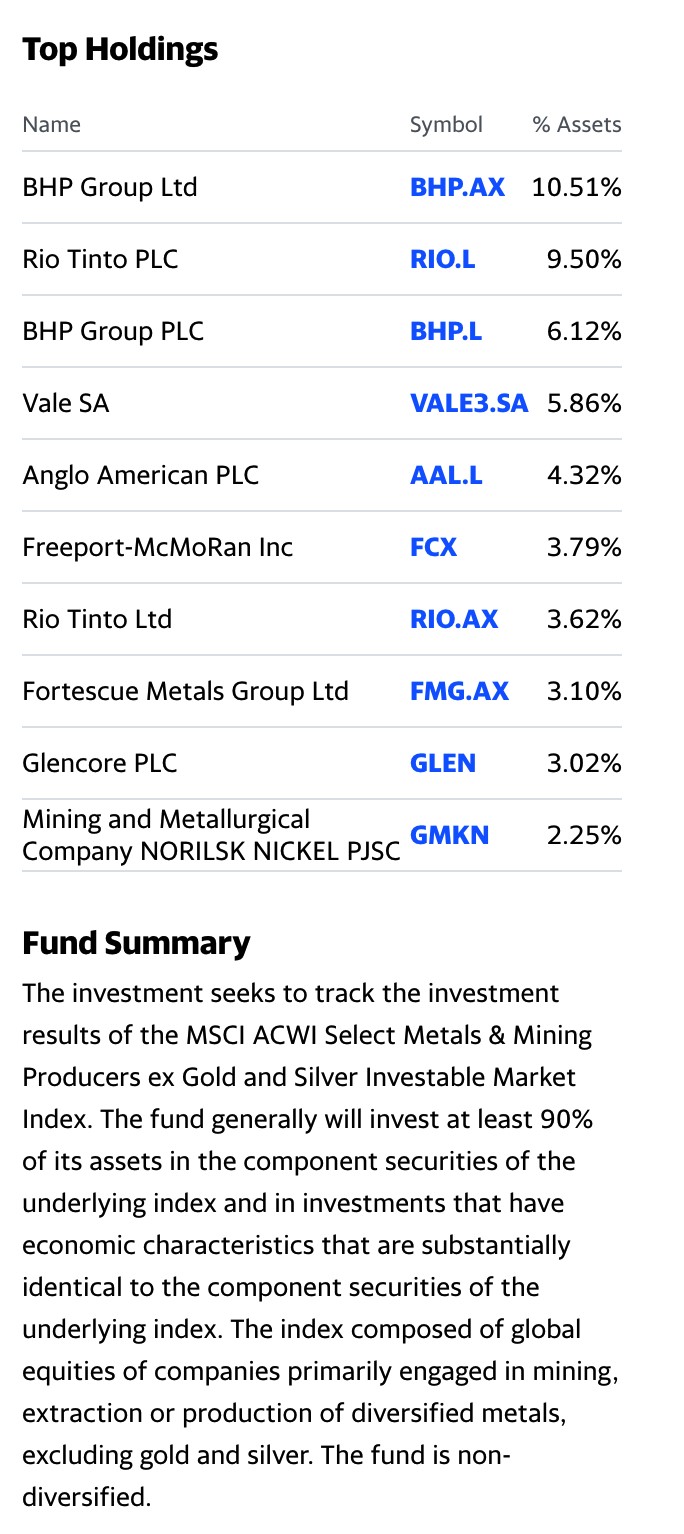

The companies that extract industrial metals and minerals from the earth’s crust are likely to benefit from inflationary pressures, demand from China, and any US infrastructure rebuilding program in 2021 and beyond. PICK provides diversified exposure to the leading commodity producers worldwide. The fund summary and top holdings of PICK include:

Source: Barchart

Source: Barchart

PICK has net assets of $281.32 million, trades an average of 197,807 shares each day, and charges a 0.39% expense ratio. PICK has a blended dividend yield of 4.20%. The rise in industrial commodity prices has already pushed the PICK ETF higher in 2020.

Source: Barchart

Source: Barchart

PICK fell to a low of $16.01 in March and was trading at over double that level on December 31, 2020. In 2012, the PICK ETF was over $50 per share. As the demand for industrial commodities rises and prices move higher, PICK could be on its way to a new all-time high over the coming years.

Lots of upside in Fluor Corporation

Fluor Corporation (FLR), through its subsidiaries, provides engineering, procurement, construction, fabrication and modularization, operation, maintenance and asset integrity, and project management services worldwide. FLR has been around since 1912. The US company’s headquarters is in Irving, Texas.

FLR has a market cap of $2.247 billion at $15.97 per share on December 31, 2020. The stock trades an average of over 1.90 million shares each day. FLR shares have been making lower highs and lower lows since reaching an all-time peak in 2008 at $101.36. In March 2020, the stock traded to an all-time low of $2.85.

Source: Barchart

Source: Barchart

FLR recovered to just below the $16 level at the end of 2020. A massive US infrastructure program over the coming years could provide FLR with government contracts that will increase revenues, earnings, and the share price. FLR’s expertise and services are perfectly suited for a newer New Deal in the US over the coming years.

Profits from a long-overdue infrastructure program in the US could turn mining, engineering, and construction companies into growth stocks over the coming years. PICK and FLR are just two examples of an ETF and stock that could experience substantial upside in 2021 and beyond.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

The #1 CRITICAL Investment Lesson from 2020

7 Best ETFs for the NEXT Bull Market

PICK shares were trading at $37.91 per share on Monday afternoon, up $1.06 (+2.88%). Year-to-date, PICK has gained 2.88%, versus a -2.05% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PICK | Get Rating | Get Rating | Get Rating |

| FLR | Get Rating | Get Rating | Get Rating |