“Do not touch nothing. The truth will be revealed by the facts as they exist.”

-Hercule Poirot’s in the Murder on the Orient Express

One of the biggest challenges of using options, as an investment tool, is that you must be right on direction and price target, and also accurate in your timing. And, with all the recent turmoil getting it right at the exact right moment, it’s especially difficult.

You can buy a call with too short of an expiration period, watch the stock go up, and actually lose money because time decay will offset most or all of the directional gains if the move does not come soon enough. Sell a put, or establish a position for a net credit using long-dated options to get more premium, and an adverse move in the short-term can cause a large-enough drawdown to knock you out of the position for a loss.

Butterfly spreads are a good, low-cost way to establish positions that are not impacted by time decay or short-term price movement. Due to their balanced construction, their value only becomes price sensitive — but exponentially so — as expiration approaches. In this way, one can eliminate the need to be right about the velocity of the price move — you need only be correct about the price level a given point in time. This makes them useful as both protective positions and potentially highly-profitable directional bets.

A Stack of Spreads

A butterfly is a 3-strike position that involves a combination of the following:

-The sale (or purchase) of 2 identical options

-The purchase (or sale) of 1 option with an immediately higher strike than the 2 identical

-The purchase (or sale) of 1 option with an immediately lower strike than the 2 identical

All options must have the same underlying stock and have the same expiration date.

One way to think of butterflies is as a combination of 2 vertical spreads — one bullish and one bearish — with a common middle strike. It has a 1 x 2 x 1 construction.

Today, we’ll focus on the long butterfly, in which the two outside strikes are purchased and the “body”, or center strike, is sold for a net debit. This “stack of spreads” (one long, one short) creates a position that is initially both near delta and theta neutral. This means that changes in price and time, and even implied volatility, have little impact on the value of the position.

This strategy’s name undoubtedly is derived from its structure of a midsection and 2, equidistant outside pieces. This creates a profit-loss diagram with 2 “wings” in which the middle common strike is typically sold short and represents the price of maximum profit on expiration day.

For example; with SPY , if one thinks the market can rebound in coming weeks, maybe Trump goes back to negotiating before the September 1st tariffs go into effect, you can set up a bullish butterfly spread.

With SPY currently trading around $285, could:

- -Buy 1 Aug (8/30) 284 call

- -Sell 2 Aug (8/30) 290 call

- -Buy 1 Aug (8/30) 296 call

For a Net debit of $1.25

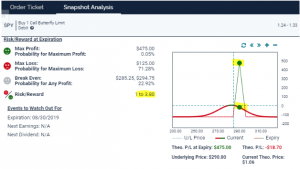

The maximum profit is $4.75 (calculated by the width between strikes minus the cost or $6-minus 1.25 =4.75) and would be realized if SPY is exactly at $290 on the 8/30 expiration.

As the P/L graph below shows that would be a 380% gain. But note, almost all of the profits would accrue as the expiration date approaches-the green line. During the interim, the position’s value stays fairly stable.

Low Maintenance

For this reason, butterfly positions are often referred to as “vacation positions” because they’re low cost and have minimum risk, and you can basically put them on and forget about them for a while. For most retail investors, there’s no need for monitoring or adjustments on a daily or even weekly basis, until expiration approaches.

The trade-off is that significant profits can only be realized near expiration. As expiration approaches, the position’s gamma, or rate of change in delta, increases dramatically, so the incremental profits that might have accrued over a few weeks can evaporate in a few days.

However, the low-cost nature of these positions can make them very useful as a portfolio protection tool for less active traders. Let’s assume that one would like to hedge downside risk in a reasonably diversified portfolio. It might make sense to buy some wide width butterfly spreads — let’s say $10 between strikes — on the Spyder Trust (SPY) that would land in the profit zone on a 5% to 10% market decline.

More active traders will often use butterflies in multiple layers, to maintain an inventory of spreads that can both deliver profits across several price levels and expirations to trade against shorter-term price swings.

Given the nature of the price stability of these spreads, this can be an especially powerful tool for establishing positions that won’t get shaken out during short-term volatility.

You basically set it and forget it, and hope price lands on your middle strike and the butterfly emerges as a beautiful profit.

SPY shares were trading at $287.01 per share on Wednesday afternoon, down $0.79 (-0.27%). Year-to-date, SPY has gained 15.91%, versus a % rise in the benchmark S&P 500 index during the same period.

This article is brought to you courtesy of Stock News.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |