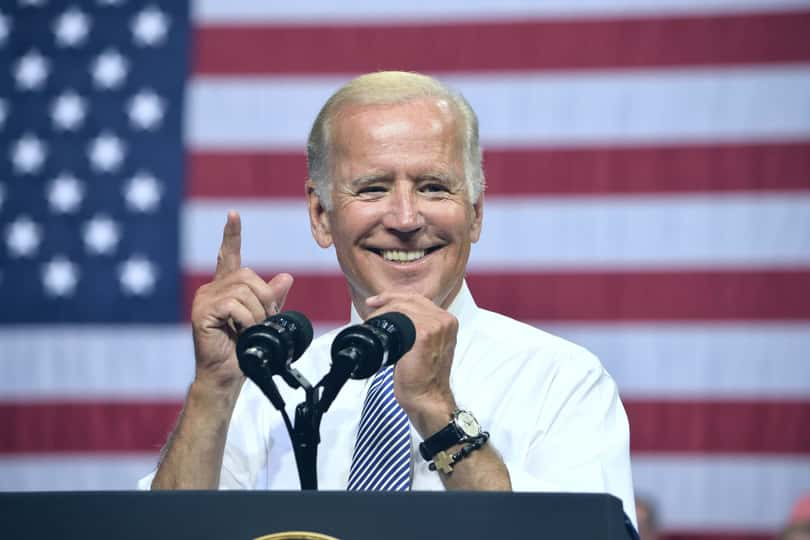

The infrastructure plan approved by the Senate less than two months ago is currently stalled because some Democrats refuse to support its passage unless an additional $3.5 trillion in welfare and climate change spending is approved. However, President Biden asserted that “we’re going to get it done” after a surprise visit to Congress last week.

Due to steel’s extensive use in construction, the potentially transformative infrastructure spending opens enormous growth prospects for the steel industry. Furthermore, with the economy’s reopening, increased construction and manufacturing activity should continue to drive steel demand. According to the World Steel Association, the global steel demand is expected to increase 3.8% year-over-year in 2021.

Given this backdrop, we think steel stocks Schnitzer Steel Industries (SCHN) and United States Steel Corporation (X), which have suffered price declines lately, could now be great bets to cash in on the industry tailwinds.

Click here to check out our Infrastructure Sector Report for 2021

Schnitzer Steel Industries (SCHN)

SCHN recycles ferrous and nonferrous scrap metals and produces finished steel products for consumers worldwide. Auto and Metals Recycling (AMR); and Cascade Steel and Scrap are the two operational segments of the Portland, Ore.-based company.

In August, SCHN resumed production at its Cascade Steel Rolling Mills in McMinnville, Ore. In addition, the company agreed to acquire Columbus Recycling’s holdings in the Southeast United States. The acquisition will enable the company to expand its offerings in the robust regional market.

SCHN’s revenue increased 103.8% year-over-year to $820.72 million in the third quarter, ended May 31, 2021. Its operating income came in at $81.38 million, versus a $3.71 million operating loss in the prior-year quarter. The company reported a $63.64 million in net income, compared to a $4.99 million net loss in the third quarter of 2020. Its EPS amounted to $2.15 versus an $0.18 loss per share in the same period last year.

The company’s EPS is expected to grow 1,276.7% year-over-year to $5.92 in its fiscal year 2021. Analysts expect SCHN’s revenue to increase 57.4% year-over-year to $2.69 billion in the current year. The stock has gained close to 130% in price over the past year and more than 30% over the past nine months.

The stock is currently trading more than 18% below its 52-weeks high of $59.34, which it hit on June 01, 2021.

SCHN’s POWR Ratings reflect this promising outlook. The company has an B overall rating, which translates to Buy in our proprietary rating system. The POWR Ratings assess stocks by 118 distinct factors, each with its own weighting.

SCHN has also been rated A for Growth and Momentum, and B for Value. Within the A-rated Steel industry, it is ranked #19 of 33 stocks.

To see additional POWR Ratings for Stability, Sentiment, and Quality for SCHN, click here.

United States Steel Corporation (X)

Pittsburgh, Pa.-based X principally manufactures and sells flat-rolled and tubular steel throughout North America and Europe. North American Flat-Rolled (Flat-Rolled); U.S. Steel Europe (USSE); and Tubular Products are the company’s three segments. In addition, the company offers railroad services and real estate operations.

Last month, X launched an exploratory site selection process to develop a new state-of-the-art micro mill in the United States as part of its ongoing transition to its Best for AllSM strategy. The continued use of micro mill technology will increase the company’s capacity to manufacture the next generation of highly lucrative proprietary sustainable steel products, including advanced high strength steels.

During the second quarter, ended June 30, 2021, X’s net sales increased 140.3% year-over-year to $5.03 billion. The company reported net income of $1.01 billion, versus a $589 million net loss in the second quarter of 2020. Its EPS was $3.53, compared to a $3.36 loss per share in the same period last year. In addition, its net cash from operating activities came in at $1.10 billion for the six months ended June 30, 2021.

A $13.71 consensus EPS estimate for the current year represents a 393.6% improvement year-over-year. Analysts expect X’s revenue to increase 105% year-over-year to $19.97 billion in its fiscal year 2021. The stock has gained more than 142% in price over the past year and close to 24% year-to-date.

X is currently trading more than 30% below its 52-weeks high of $30.57, which it hit on August 18, 2021.

X’s strong fundamentals are reflected in its POWR Ratings. The stock also has an A grade for Value and Momentum, and a B for Growth. In the Steel industry, it is ranked #26.

In total, we rate X on eight distinct levels. Beyond what we’ve stated above, we have also given X grades for Stability, Quality, and Sentiment. Get all the X ratings here.

Click here to check out our Infrastructure Sector Report for 2021

Want More Great Investing Ideas?

SCHN shares were trading at $49.56 per share on Wednesday morning, up $0.06 (+0.12%). Year-to-date, SCHN has gained 57.50%, versus a 16.97% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SCHN | Get Rating | Get Rating | Get Rating |

| X | Get Rating | Get Rating | Get Rating |