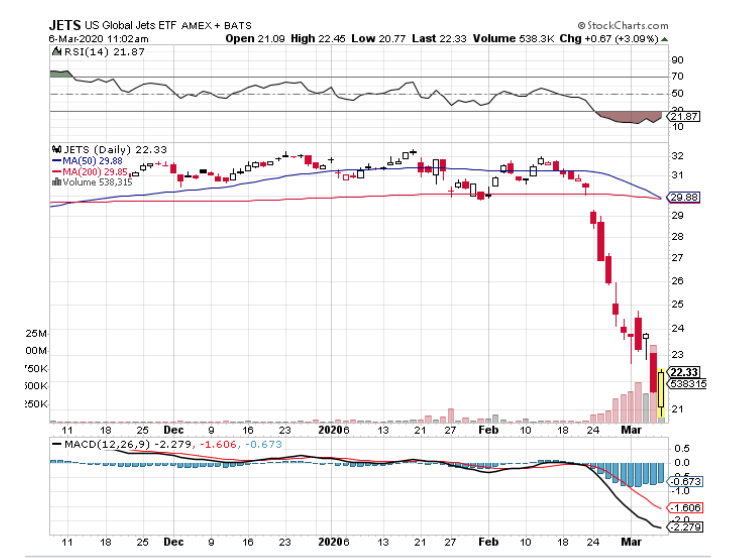

The airline stocks had been the first to decline as the Covid19 virus started spreading beyond China and they have now been the hardest hit. The “US. Global Jets ETF (JETS)” is down some 32% in the past three weeks, which is nearly three times worse than the broader “SPDR S&P 500 (SPY)” 12% correction over the same time period.

While there is no sign travel will return back to normal anytime soon, in fact, it will probably get worse in the coming weeks, it seems investors might be trying to find a glimmer of bluer skies for the sector.

In trading, the saying “it’s always darkest before the dawn” translates to “reversals often occur when traders and investors are most afraid they won’t.

In real-time, of course, it’s extremely difficult to know when those moments are occurring, and it’s even more of a challenge to put on a trade. But when prices reach levels that allow you to clearly define risk and potential reward, it can be easier to make an objective decision.

Airline stocks look like they are trying to have that moment today as JETS and several of the major carriers have seen a big reversal and were actually up on the day even as SPY was still down over 2% at midday.

In technical analyst terminology, such price action creates a “hammer” or “green candle” which often identifies important turning points.

While some smaller and foreign airline stocks which don’t have strong balance sheets and are seeing a near standstill in travel might struggle and face the possibility of bankruptcy the major U.S. based carriers will be able to make it through the storm.

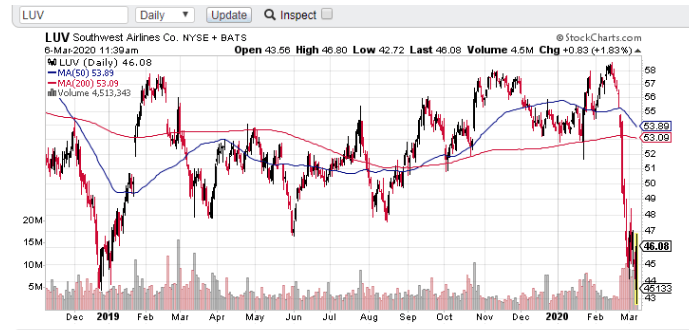

Assuming travel begins to normalize by the summer a few of the airlines are starting to look attractive from both fundamental valuation measures and technical levels.

“Southwest (LUV)” which is mostly domestic travel within the U.S. just touched the low near $45 it hit during the December 2018 sell-off.

Experienced traders know markets like to inflict as much pain as possible before they reverse—head fakes at key technical levels are one way to do that. But traders who are prepared to weather a certain amount of adverse price action, while committing to limiting losses at a predetermined level, can sometimes find themselves in good positions.

The use of long-dated options will also help define and limit losses.

SPY shares were trading at $294.91 per share on Friday afternoon, down $7.55 (-2.50%). Year-to-date, SPY has declined -8.37%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |