We’re currently in a bubble and I’m hardly the only one who thinks so.

If you’re a day trader and you can walk and chew gum, you are making money right now…

You’re doing the same thing they did in the late ’90s…You’re rolling it. You think everybody is a genius in a bull market…

Once we start to really have definitive data on the other side, people are going to sell on the news, and if I had to make a bet, that’s it…

I don’t think the market is truly understanding the challenges that we may be facing. ” – Mark Cuban

Mark Cuban isn’t just a brilliant entrepreneur, he’s also someone who sold Broadcast.com to Yahoo for $5.7 billion 10 months before the tech bubble burst.

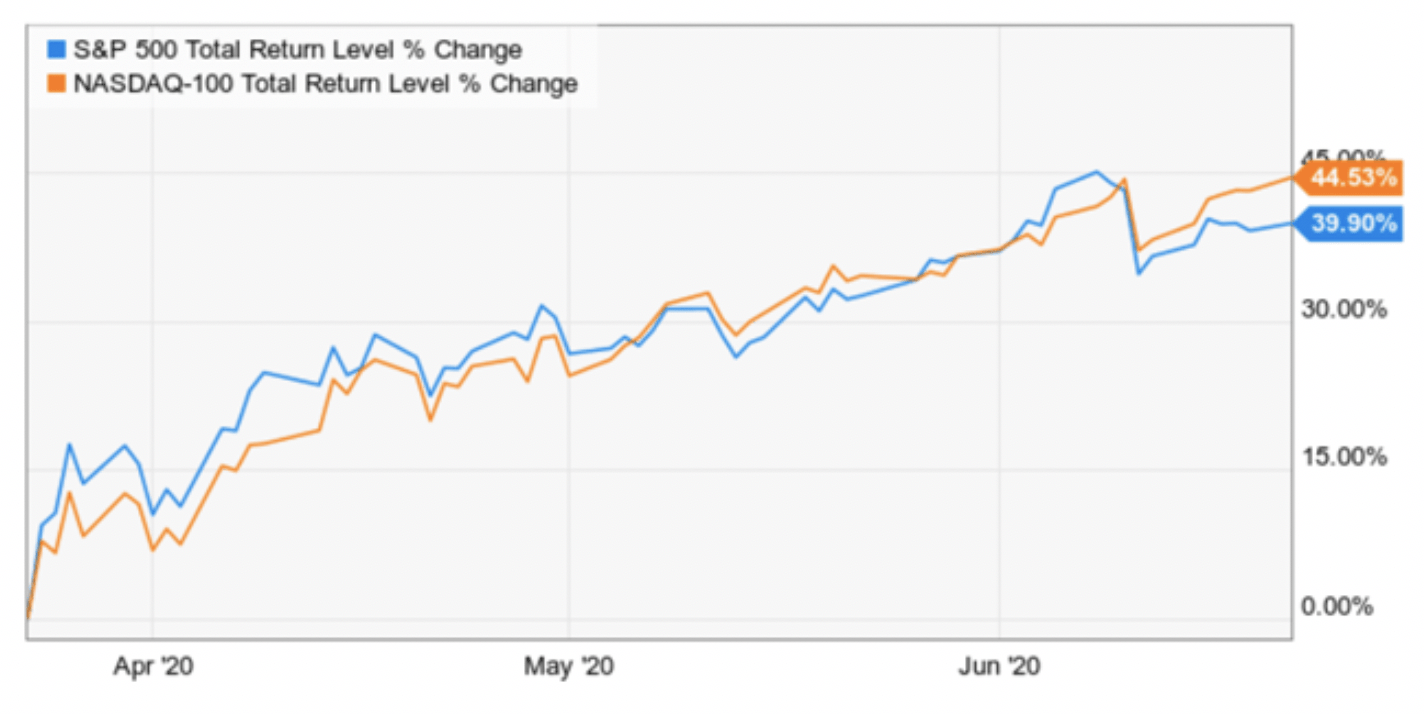

How do I know we’re in a bubble? It’s not just that the S&P 500 has roared higher by 40% since the March lows or the fact that the Nasdaq is now at a record high.

(Source: Ycharts)

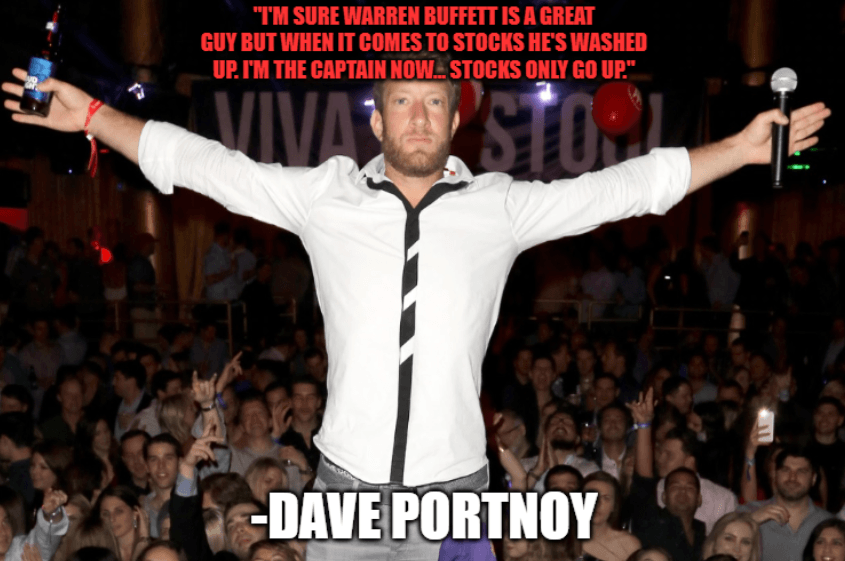

Rather it’s the rampant speculation that is going on all around us, exemplified by the “captain of the day traders” Dave Portnoy.

(Source: Imgflip)

Portnoy is not an analyst, but a shock jock trying to gin up publicity at a time when there are no sports to talk about.

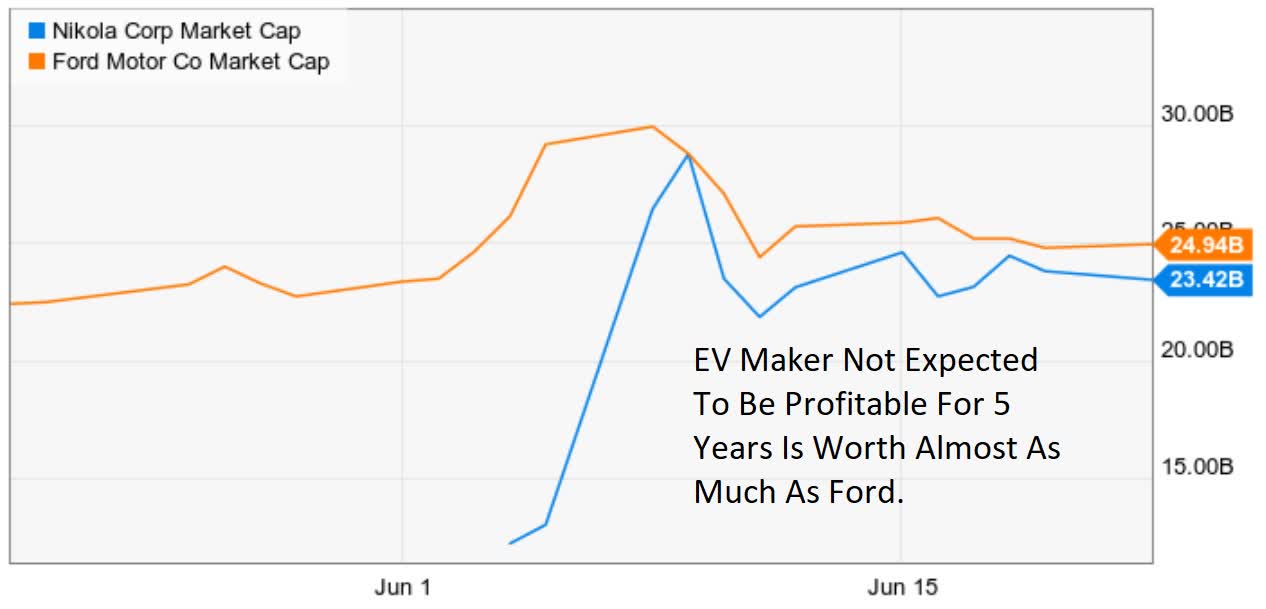

However, retail investors who follow him and others like him are causing some truly insane things to happen, involving rampant and dangerous speculation the likes we haven’t seen since the Dot Com bubble.

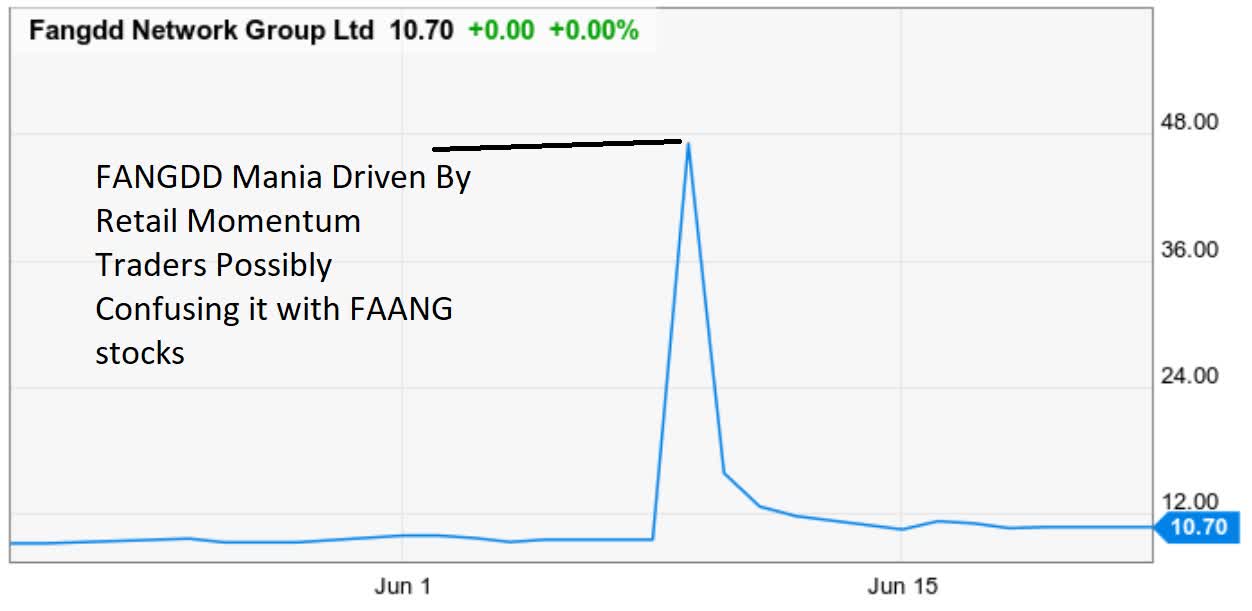

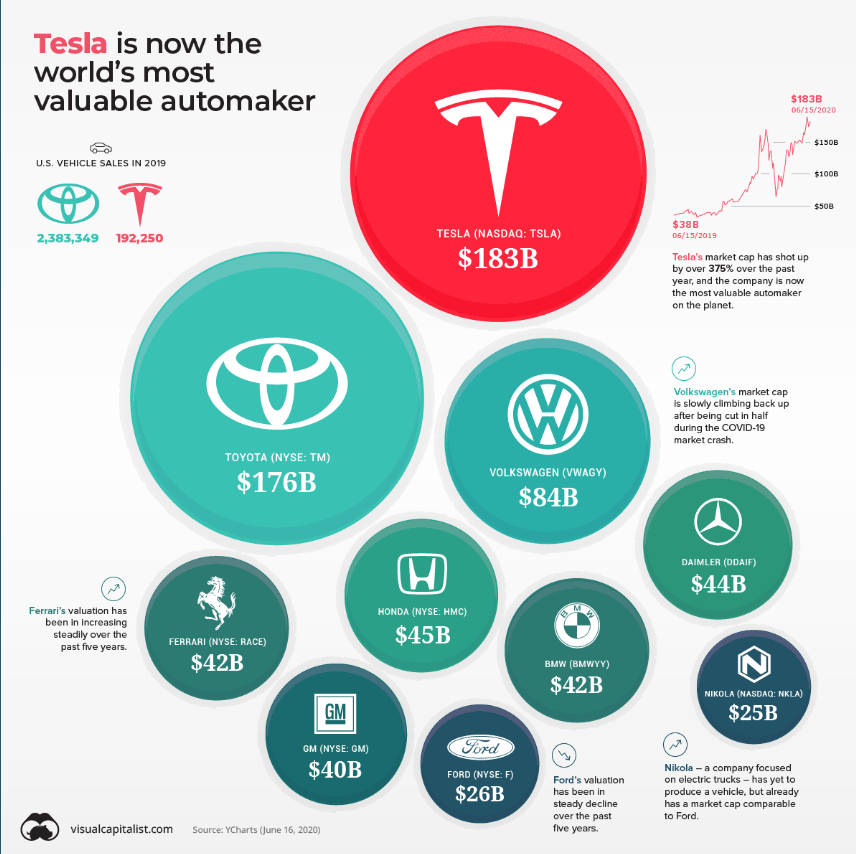

(Source: Ycharts)

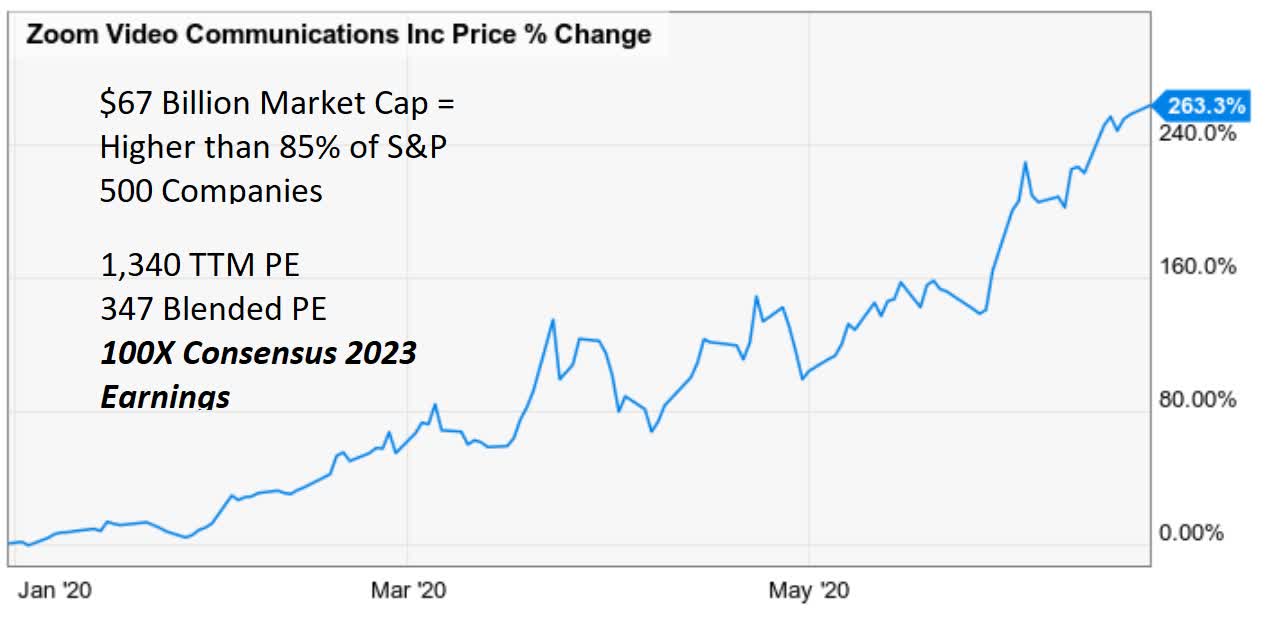

(Source: Ycharts)

(Source: Ycharts)

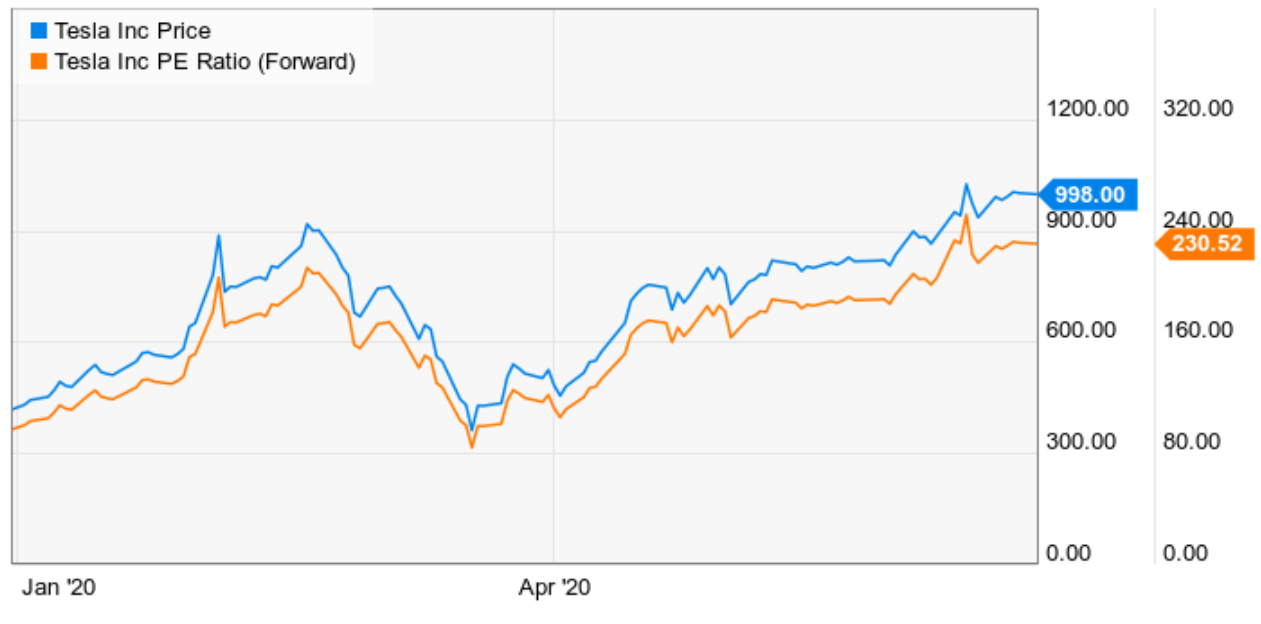

Tesla is now trading at 231 times forward earnings and the most valuable carmaker on earth.

(Source: Ycharts)

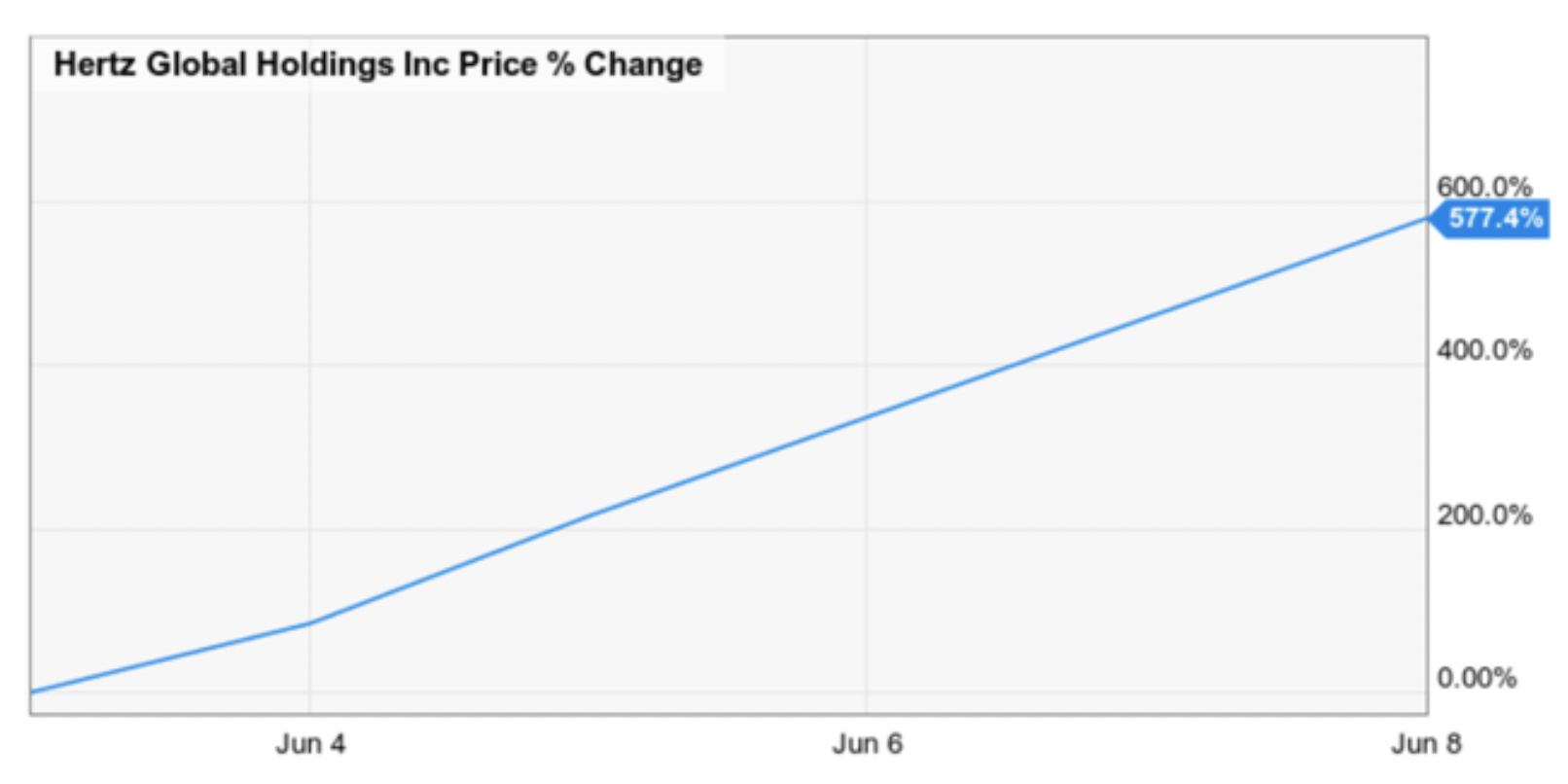

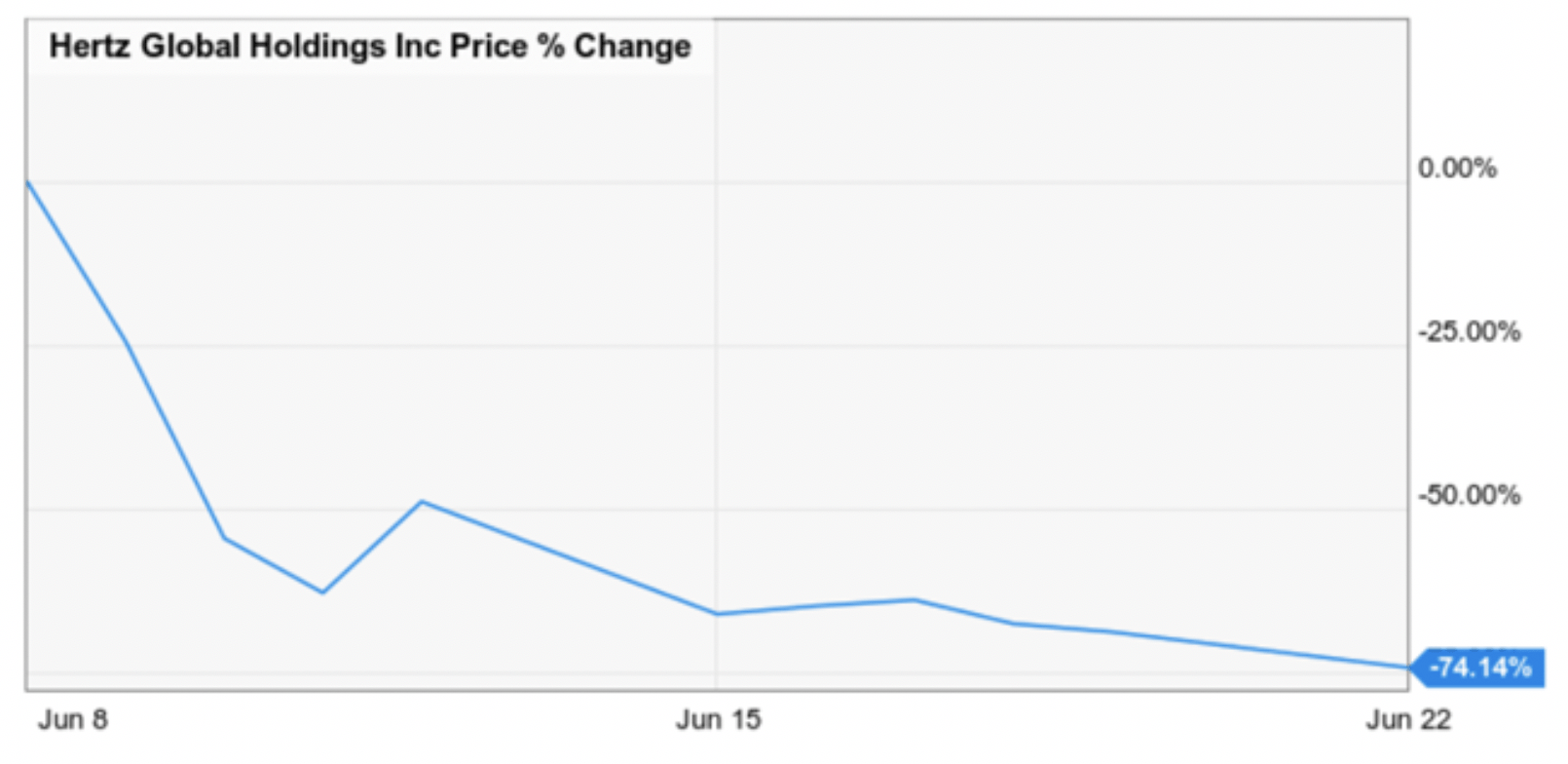

Or perhaps the ultimate example of bubble insanity is Hertz (HTZ).

A Company Worth Zero went up Almost 600%…

(Source: Ycharts)

Hertz soared almost 6-fold AFTER both declaring bankruptcy and then announcing plans to sell up to $1 billion worth of worthless shares to investors.

Literally, in the prospectus, it said that shares were at high risk of going to zero.

…And Is Now Rapidly Approaching Fair Value ($0)

(Source: Ycharts)

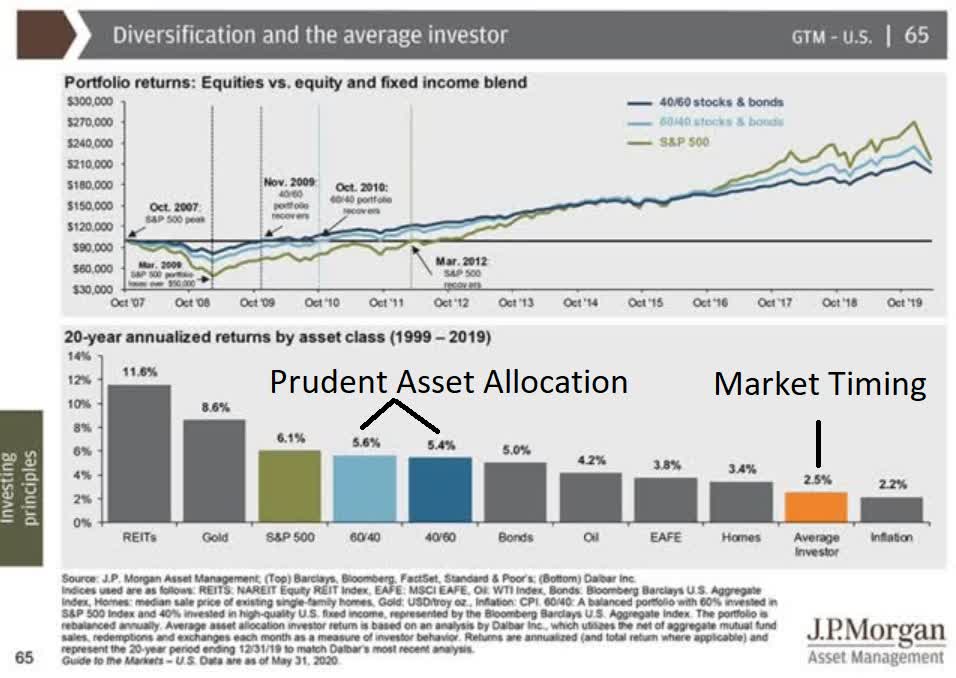

The bad news is that market timing can’t be used to avoid short-term losses in the stock market, as decades of historical data makes very clear.

The good news is there are 3 simple ways to avoid becoming the victim of dangerous speculative bubbles in these dangerous economic times.

3 Smart Ways to Buy Stocks in a Confusing Market

(Source: Imgflip)

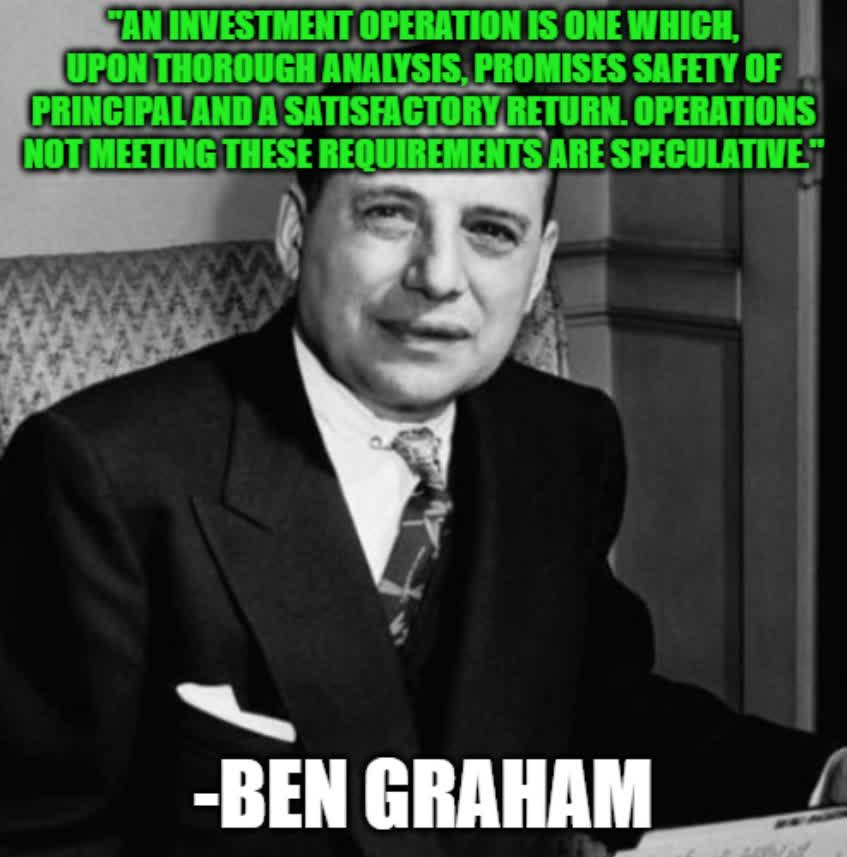

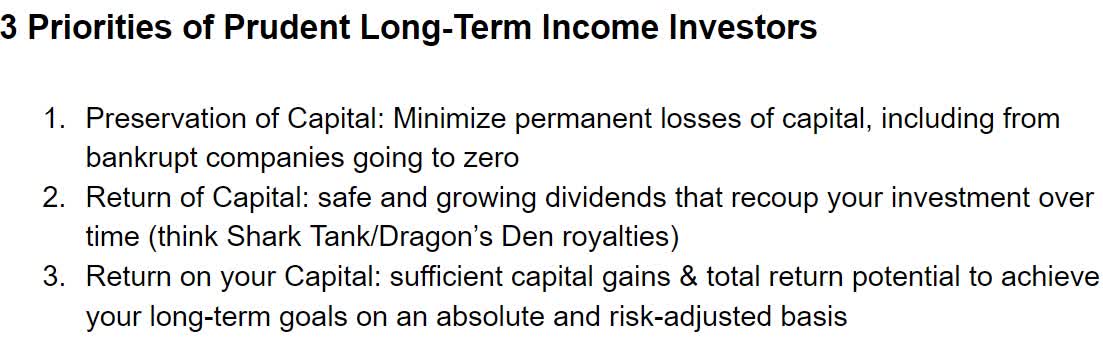

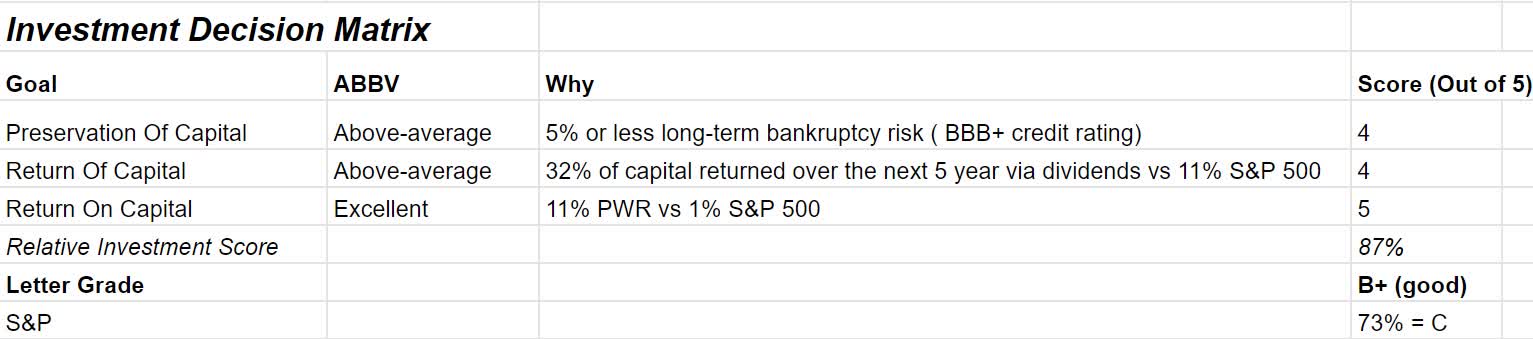

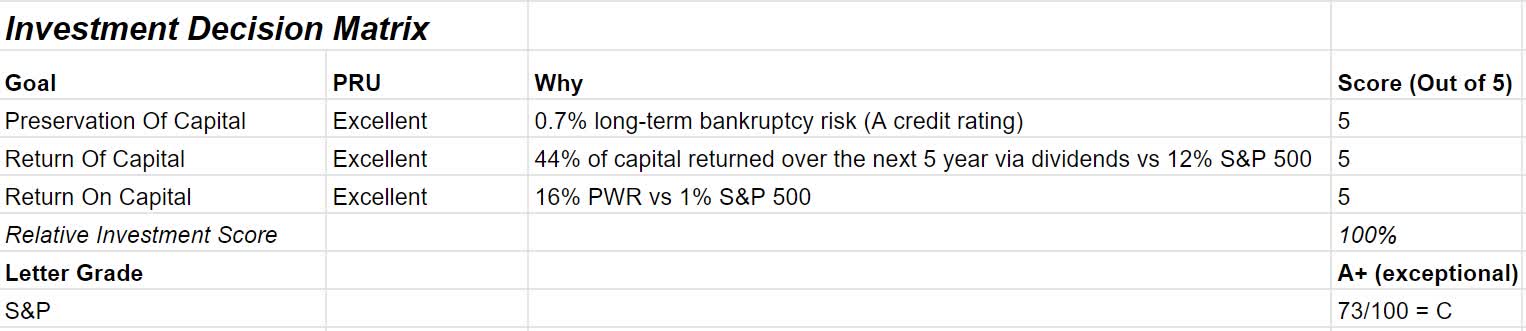

The difference between gamblers and investors is that investors think in terms of three key priorities.

First, we strive to not lose money, because you can’t compound something that’s declining over time.

Next, we strive to get our money back, so we can put it to work for us and compound faster.

Only after we’re confident of not losing money and having our money come back to us over time, do we think in terms of making profits on our money.

Follow those three priorities, as part of a diversified and prudently risk-managed portfolio, and achieving your long-term goals doesn’t become a matter of luck, but a matter of time, discipline, and patience.

How Smart Investors Make Their Own Luck In The Stock Market

(Source: AZ quotes)

Time arbitrage is the only real advantage retail investors have over the “pros”.

Simply put, we have the time to wait out the market’s irrational underpricing of quality companies that fund managers may not.

Underperform for too long and a fund manager will lose their job. This is why momentum chasing into bubble stocks is something that even well-educated and experienced institutional managers often do.

- A Fast-Growing 3.2% Yielding Blue-Chip With 300% Total Return Potential In The Coming Years

- This 5% Yielding Defensive Dividend Aristocrat Could Double Your Money Over The Next Few Years

I combine the three priorities of prudent investing in the Dividend Kings Investment Decision tool.

(Source: Dividend Kings Investment Decision Tool)

This takes all of 5 to 10 minutes to do with the spreadsheet we’ve created for our members and is what I do for each DK Daily Blue-Chip buy. This is a daily video series that points out reasonable and prudent investments that you can make no matter what the economy or stock market is doing.

Literally not a day goes by that we’re not putting real money to work in quality companies trading at reasonable to attractive valuations.

I’m buying the DK Daily Blue-Chip buy for my retirement portfolio every day because I believe in eating my own cooking.

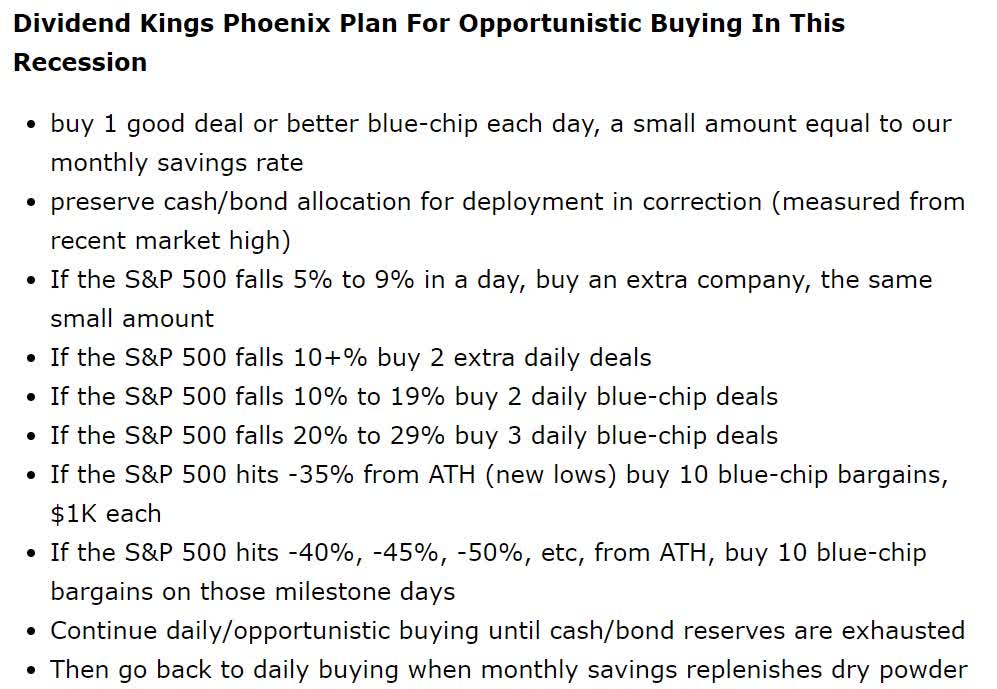

We’re not crazy, unaware that the market is going to suffer a nasty correction.

I track the big macro fundamentals each week, and we have a reasonable and prudent plan for profiting from the next inevitable but impossible to predict stock market decline.

We have numerous watchlists and high priority blue-chip names with potentially good buy (or better) prices set and just awaiting the market’s next freak out.

For example, there are three exceptional dividend blue-chips that I’m especially excited to buy during the next market decline.

Here’s just one of them.

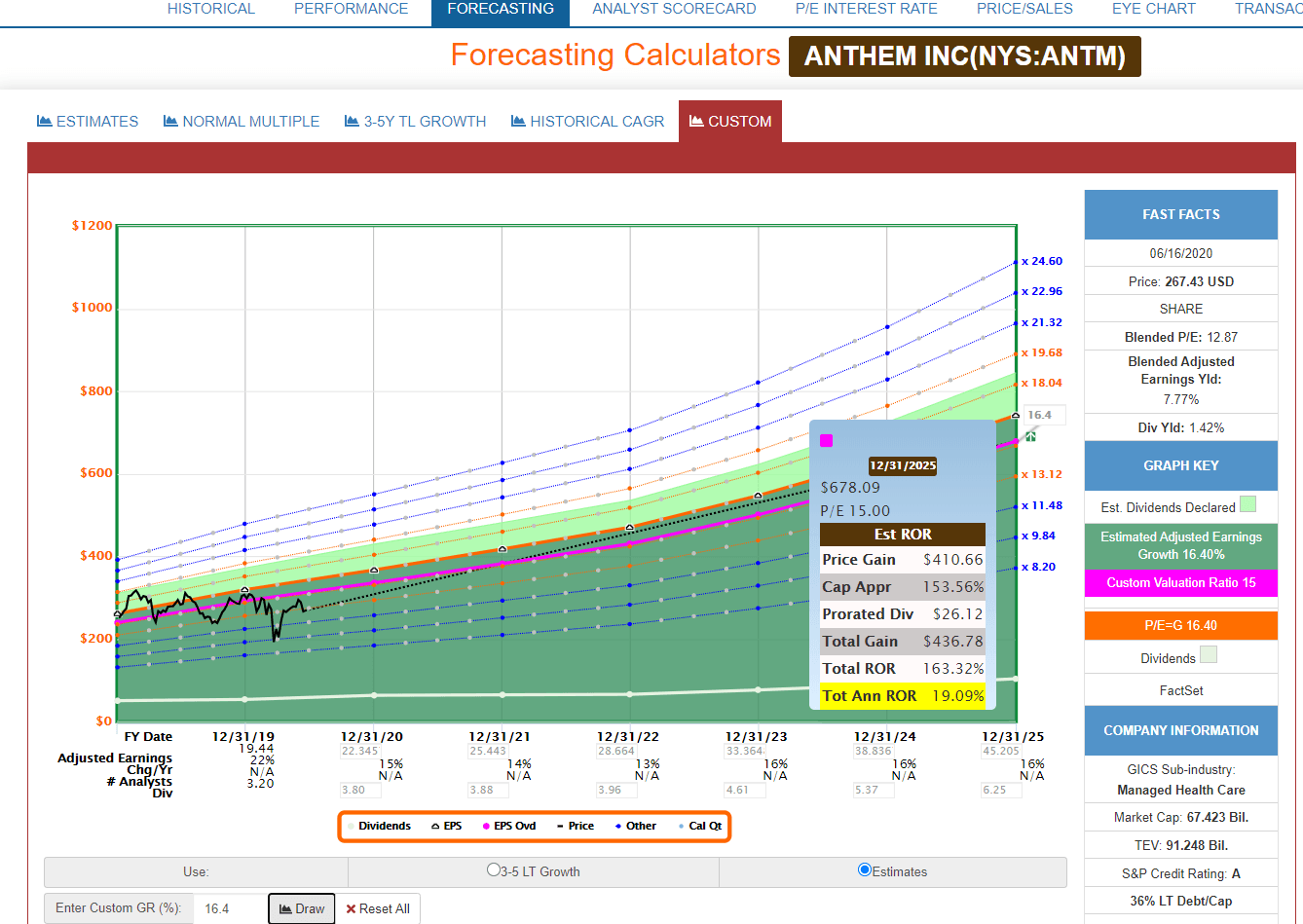

ANTM 2025 Consensus Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

I don’t have to know when the next market decline is coming, how long it will last, or how bad it will be.

I just have to keep putting money to work at a steady clip while holding a reasonable amount in reserve via a pile of cash and bonds, for when the inevitable does happen.

Bubbles can last longer than you might think possible, up to seven years in fact.

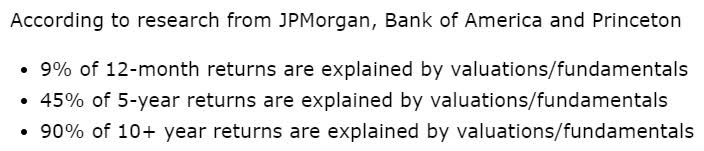

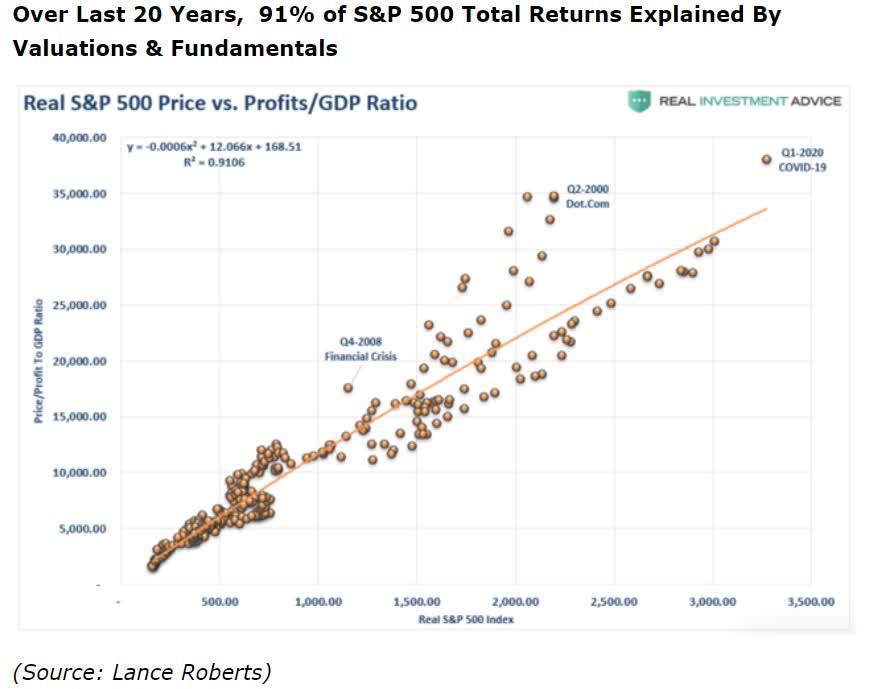

But while 12-month returns are impossible to predict because they are 91% driven by fickle sentiment, over the long-term fundamentals drive 91% of returns.

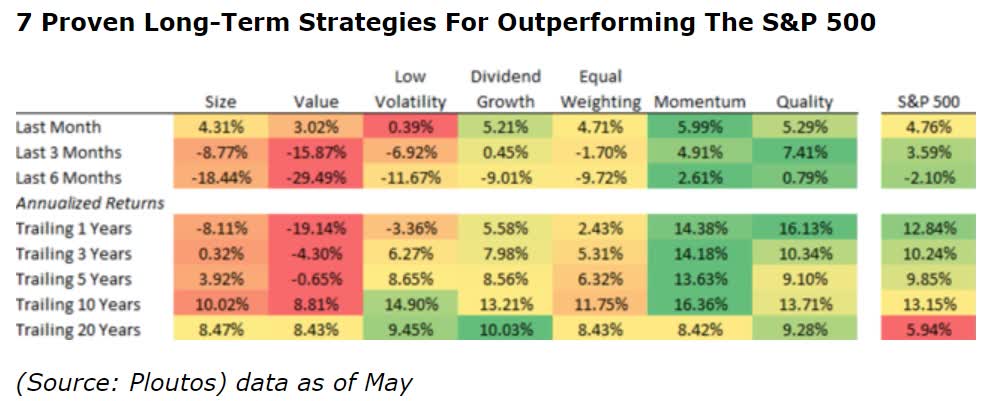

Which is why there are seven proven methods of beating the market.

As long as you have the patience to wait out periods of underperformance, which all strategies have (otherwise they’d stop working entirely) achieving your financial goals can be accomplished without obsessing over short-term market fluctuations.

(Source: imgflip)

We can’t control what the facts will do in the future. But we can control our reasoning and risk-management, and as long as you do that, then success isn’t a matter of luck, it’s a function of discipline, time, and strong company fundamentals.

This is why our motto is “quality first and prudent valuation & risk management always.”

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

Top 3 Investing Strategies for the Year Ahead

7 “Safe-Haven” Dividend Stocks for Turbulent Times

SPY shares were trading at $308.14 per share on Wednesday morning, down $3.91 (-1.25%). Year-to-date, SPY has declined -3.28%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| NDAQ | Get Rating | Get Rating | Get Rating |