Electrameccanica Vehicles Corp. (SOLO): Price and Financial Metrics

SOLO Price/Volume Stats

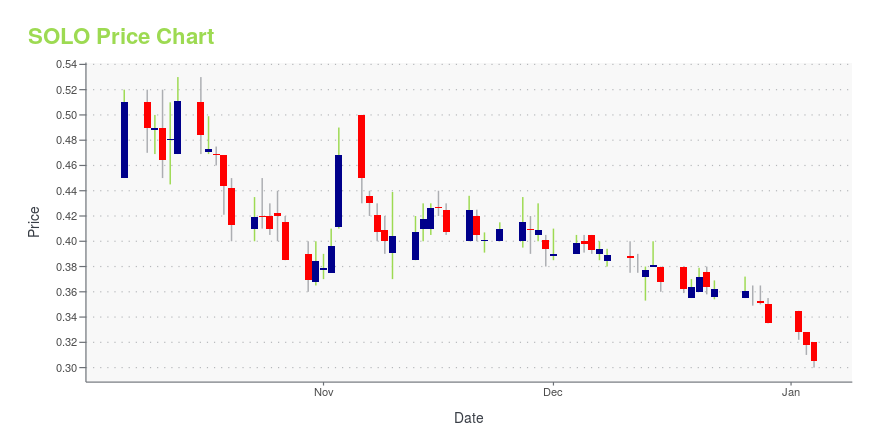

| Current price | $0.21 | 52-week high | $1.04 |

| Prev. close | $0.22 | 52-week low | $0.20 |

| Day low | $0.21 | Volume | 437,400 |

| Day high | $0.22 | Avg. volume | 522,441 |

| 50-day MA | $0.25 | Dividend yield | N/A |

| 200-day MA | $0.49 | Market Cap | 25.36M |

SOLO Stock Price Chart Interactive Chart >

Electrameccanica Vehicles Corp. (SOLO) Company Bio

Electrameccanica Vehicles Corp. engages in development and manufacture of electric vehicles. It operates through Electric Vehicles and Custom Build Vehicles segments. The Electric Vehicles segment develops and manufactures electric vehicles for mass markets. The Custom Build Vehicles segment offers high-end custom built vehicles

Latest SOLO News From Around the Web

Below are the latest news stories about ELECTRAMECCANICA VEHICLES CORP that investors may wish to consider to help them evaluate SOLO as an investment opportunity.

ElectraMeccanica Vehicles Corp. Reports Results of 2023 Annual General Meeting of ShareholdersMESA, Ariz., December 22, 2023--ElectraMeccanica Vehicles Corp. (NASDAQ: SOLO) ("ElectraMeccanica"), a designer and assembler of electric vehicles, today announces the results of the 2023 annual general meeting of shareholders of ElectraMeccanica (the "Shareholders") held virtually on Thursday, December 21, 2023 (the "Meeting"). |

ElectraMeccanica Provides Shareholders with December CEO UpdateMESA, Ariz., December 06, 2023--ElectraMeccanica Vehicles Corp. (NASDAQ: SOLO) ("ElectraMeccanica" or the "Company"), a designer and assembler of electric vehicles, today issued a letter to its shareholders from Susan E. Docherty, ElectraMeccanica’s CEO, providing an update on the business. Please visit the company’s IR site for additional details: https://ir.emvauto.com/emotion/blog-details/2023/December-Update/default.aspx |

ElectraMeccanica and Tevva Resolve Merger LitigationMESA, Ariz., November 28, 2023--ElectraMeccanica Vehicles Corp. (NASDAQ: SOLO) ("ElectraMeccanica"), a designer and assembler of electric vehicles, today announced the amicable resolution of litigation with Tevva Motors Limited ("Tevva") relating to the termination of the previously-announced arrangement agreement, dated August 14, 2023, by and among the parties. The parties’ agreement resolves Tevva’s claims against ElectraMeccanica, 1432952 B.C. Ltd. ("Holdco"), 1432957 B.C. Ltd. ("Parentco") |

Update on ElectraMeccanica Litigation Dispute With TevvaMESA, Ariz., November 09, 2023--ElectraMeccanica Vehicles Corp. (NASDAQ: SOLO) ("ElectraMeccanica"), a designer and assembler of electric vehicles, today announced that the United States District Court for the District of Arizona issued an order on November 7, 2023 dismissing the previously filed complaint by Tevva Motors Limited ("Tevva") against ElectraMeccanica, 1432952 B.C. Ltd. ("Holdco"), 1432957 B.C. Ltd. ("Parentco") and Susan E. Docherty, ElectraMeccanica’s Chief Executive Officer and I |

Complaint Filed Against ElectraMeccanica in Connection With Termination of ArrangementMESA, Ariz., November 07, 2023--ElectraMeccanica Vehicles Corp. (NASDAQ: SOLO) ("ElectraMeccanica"), a designer and assembler of electric vehicles, today announced that Tevva Motors Limited ("Tevva") filed a complaint (the "Complaint") in the United States District Court for the District of Arizona on November 3, 2023 against ElectraMeccanica, 1432952 B.C. Ltd. ("Holdco"), 1432957 B.C. Ltd. ("Parentco") and Susan E. Docherty, ElectraMeccanica’s Chief Executive Officer and Interim Chief Operating |

SOLO Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -18.92% |

| 1-year | -68.90% |

| 3-year | -93.71% |

| 5-year | -92.56% |

| YTD | -37.39% |

| 2023 | -44.44% |

| 2022 | -73.52% |

| 2021 | -63.17% |

| 2020 | 187.91% |

| 2019 | 101.88% |

Continue Researching SOLO

Want to see what other sources are saying about Electrameccanica Vehicles Corp's financials and stock price? Try the links below:Electrameccanica Vehicles Corp (SOLO) Stock Price | Nasdaq

Electrameccanica Vehicles Corp (SOLO) Stock Quote, History and News - Yahoo Finance

Electrameccanica Vehicles Corp (SOLO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...