- Silver often follows gold- the yellow metal has been trending higher

- Silver’s technical trend remains higher since moving above $21 per ounce

- Three reasons gold and silver should continue to make higher highs

- Silver mining stocks tend to outperform the metal during rallies

- SILJ is the junior mining ETF that diversifies risk- A potential for explosive growth

Silver is a highly volatile precious metal. In 2020, the price traded in an over $18 range. After hitting the lowest level since 2009 at $11.74 in March 2020, during the height of the global pandemic, the price more than doubled. Silver reached the highest price since 2013 when it moved to just below $30 last August. In Q1 2021, silver made a marginally higher high when the continuous futures contract reached $30.35 on February 1. The GameStop (GME) crowd bought silver, but the price ran out of upside steam at the new peak.

Silver mining shares provide leverage when it comes to the metal’s price as they tend to outperform during rallies and underperform during price corrections. The ETFMG Prime Junior Silver Miners ETF product (SILJ) holds a diversified portfolio of the leading junior silver mining companies. While SILJ acts as a leveraged product, it does not suffer from time decay like many other ETF/ETN products that use options and derivatives for gearing.

Silver often follows gold- the yellow metal has been trending higher

Gold made lower highs and lower lows since August 2020 when the continuous futures contract reached $2063 per ounce, a record high.

Source: CQG

Source: CQG

The chart shows that June gold futures fell steadily from August 2020 through early March 2021, reaching a low of $1676.20 on March 8. The continuous contract low was at $1673.30 per ounce. Since then, gold made a higher low at $1677.30 on March 31. On April 8, it rose above the lower high at $1756 from March 18 when it moved to $1759.40. On April 19, gold traded up to $1798.40 as it continued to make higher lows and higher highs over the past weeks.

Source: CQG

Source: CQG

The daily COMEX May silver chart shows that silver has made higher lows and higher highs since March 31 as the volatile precious metal has kept pace with gold.

Silver’s technical trend remains higher since moving above $21 per ounce

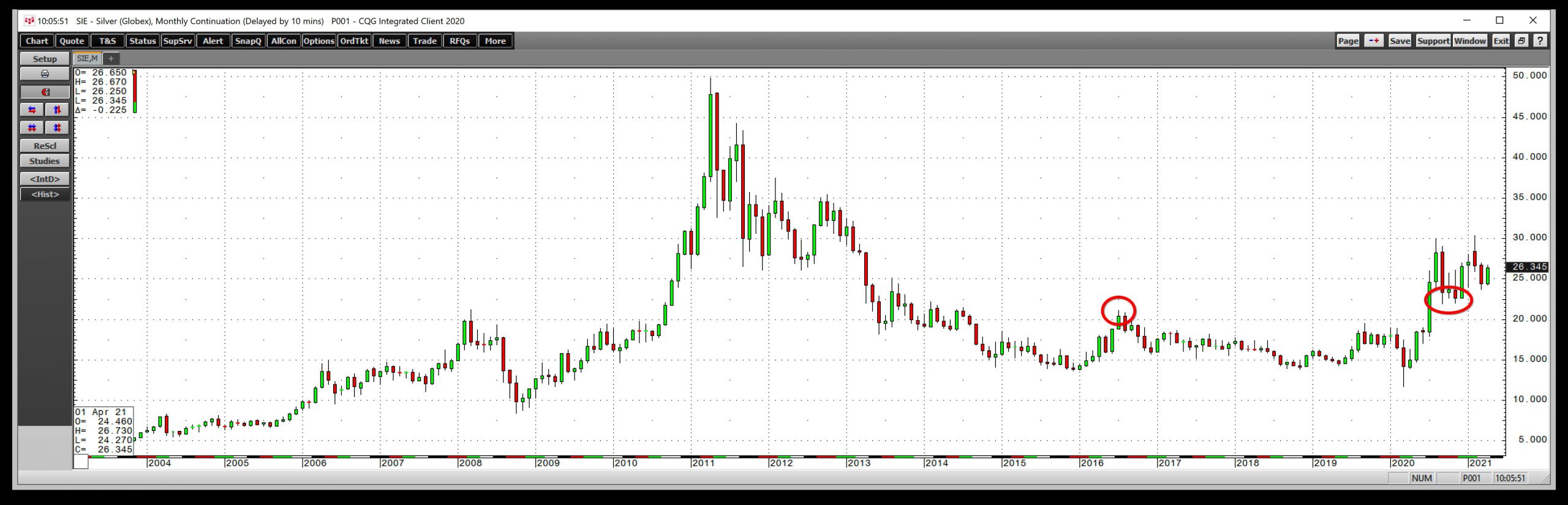

Silver had a wild year in 2020. After falling to the lowest price since 2009 at $11.74 in March 2020, the price broke above its critical technical resistance level in July.

Source: CQG

Source: CQG

The monthly chart shows that silver soared above the July 2016 high at $21.095 per ounce, reaching a high of $29.915 last August. In February 2021, silver made a marginally higher high at $30.35 per ounce. Since silver broke out to the upside, it has not traded below the $21.96 level.

The trend remains higher in the silver market, despite its recent consolidation. In 2020, silver traded in an $18.175 range. So far, in 2021, the bank from low to high has been $6.31. Silver has been consolidating above the $23.70 level and digesting last year’s wild price swings.

Three reasons gold and silver should continue to make higher highs

Gold and silver markets have fallen out of the market’s spotlight after gold reached a record peak in 2020 and silver probed above $30 per ounce in early February 2021. However, three factors support the metal’s prices as they sit at $1,785 and $26.35 per ounce on April 22.

- Central bank liquidity continues at an unprecedented rate, increasing the money supply, which is inflationary. Gold and silver historically thrive in an inflationary environment.

- The dollar index fell from 103.96 in March 2020 to a low of 89.165 in early January. At the 91.325 level, the dollar index remains close to the low, supporting gold and silver prices.

- The pullback in gold and silver has increased physical demand for the metals. While the bulk of demand in gold is from the investment and jewelry sector, industrial demand for silver is rising as it is a critical requirement in solar panels and electronics.

Inflationary pressures continue to rise. The most recent producer and consumer price index data told us prices are increasing. Crude oil is above the $60 level, copper is trading above $4.27 per pound, and lumber rose to over $1300 per 1,000 board feet, a record high. Grain and agricultural commodity prices are rising. Corn recently traded at nearly $6.50 per bushel level for the first time since 2013.

Soybeans are in the teens, and wheat futures are north of $6.80 per bushel. The stock market is at all-time highs, and the long bond has been trending lower, reflecting rising inflationary pressures. Digital currencies continue to experience dramatic, parabolic growth, and the stock market is at record highs. Inflationary footprints are all over markets across all asset classes, which supports gold and silver prices.

Moreover, gold and silver have been in long-term bullish trends since the turn of this century when gold fell to the $250 level, and silver traded to nearly $4 per ounce. Over the past twenty years, periods of price weakness in the gold and silver markets have been buying opportunities.

Silver mining stocks tend to outperform the metal during rallies

Silver mining companies tend to outperform the metal during bullish periods and underperform when the silver price declined. The companies that extract silver from the earth’s crust act as leveraged instruments. However, they do not suffer from the time decay that other leveraged ETF/ETN products display because the mining companies are ongoing concerns.

Junior silver miners often provide even more leverage because they explore for silver deposits. The senior mining companies also offer leveraged exposure to the silver price, but they are more established producers, which weighs on volatility and gearing. Junior silver mining companies exploded higher in 2020 when silver moved from $11.74 to $29.915 per ounce on the nearby COMEX futures contract.

SILJ is the junior mining ETF that diversifies risk- A potential for explosive growth

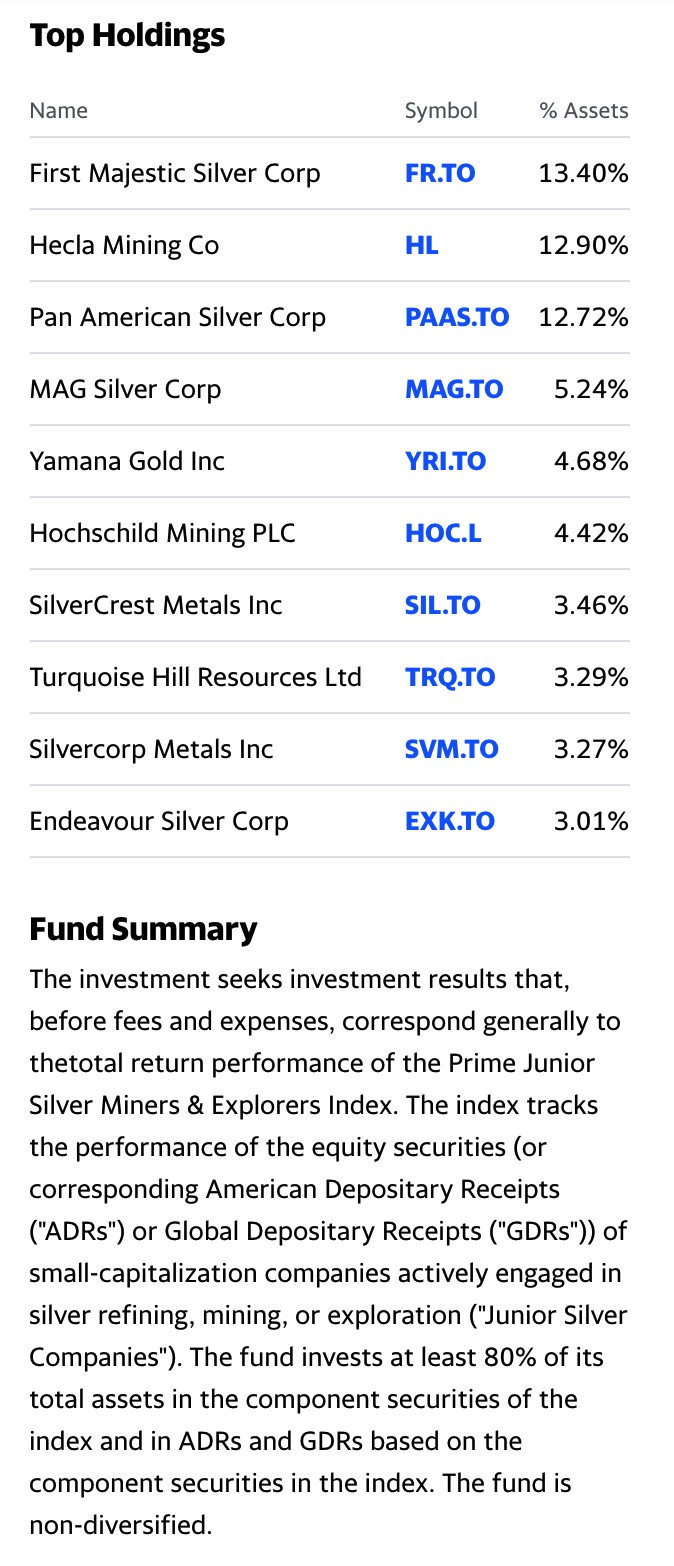

When selecting junior mining companies that will do best during a silver rally, I prefer a diversified approach. Diversification mitigates the idiosyncratic risks of individual company’s managements, mining properties, and country exposure. The ETFMG Prime Junior Silver Miners ETF product (SILJ) holds a portfolio of junior miners that can provide explosive returns during bullish periods in the silver market. The top holdings and fund summary for SILJ include:

Source: Yahoo Finance

Source: Yahoo Finance

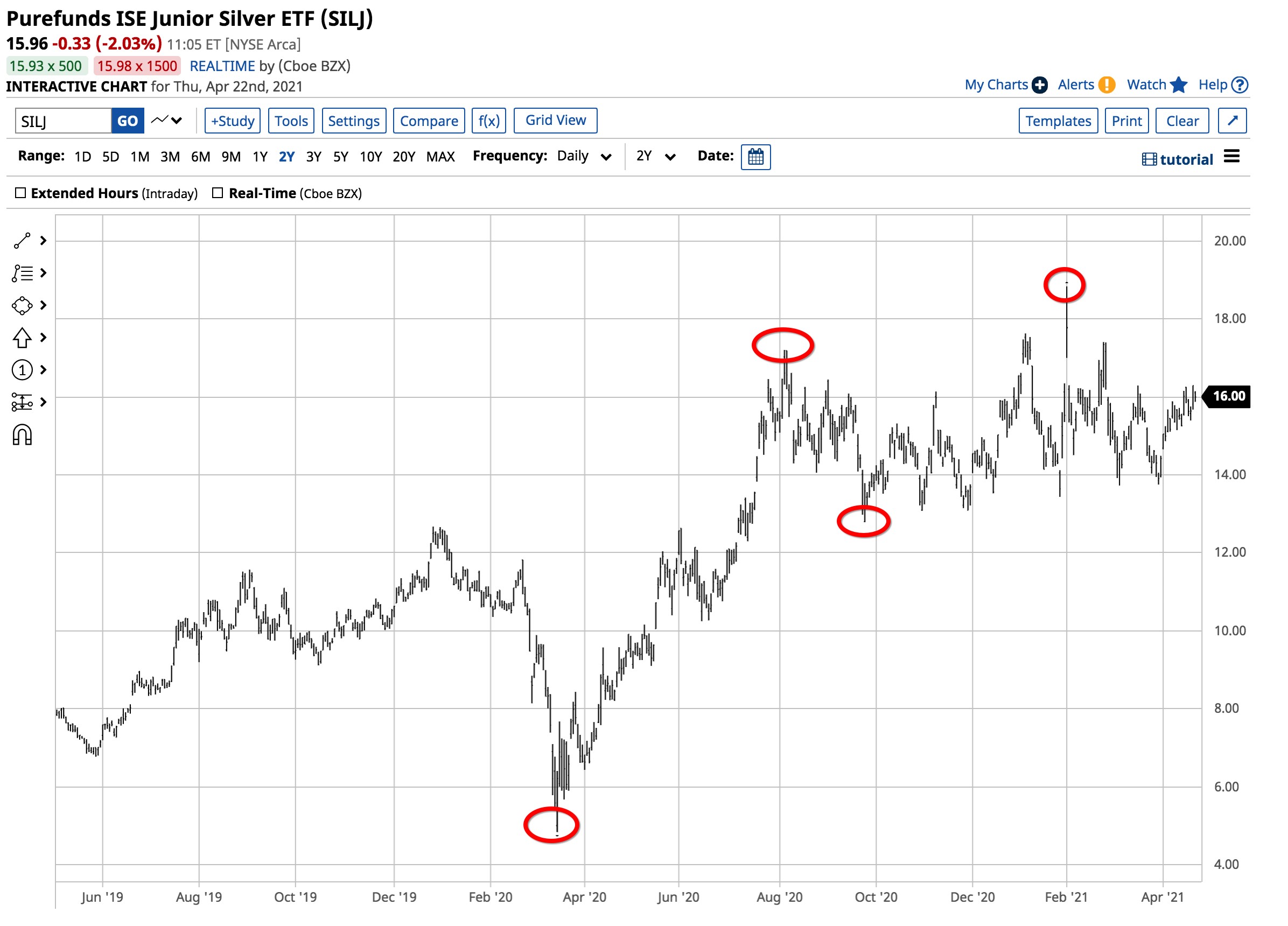

SILJ has $887 million in assets under management and trades an average of over 1.3 million shares each day. The ETF charges a 0.69% management fee. From March through August 2020, silver rose from $11.74 to $29.915, or 154.8%. Silver then fell to $21.96 in late September, a decline of 26.6% before rising to $30.35 in early February, or 38.8% higher than the late September low.

Source: Barchart

Source: Barchart

As the chart shows, SILJ rose from $4.84 in March 2020 to $17.21 per share in August 2020, or 255.6%. The ETF then fell to $12.79 in late September as it corrected by 25.7%. SILJ then rallied to $18.84 in February 2021, a rise of 47.3%. The ETF kept pace with silver during its correction but dramatically outperformed the metal’s price during rallies. On April 22, silver was trading at the $26.35 level, 13.2% below the early February high. SILJ was at $15.96, 15.3% under its peak from early February.

Many signs point higher in the silver market as the price consolidates and digests the bullish price action since the March 2020 low. If silver is preparing for its next leg higher, junior silver miners will likely deliver a leveraged return on a percentage basis compared to the metal. SILJ is a tool that holds mining shares that are candidates for growth stocks for those looking to turbocharge their exposure to the silver market.

Want More Great Investing Ideas?

SILJ shares were trading at $15.89 per share on Thursday afternoon, down $0.40 (-2.46%). Year-to-date, SILJ has declined -2.58%, versus a 11.82% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SILJ | Get Rating | Get Rating | Get Rating |