- Software and cloud solutions

- An ugly trend since September 2020

- Earnings beat expectations in the last report

- Getting close to offering value

- Splunk’s Observability Cloud

The stock market continues to roar higher. The tidal wave of central bank liquidity and government stimulus continues to create unprecedented asset inflation. The rise in the stock market could be a bit of a mirage as money’s purchasing power is declining.

As the money supply grows, inflationary pressures are bearing down on the US and global economies. The stock market is not the only place where inflation is causing asset prices to soar. Residential real estate, digital currencies, and commodity prices are all rising to multi-year or all-time highs.

Meanwhile, the global pandemic continues to cause issues. Bottlenecks in the supply chain have created a semiconductor shortage. Social distancing, working from home, and other side effects of COVID-19 have increased technology’s profile in our daily lives. The pandemic hastened the decline of retail business as it forced more consumers online. Technology companies experienced a boom in 2020, and Splunk, Inc. (SPLK - Get Rating) was no exception.

While vaccines create herd immunity to the virus, new habits may be hard to break as people have become reliant on technology for shopping, working, communicating, and entertainment. The pandemic sent the shares of many technology companies soaring in 2020. The tech-heavy NASDAQ led the stock market higher in 2020 with a 43.6% gain, which was more than twice the appreciation in the S&P 500 and DJIA last year.

So far, in 2021, the last year’s leading index has been a laggard. While the NASDAQ is higher than the December 31, 2020 closing level, it is not delivering the same percentage return as the other leading stock market indices. Splunk shares reached an all-time high in September 2020. Since then, SPLK halved in value at the most recent low this month.

Software and cloud solutions

SPLK provides software and cloud solutions that deliver and operationalize insights from the data generated by digital systems in the United States and worldwide. The company’s Splunk Platform is a real-time instrument that collects, streams, indexes, searches, reports, analyzes, and allows for machine learning, alerting, monitoring, and managing data capabilities.

Splunk also provides Splunk Solutions, such as Splunk Securities solutions that allow cybersecurity teams to streamline security operations workflow, accelerate threat detection and response, enhance threat visibility, and scale resources to increase analyst productivity via machine learning and run-book driven automation.

Splunk IT Solutions provide IT Operations teams visibility and control across cloud and on-premises environments. The company also operates Splunk Observability Solutions, Splunk On-Call, Splunk Infrastructure Monitoring, and Plunk Phantom Solutions.

Splunk has been around since 2003, with headquarters in San Francisco, California. At $116.22 per share at the end of last week, SPLK had a market cap of around $18.35 billion. The stock trades an average of over 2.25 million shares each day.

An ugly trend since September 2020

SPLK’s IPO on NASDAQ was on April 18, 2012, at $17 per share. The stock opened at $32 and made higher lows and higher highs over the next eight years, reaching a peak at $225.89 in September 2020.

Source: Barchart

Source: Barchart

The chart shows that SPLK shares suffered the most significant correction from the September 2020 high through the end of last week. SPLK fell to a low of $110.28 on May 11 and was near the lows at the $116.22 level on May 14. However, the stock put in a bullish key reversal pattern on May 11, which could be a sign of a bottom. SPLK was down 48.6% as of the end of last week.

Earnings beat expectations in the last report

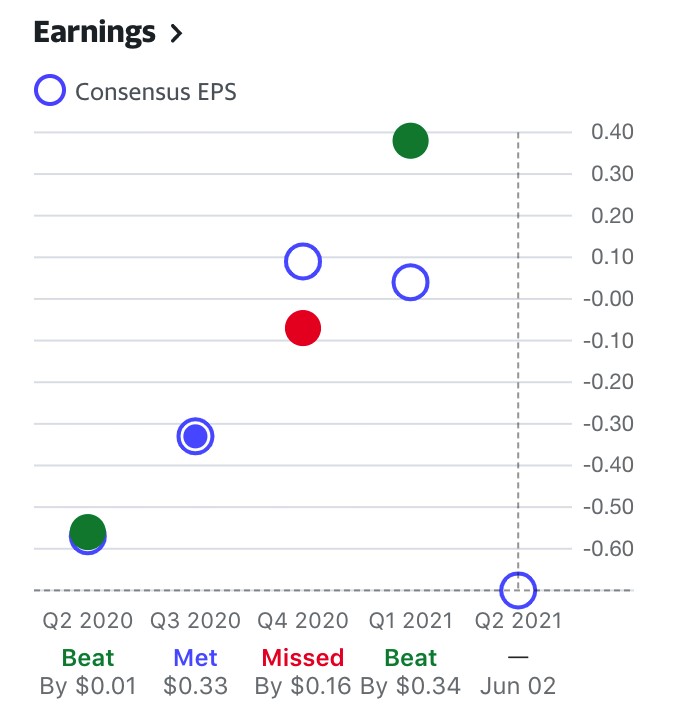

While earnings had been on either side of analysts’ forecasts over three quarters, the company outperformed the estimates in Q1 2021.

Source: Yahoo Finance

Source: Yahoo Finance

SPLK reported losses from Q2 2020 through Q4 2020. The company had a marginal beat compared to expectations in Q2 2020, met them in Q3 2020, missed by 16 cents in Q4 2020. SPLK moved to profitability in Q1 2020, beating expected EPS by 34 cents when it reported a 38 cents per share profit. SPLK will report fiscal Q2 2021 EPS on June 2, and the estimates are for a bad quarter and a loss of 70 cents per share, which continues to weigh on the stock’s price.

Source: Yahoo Finance

Source: Yahoo Finance

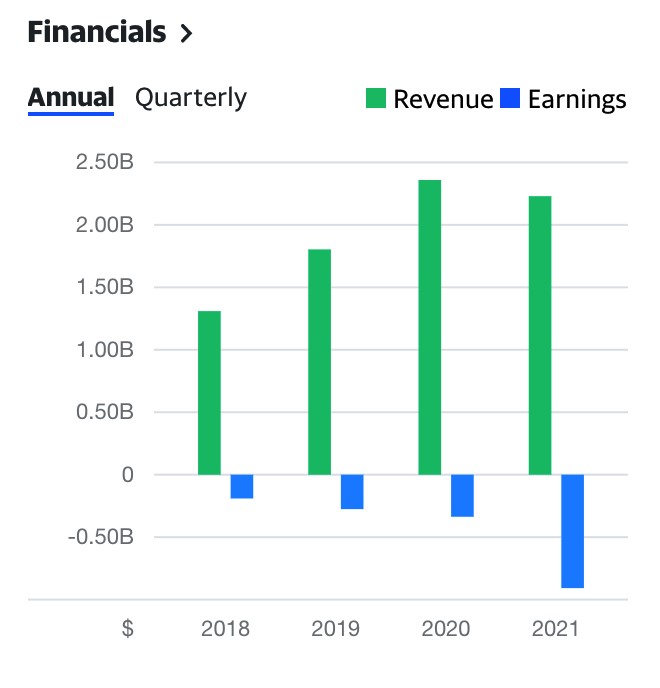

The annual revenue and earnings picture from 2018 through 2021 have been troublesome for the shares. As the earnings trend is lower and revenues turned lower in 2021.

Source: Yahoo Finance

Source: Yahoo Finance

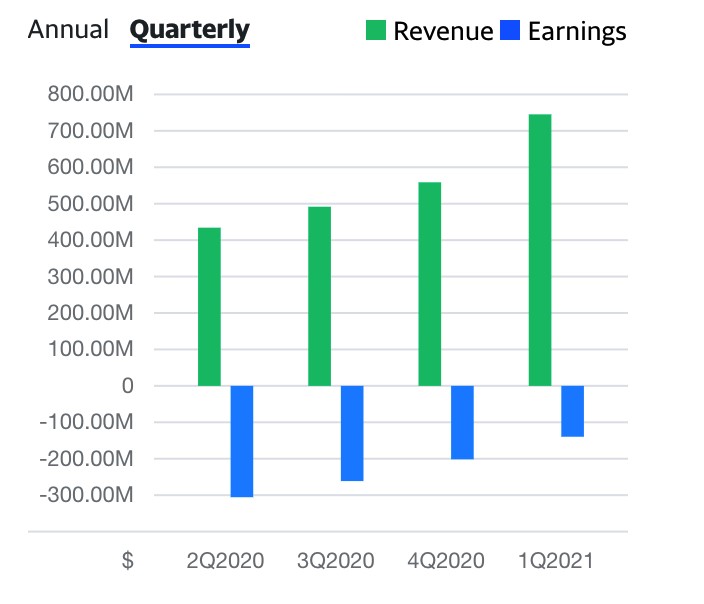

The quarterly picture looks more promising with increasing revenue and decreasing loss trends.

Morgan Stanley downgraded SPLK shares in late April because of a shift to a subscription-based revenue model and a refocusing on cloud-based versions of its software. Morgan Stanley expects “more bumps” ahead for Splunk.

Getting close to offering value

During the height of stock market selling during the pandemic, SPLK shares reached a low of $93.92 in March 2020. After exploding to the record high of $225.89 six months late in September 2020 with the rest of the stock market and tech-heavy NASDAQ, SPLK has underperformed the market as it sits at the $116.22 level. SPLK looked headed for a test of the March 2020 low as the market awaits its next earnings report, but the key reversal on May 11 could change the stock’s technical dynamics.

Expectations are low for the June 2 report, which could set the stage for a recovery in the shares. If SPLK outperforms, we could see a sharp and sudden jump in the share price. Even if EPS comes in around the forecast level at a 70 cents per share loss, the stock may have suffered enough and could jump.

Meanwhile, the trend is always your best friend in markets, and it is lower in SPLK shares. More than a few market participants have lost their shirts by attempting to pick bottoms in a stock that had been a falling knife over the past eight months. We may have to see a significant blow-off low before SPLK offers value and can recover.

Splunk’s Observability Cloud

On May 5, SPLK put out a press release through Businesswire announcing its new Splunk Observability Cloud, which is the “only full-stack, analytics-powered and enterprise-grade Observability solution available.” The company also highlighted “simplified pricing” in the press release outlining a host-based pricing metric tied to the value IT and DevOps teams gain from the product. SPLK seems to be betting that its new observability cloud product will change the fortunes of the company.

According to Carillon Tower Advisers, “Splunk’s on-premise segment remains pressured by cautious customers delaying capacity expansion plans in the near term. We expect contract renewals to pick up in the second half of the year, as the world reopens.”

I view SPLK as a highly speculative stock in the current environment. The performance has been ugly, and the stock continues to make lower lows. While implied volatility on out-of-the-money options is trading at high implied volatilities over 50%, the most conservative approach to dipping a toe into SPLK on the long side may be via call options.

When you purchase a call, all you can lose is the premium paid for the option. At the end of last week, a $115 call option for expiration on June 11, a little over one week past the next earnings report, was trading at the $6.60 bid to $7.35 offer level. A share price of $122.35 would provide a breakeven with participation on every $1 above until June 11 for those paying $7.35 for the call option.

Want More Great Investing Ideas?

SPLK shares were trading at $114.53 per share on Tuesday morning, up $0.16 (+0.14%). Year-to-date, SPLK has declined -32.59%, versus a 11.42% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPLK | Get Rating | Get Rating | Get Rating |