Best Buy Co. Inc. (BBY): Price and Financial Metrics

BBY Price/Volume Stats

| Current price | $87.35 | 52-week high | $93.72 |

| Prev. close | $87.35 | 52-week low | $62.30 |

| Day low | $86.78 | Volume | 1,734,759 |

| Day high | $88.70 | Avg. volume | 3,153,584 |

| 50-day MA | $83.98 | Dividend yield | 4.23% |

| 200-day MA | $76.53 | Market Cap | 18.84B |

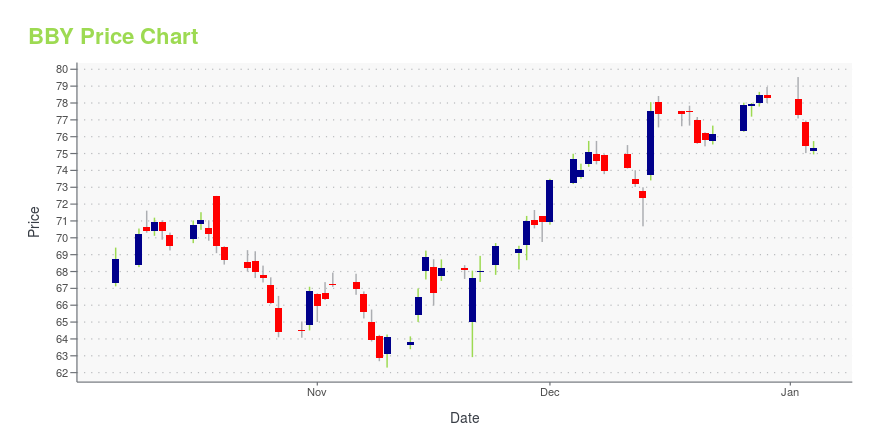

BBY Stock Price Chart Interactive Chart >

Best Buy Co. Inc. (BBY) Company Bio

Best Buy is an American multinational consumer electronics retailer headquartered in Richfield, Minnesota. Originally founded by Richard M. Schulze and James Wheeler in 1966 as an audio specialty store called Sound of Music, it was rebranded under its current name with an emphasis on consumer electronics in 1983. (Source:Wikipedia)

Latest BBY News From Around the Web

Below are the latest news stories about BEST BUY CO INC that investors may wish to consider to help them evaluate BBY as an investment opportunity.

Consumer Kings 2024: The 3 Best Large Retail Stocks to Buy NowWith retailers benefiting from higher margins, the strong economy and a shift towards goods, these retail stocks are at the top. |

Dividend Contenders List Ranked By Yield: Top 25In this article, we discuss top 25 dividend contenders according to yields. You can skip our detailed analysis of dividend stocks and their previous performance, and go directly to read Dividend Contenders List Ranked By Yield: Top 10. Dividend contenders typically refer to companies that have consistently increased their dividends for at least 10 consecutive […] |

Best Buy (BBY) Up 11.1% Since Last Earnings Report: Can It Continue?Best Buy (BBY) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

10 Highest Dividend Stocks on Cash AppIn this article, we discuss 10 highest dividend stocks on Cash App. You can skip our detailed analysis of investing through Cash App and the previous performance of dividend stocks, and go directly to read 5 Highest Dividend Stocks on Cash App. In this digital age, our lives have seamlessly integrated with technology, transforming various […] |

Best Buy Co Inc's Dividend AnalysisBest Buy Co Inc (NYSE:BBY) recently announced a dividend of $0.92 per share, payable on 2024-01-02, with the ex-dividend date set for 2023-12-11. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Best Buy Co Inc's dividend performance and assess its sustainability. |

BBY Price Returns

| 1-mo | 3.67% |

| 3-mo | 17.57% |

| 6-mo | 19.37% |

| 1-year | 9.65% |

| 3-year | -13.14% |

| 5-year | 34.60% |

| YTD | 14.09% |

| 2023 | 2.51% |

| 2022 | -17.49% |

| 2021 | 4.44% |

| 2020 | 16.71% |

| 2019 | 70.50% |

BBY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BBY

Want to do more research on Best Buy Co Inc's stock and its price? Try the links below:Best Buy Co Inc (BBY) Stock Price | Nasdaq

Best Buy Co Inc (BBY) Stock Quote, History and News - Yahoo Finance

Best Buy Co Inc (BBY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...