United States Steel Corporation (X): Price and Financial Metrics

X Price/Volume Stats

| Current price | $40.75 | 52-week high | $50.20 |

| Prev. close | $40.63 | 52-week low | $22.26 |

| Day low | $40.39 | Volume | 2,843,058 |

| Day high | $40.85 | Avg. volume | 3,808,473 |

| 50-day MA | $37.79 | Dividend yield | 0.51% |

| 200-day MA | $40.13 | Market Cap | 9.16B |

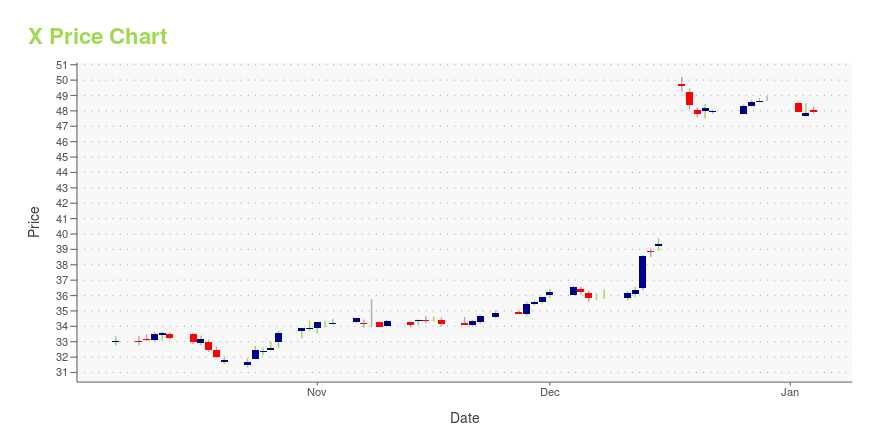

X Stock Price Chart Interactive Chart >

United States Steel Corporation (X) Company Bio

United States Steel produces and sells flat-rolled and tubular steel products in North America and Europe. It operates through three segments: Flat-Rolled Products, U. S. Steel Europe, and Tubular Products. The company was founded in 1901 and is based in Pittsburgh, Pennsylvania.

Latest X News From Around the Web

Below are the latest news stories about UNITED STATES STEEL CORP that investors may wish to consider to help them evaluate X as an investment opportunity.

U.S. Steel CEO Sells $13 Million Worth of Stock Through PlanCEO David B. Burritt sold a large block of the steel maker’s stock on the day that U.S. Steel said it had agreed to be bought by Japan’s Nippon Steel. |

United States Steel (X) Beats Stock Market Upswing: What Investors Need to KnowUnited States Steel (X) closed the most recent trading day at $48.61, moving +0.54% from the previous trading session. |

U.S. Steel Is No Longer a Force. The Nippon Steel Purchase Puts It Back in the Spotlight.U.S. Steel was once the largest company in the world. It stopped being the largest global steel maker in 1970. Now, U.S. Steel’s Dec. 18 agreement to sell to Japan’s Nippon Steel for $14.1 billion, and the heated opposition the deal faces, are putting the company in the spotlight once again. |

Despite Fast-paced Momentum, U.S. Steel (X) Is Still a Bargain StockIf you are looking for stocks that have gained strong momentum recently but are still trading at reasonable prices, U.S. Steel (X) could be a great choice. It is one of the several stocks that passed through our 'Fast-Paced Momentum at a Bargain' screen. |

Is Ryerson (RYI) Stock Undervalued Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

X Price Returns

| 1-mo | 9.60% |

| 3-mo | 9.04% |

| 6-mo | -15.45% |

| 1-year | 63.77% |

| 3-year | 74.60% |

| 5-year | 177.80% |

| YTD | -16.04% |

| 2023 | 95.71% |

| 2022 | 6.15% |

| 2021 | 42.45% |

| 2020 | 47.67% |

| 2019 | -36.61% |

X Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching X

Want to see what other sources are saying about United States Steel Corp's financials and stock price? Try the links below:United States Steel Corp (X) Stock Price | Nasdaq

United States Steel Corp (X) Stock Quote, History and News - Yahoo Finance

United States Steel Corp (X) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...