A few years ago there was an “Interactive Broker (IBKR)” commercial that used to run with frequency showing a woman arriving late for dinner saying “sorry, the market’s a mess, it’s down 2% and everyone’s selling, I needed to get some hedges on.

Can you imagine a 2% decline inducing a rush to hedge? What quaint notion in this current environment of 5% daily moves and 30% plunge in the last 30 days.

But is it too late to now start putting on those hedges or taking action to protect your portfolio?

We can look at two basic approaches to protecting your portfolio; trend following in which one reduces exposure as signals get triggered, and hedging which usually takes the form of buying out options. If we were pursuing guaranteed protection, we’d prefer something like a put option. But that contractual nature can make put options prohibitively expensive, especially if we have to roll our protection during periods of high market volatility.

Trend following tries to reduce the cost of protection, but in doing so eliminates the guarantee.

One might think of it this way: a put option is like buying fire insurance on your house (with the added risk that you might have to re-up your insurance while the house is on fire) and trend following is more like an alarm and sprinkler system.

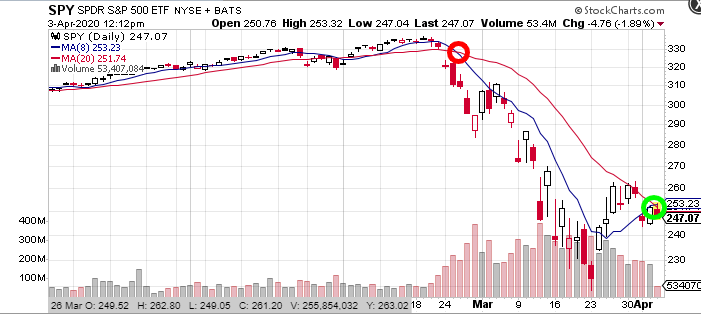

With the former we pay premiums year-in and year-out; with the latter, we get false alarms and the risk that we cannot respond fast enough when a fire breaks out. For people with a relatively short term time frame—one to six months—a typical signal to reduce exposure, or even get short, is when the 8- day moving average crosses the 20-day moving average.

As you can see that would have gotten you out of the market in early March just as the sell-off was beginning. What also should be noted is that it looks like the 8 DMA is readily trying to cross back above the 20 DMA which might give a buy signal.

Unfortunately, the change in trend signal, at least for this time frame, has already passed. But one can still use put options to get some portfolio insurance in place

Let’s look at three ways to use options to protect, or even benefit, from if we have another 15% to 25% decline in the “SPDR Trust (SPY)” using put options.

Outright Put Purchase

The simplest and most straightforward way to establish downside protection is through the outright purchase of puts. With the SPY trading around $250, one can buy the $240 strike puts with an August expiration for $3.50 a contract.

The advantages: It provides unlimited profit potential or downside protection. You can take close it for a large profit at any point prior to expiration.

The disadvantages: It is negatively impacted by time decay and decline in implied volatility.

Basic Vertical Spread

A vertical put spread involves simultaneously buying puts and selling an equal number with a lower strike price with the same expiration date. For example; August $250 puts and sell then $200 puts for a net debit of $8 for the spread.

The advantages: A spread greatly reduces the cost. Mitigates the impact of time decay and implied volatility.

The disadvantages: Profits /protection is limited to the width of the spread. In the example above the maximum gain is $42 and would be realized if SPY is below $260 at the August expiration.

Ratio Spread

A ratio spread involves buying a higher strike put and selling a greater number of lower, further out-of-the-money puts. For example; buy 1 August 250 put and sell 2 August 200 puts for even money.

The advantages: Ratio spreads can be established for little or no cost; sometimes even a credit in times of high implied volatility. This means there is no loss if SPY is above $250 at expiration. The position benefits from both time decay and a decline in implied volatility.

The disadvantages: Because you are selling more put option contracts than you are purchasing it has a “naked” component. Meaning you exposed to unlimited losses if SPY shares decline below the breakeven point. In the example above the breakeven is $180 or a 20% decline in the SPY.

These are three examples of how put option strategies can be used to both protect and profit from market declines. The approach you use will depend on your market outlook and risk tolerance.

Want more great investing ideas?

The Fake Rally is Over! – Why the bear is still in charge. Along with the right investment strategy to generate profits while stock prices head lower.

How to Make Money in a Bear Market – Learn more about this vital webinar with famed investor Marc Chaikin.

Reitmeister Total Return portfolio – Discover the portfolio strategy that Steve Reitmeister used to produce a +5.13% gain while the S&P 500 fell by -14.97%.

SPY shares were trading at $247.46 per share on Friday afternoon, down $4.37 (-1.74%). Year-to-date, SPY has declined -22.66%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating |