ElectraMeccanica Vehicles Corp. (SOLO - Get Rating) is a Vancouver-headquartered designer and manufacturer of electric vehicles (EVs). Its flagship offering is the SOLO, a single-seat three-wheeled EV that retails for $18,500. It also sells the four-wheel, two-seat eRoadster, an EV with a $124,900 starting price. The company was incorporated in 2015 and began marketing the SOLO vehicles in the U.S. in August, targeting the three West Coast markets where it has a retail presence (Southern California, Scottsdale, Arizona, and Portland).

Earlier this year, SOLO announced plans to open a manufacturing facility in the U.S. and conducted a competition among major metro areas to host the property. In October, it narrowed the field to Nashville and Phoenix, but as of this writing it has yet to announce where the facility will be based. The SOLO vehicles now on the road are manufactured by Zongshen Industrial Group in Chongqing, China.

SOLO was founded in 2015 by Henry Reisner, the son of Frank Reisner, who launched the automobile manufacturer InterMeccanica in 1959. Reisner took the reins of his father’s company in 2011 and made InterMeccanica a SOLO subsidiary in 2017.

Here’s how our proprietary POWR Ratings system evaluates SOLO:

Trade Grade: D

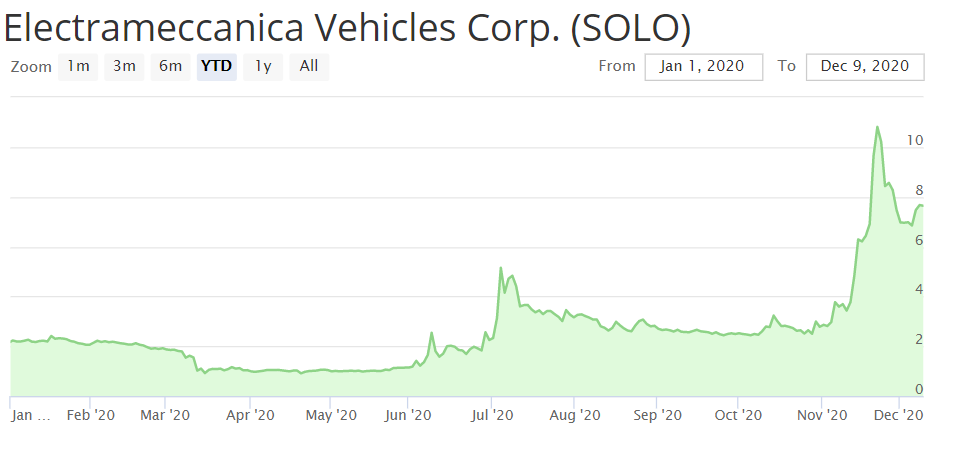

SOLO is currently trading at $7.62, roughly in between its 52-week high of $13.60 and its 52-week low of $0.89. The stock has mostly been flat over the past several months, experiencing blips of upward activity in late June after announcing Gateway Investor Relations would manage its IR program and then in November after its Q3 earnings report.

Buy and Hold Grade: D

SOLO’s Q3 report on Nov. 10 was followed by a 9.5% upswing in its stock price on Nov. 12 and a 39.5% spike ascension on Nov. 19. The euphoria was fueled by a $0.19 per share pro forma profit in the quarter, far removed from analysts’ prediction of a $0.11 per share loss.

Still, SOLO came out of the Q3 with a few bruises: it lost $14.9 million in the quarter, compared to a C$5.3 million loss for the same period one year earlier. CEO Paul Rivera noted that Q3 activity was focused on putting the SOLO vehicles “to use in high-value commercial activities including marketing, retail distribution, test drives and fleet demonstrations” – no vehicle was sold during this period, and Rivera added customer deliveries would begin in early 2021.

Peer Grade: D

SOLO ranks #30 out of #34 in the Automobile & Vehicles Manufacturers category – another EV company, run by Elon Musk, ranks first. As the EV market equivalent of the new kid on the block, SOLO has a lot of catching up to do against well-established competition.

Industry Rank: A

The Automobile & Vehicles Manufacturers category ranks #5 out of #123 stock categories. Despite the leadership position held by Tesla (TSLA) in this category, EVs make up less than 2% of the vehicles on U.S. roads – the product’s popularity is greater in Europe than China.

Overall POWR Rating: D

Based on its stock performance and widening losses, SOLO gets a “Sell” grade from our POWR Ratings.

Bottom Line:

SOLO is just starting to make itself known in the U.S., but its formidable competition and severely limited retail presence equals a steep road ahead. The real test begins in early 2021 as the company’s EVs start to take their place on U.S. streets and highways. In view of SOLO’s slow start, impatient investors might wish to jettison this stock while the more cautious personalities should hold off on buying and just keep an eye on its progress.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

Chart of the Day- See Christian Tharp’s Stocks Ready to Breakout

SOLO shares were trading at $7.63 per share on Wednesday morning, down $0.04 (-0.52%). Year-to-date, SOLO has gained 254.88%, versus a 16.46% rise in the benchmark S&P 500 index during the same period.

About the Author: Phil Hall

Phil is an experienced financial journalist responsible for generating original content on the weekly Fairfield County Business Journal and Westchester County Business Journal, plus their respective daily online news sites, podcasts and video interview series. He is the winner of 2018, 2019 and 2020 Connecticut Press Club Awards and 2019 and 2020 Connecticut Society of Professional Journalists Award for editorial output. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SOLO | Get Rating | Get Rating | Get Rating |