(Please enjoy this updated version of my weekly Tuesday commentary from the Reitmeister Total Return newsletter).

In Friday’s commentary I talked about my disdain for the erratic movement of the market in the clutches of the Retail Bros epic battle with the Wall Street titans. Well there are signs that bubble has quickly burst as GameStop comes down from a loony bin level of $350 to a less insane $90 at the close tonight.

As such the overall market is pressing back towards the all time highs. Further emboldening the bull case is another strong earnings season in the books and economic data still showing improvement.

We will cover all this and more in this week’s RTR commentary.

Market Commentary

First up let’s talk about yesterday’s Members Only webinar. Here is what we covered:

- January rewind & how our portfolio did relative to the S&P

- Market outlook and how it has changed thanks to the “Rise of the Retail Bros”

- Trading strategy with 2 important changes you need to know about.

- Primer on the New POWR Ratings system launched on StockNews…and what’s behind the impressive +30.72% annual return. And how we will start using for our future trades.

- Review of all 13 positions in our portfolio.

- Lengthy Q&A section covering numerous topics brought up by RTR members (and likely topics that are important to you as well).

Click Here to Watch Webinar Replay >>

As stated in the intro, the craziness from last week’s volatility is starting to reverse course. With that all the worthless POS stocks (yes…that meaning of POS

Enough ink has been spilt talking about the Retail Bros clash with Wall Street. So let’s not belabor the point much further. Instead let’s talk about the REAL stock market which is still very much on a bullish run in 2021.

First, because the math of all time low interest rates makes stocks the 3X better value than bonds and cash. (explored in detail in the January members only webinar).

Second, because the economy is improving faster than expected from the meteor sized crater created by the Coronavirus. This point was made loud and clear once again with a better than expected Q4-20 earnings season. Let’s explore a bit deeper followed by more of the recent positive economic proof.

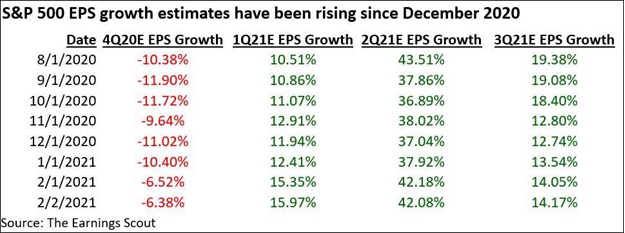

Below is the latest analysis from my old industry friend, Nick Raich at the Earnings Scout.

The chart has a lot of data, so let me boil it down for you by focusing on the 2nd column from the left. What it tells you is that just before earnings season began Wall Street analysts expected Q4 earnings to come in -10.40% lower than Q4 of 2019.

That decline makes sense given the lingering effects of the Coronavirus. However, as the actual earnings reports rolled in that expected decline is now only -6.38% year over year. And likely by the time we wrap up earnings season it may be closer to only -5%.

The next most important thing to appreciate is that after earnings came out better than expected then analysts busily increased their growth expectations for future quarters. That is very evident when you explore the current expectations for Q1, Q2 and Q3 now versus where they were just a month ago.

Since the earnings outlook is the #1 driver of stock prices, then no surprise that this evidence has the S&P sprinting higher the past two sessions. And likely going to give 3,900 a run for the money soon. And 4,000 probably not far behind. I suspect that level will be a point of strong resistance for a while.

Now let’s explore some of the additional positives sprouting up in recent economic reports. Most impressive of which was Monday’s ISM Manufacturing report at a very healthy 58.7. The forward looking New Orders reading was a notch higher at 61.1.

The best part of this whole report was that the employment component is finally showing notable strength rising nearly a full point to 52.6. Yes, that is notably lower than the other readings. However, you need to remember that employment is a lagging indicator which means it typically will be the last part to improve. But the fact that it is FINALLY improving bodes very well for business owners economic outlook making them feel confident to add more employees.

The Redbook Weekly Retail Sales report from this morning was another bright spot as it turned up a notch from 3.9% to 4.4% year over year gains. This clear spending strength by consumers was one of several reasons behind my choice of Best Buy as my latest Stock of the Week.

Lastly, I will note that Jobless Claims is starting to descend from its recent Covid induced peak. 847K new claims is still a touch high, but nicely under 914K from last week. As the number of Coronavirus cases declines around the country, that should lead to further improvements in the jobs picture.

The stock market does not go straight up or down. It is a more meandering path. However, make little doubt that we are still in the midst of a bull market so best to align yourself with that. The best strategy for that is what I laid out in detail in February’s Members Only Webinar. So watch now if you have not already. (Watch Here>)

What To Do Next?

Right now my Reitmeister Total Return portfolio is correctly positioned for where the market appears to be headed in 2021. Gladly we have been reading the tea leaves well of late which is why we have consistently outperformed…

- The last month

- The last 3 months

- The last 6 months

If you would like to see the current portfolio of 13 stocks and ETFs, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About Reitmeister Total Return newsletter & 30 Day Trial

Wishing you a world of investment success!

Steve Reitmeister

…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares were trading at $381.54 per share on Wednesday morning, down $0.01 (0.00%). Year-to-date, SPY has gained 2.05%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |

| BBY | Get Rating | Get Rating | Get Rating |