(Please enjoy this updated version of my weekly commentary published November 1st, 2021 from the POWR Growth newsletter).

Market Commentary

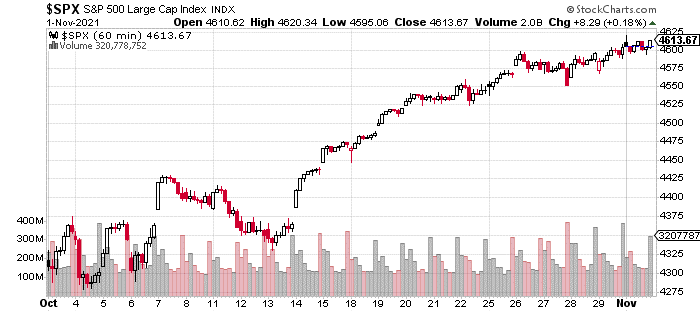

First, let’s take a look at the past week:

As we can see, the S&P 500 is up a little more than 1%. More impressive is the Russell 2000 with a nearly 3% gain.

Sometimes, the market moves to new highs, and it feels tenuous. Like the market just used up all its energy to just get to the lofty perch, and any little bit of selling pressure will send it tumbling lower.

This is not one of those times.

The market advance has been on solid footing. The advance is also deep in terms of market breadth with cumulative breadth measures breaking out to new highs for the first time since February. Another way to look at breadth is through the New Highs-New Lows Index.

And, this is also sending a strong signal that we are seeing a spike in the number of stocks making new highs which is also consistent with a broad-based advance that can trend higher for weeks or months.

So, we have a favorable market structure in addition to bullish market conditions.

Then, we have another catalyst in the form of a very strong earnings season.

Once again, estimates for earnings growth in Q3 are being raised. We are now at 36.6%, compared to 30.4% a couple of weeks ago. This would mark the third highest quarterly rate of earnings growth since 1960. Also remember that analysts were forecasting 24% earnings growth in Q3 just a couple of months ago.

So far, 56% of companies in the S&P 500 have reported. 82% have beat earnings expectations, and 75% have beat revenue forecasts.

Currently, analysts are expecting revenue growth of 20% for Q4 and 40% for the full year.

Equally important, we are not seeing any compression in margins despite management teams complaining about rising costs and supply chain issues during conference calls. As long as margins stay intact, then it’s a sign that the inflationary pressures are having a positive effect on asset prices.

Now, let’s dive into some topics that we have been discussing lately:

De-Bottlenecking: I made the case for this in last week’s commentary. We did see some relief in terms of shipping rates and the number of ships backed up at ports mildly decline. Another positive development was Ford’s earnings calls where the company said that the semiconductor situation was better in Q3 than in Q2 and should continue to improve.

This actually fit my thinking that auto stocks and auto parts stocks could be the biggest beneficiaries of auto production returning to normal as costs and shipping rates decline which would lead to higher margins. Additionally, anyone who has looked into buying a car or checked used car prices could tell you that there is massive demand for cars.

Both of these sectors are very cheap and should see earnings growth next year with increased volumes and pricing power.

Chinese Stock Rebound: Chinese stocks have gotten crushed over the past year as the government pivoted from a business-friendly stance to much more aggressive in terms of regulations like curbing market power, user privacy, crypto, and payment apps.

It’s resulted in nearly every Chinese stock dropping in price by more than 50% over the last couple of months. Some of them have had no change in earnings power and even managed to continue increasing them. Of these, many are too small to really be on the Chinese government’s radar.

Of course, there is considerable risk, but I think it’s worth looking into opportunities on the long side with favorable risk/reward parameters.

Implications of High Energy Prices: With high oil prices, we are starting to see strength in EV and alternative energy. These projects become more attractive from an economic sense when energy prices are high.

Thus, my bullishness on oil means that I am also bullish on certain companies within these sectors. Of course, there is a downside to high energy prices in terms of it eroding consumer spending. While this outcome is certainly possible based on the current path, I don’t think we are seeing enough evidence of it yet.

However, it’s a longer-term issue to monitor as it certainly could be a terminal threat to the bull market.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $461.73 per share on Tuesday morning, up $1.69 (+0.37%). Year-to-date, SPY has gained 24.70%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |