As I write this article things have not further escalated between the US and Iran following the airstrike on one Iran’s key military figures. However, in the aftermath of this event was the kind of sabre rattling comments from Iranian officials that points to this being far from over. Thus, I thought worthwhile to explore the history of stock prices after wars commence.

Note, this may not become a war. And we certainly don’t want a war. This is just the prudent steps investors should take to consider what lies ahead to adjust our portfolio strategy if needed.

The Facts

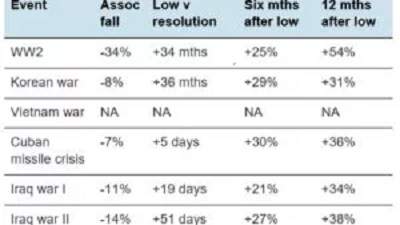

Below is a chart I grabbed from a 2017 article on Business Insider. I think it does the best job to show the initial reaction to the onset of war, how long it took for the low to be found, followed by the resulting bounces 6 and 12 months later.

You may wonder why there is no data for the Vietnam war. That is because it was such a slow rolling event that it was hard for the experts to pinpoint a start date to measure results. However, the rest of the data provides a very clear pattern of stocks initially tumbling followed by impressive bounces that more than make up for the original decline.

What I find most interesting is how much shorter and shallower were the declines in the most recent military conflicts. I believe the obvious answer is that investors learn from history and we get smarter every time. Thus, if stocks bounce back with gusto after the initial drop…then investors find less reason to drop in the first place.

What Should Investors Do This Time Around?

Again, this may not escalate much further and may never be classified as a war. Of course, that is what we hope for. So at this stage investors should do very little which is why the market cut pre-market losses nearly in half by the end of Friday’s session.

However, let’s imagine that things do escalate and a new war in the middle east emerges. Here would be my game plan:

- Get more conservative in your portfolio. That would mean selling some of your most aggressive positions that would likely tumble the most.

- Consider 20% cash or more. But probably not more than 50%.

- Maybe a touch of gold which often rallies at times of world discord (note gold rallied nearly 2% Friday).

- Oil prices will go up. So energy stocks will do well. And industries that have high energy costs will do poorly (Ex. Chemicals and Airlines).

- Flight to Safety = Lower Interest Rates = Financial stocks also underperform. (Also bond funds would see better than expected returns).

- The most aggressive among you should consider buying inverse ETFs or VIX positions that would rally on a market decline. But lock in those gains quickly because as you can see in the chart…the market bounces back with gusto.

- Get ready to buy the dip with both fists for the likely rally to ensue.

I will do my best to keep you all up to date through my commentary. For now I would stay the course leaning into this bull market that continues to provide attractive returns. The resources below should keep you on the right track:

5 Fresh Upgrades to Start the New Year

3 “Surprising” Growth Stocks for 2020

Wishing you a world of investment success!

Steve Reitmeister

…but my friends call me Reity (pronounced “Righty”)

CEO, Stock News Network

Editor, Reitmeister Total Return

SPY shares . Year-to-date, SPY has gained 0.17%, versus a 0.17% rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating | |

| IWM | Get Rating | Get Rating | Get Rating |

| MDY | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |