Inflation is on a lot of people’s minds right now, and that’s understandable.

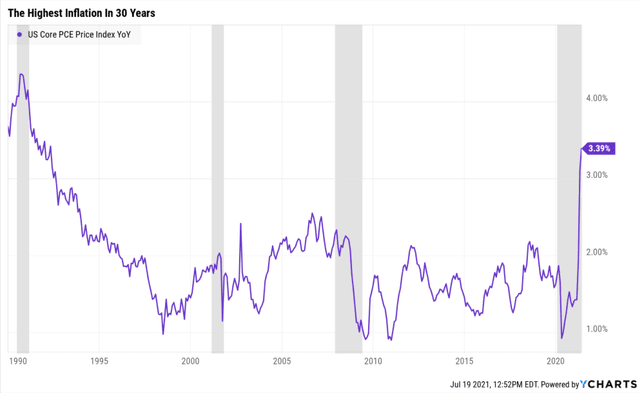

Based on core PCE, the Fed’s favorite inflation metric, we’re now seeing the highest inflation in 30 years.

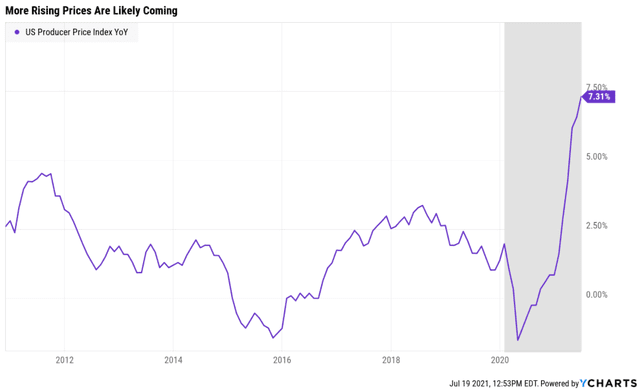

Producer prices are up even more, potentially indicating that rising prices have yet to peak as the economy reopens.

Here are the basic facts you need to know about inflation and how to protect your retirement portfolio from what’s likely coming next.

Why Inflation Is At 30 Year Highs

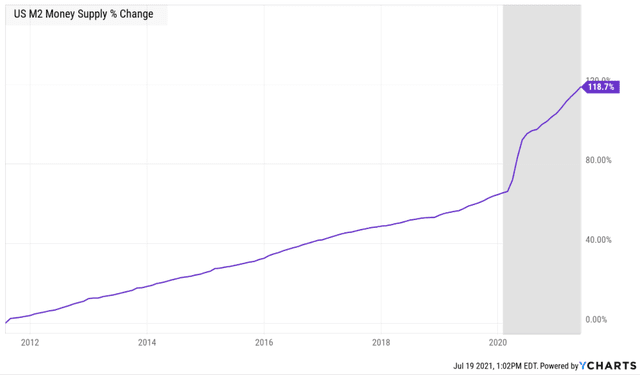

Many people think that the Fed’s money printing and record stimulus during the pandemic are the main culprits for high inflation.

That’s certainly one reason for rising prices, but the world is more complex than TV pundits or bumper stickers would have you believe.

The pandemic stimulus has created an estimated $2 trillion in excess savings and now that much of the US and world economies have started to reopen, there is a lot of pent-up demand.

For example, used car prices are up over 30% in the past year. Some rental cars are now fetching $700…per day.

But this brings us to the biggest reason for fast-rising inflation, global supply chain disruption.

Let’s use the used car market and rental cars as examples.

Early in the pandemic car rental firms were desperate for cash ahead of what many economists feared was another Great Depression.

Fleets were sold off, and automakers shut down factories due to the pandemic. Today’s cars average 5 computers each and that requires a lot of computer chips.

Automakers canceled most of their chip orders expecting auto demand would fall off a cliff as occurs in most recessions.

Instead, stimulus + people moving to the suburbs and fearing to use public transit quickly resulted in record new car demand.

Big tech companies like Apple (AAPL) and Samsung didn’t cancel their chip orders. In fact, they doubled down and scooped up as much supply as they could get.

That proved fortuitous because locked down populations all over the world, flush with stimulus cash, were soon ordering computers, laptops, tablets, and smartphones in record amounts.

Car markers ended up at the back of the line for new chip orders. And because computer chips are so complex to make, with new factories often costing $10 or even $20 billion and taking years to build, Taiwan Semi is now estimating it will take until the end of 2022 for the global chip shortage to abate.

Carmakers stand to lose billions, and the used car market is going crazy. Today there are some used cars that are more expensive than today’s model year.

Rental car companies are facing the same supply shortage, and due to leisure travel now recovering to pre-pandemic levels, car rentals often cost more than the rest of the trip combined, including plane tickets.

The labor shortage we’re facing today isn’t actually a labor shortage, but it is also helping to fuel some inflation.

There are 9.2 million US job openings according to the most recent JOLTs report. That’s basically how many US unemployed there are.

However, there continue to be various mismatches between where potential employees are and where companies are looking to hire.

- geography (many workers moved to the suburbs and out of cities)

- skills and desire (33% of restaurant workers say they will never go back to that high stress/low pay industry)

- timing (schools are still closed and parents can’t go back to work full time until schools reopen in the fall)

- pandemic concerns including the surging Delta cases among unvaccinated people

- extra unemployment benefits (7% to 13% of the reason people aren’t accepting jobs according to recent surveys and studies)

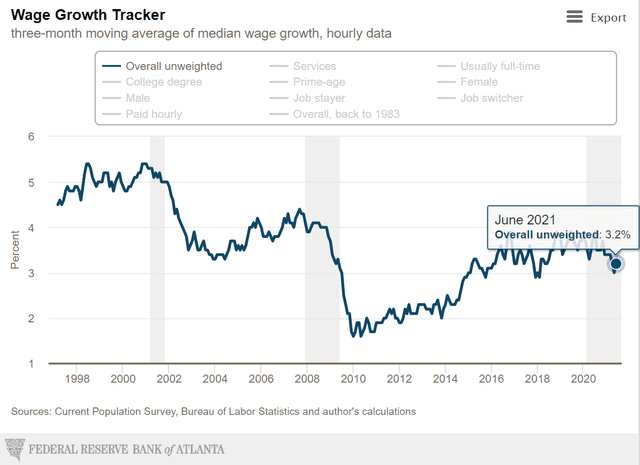

Wage growth is one of the key drivers of sustained inflation and some restaurants and hotels are having to offer wages of as high as $22 per hour, compared to $10 to $12 pre-pandemic.

How Bad Could Inflation Get?

The concern among many inflation hawks is that the proposed $4.1 trillion in infrastructure spending could help trigger a 1970s style inflation spiral.

Inflation is often a self-fulfilling prophecy. If people expect prices to keep rising, then they’ll try to spend money as fast as possible, before prices get even higher.

Workers will demand rapidly growing wages to offset inflation and companies will pass on rising inputs and wage costs to consumers.

The last time the US faced such a situation inflation peaked at 14% in 1981 and the Fed had to use the nuclear option to try to crush inflation once and for all.

The Fed hiked short-term interest rates to 20%, and 10-year treasuries yielded 16%. Mortgage rates of close to 20% were the result, as was a severe double-dip recession.

That’s what some economists worry might be coming. Fortunately, the consensus is that the inflation we’re seeing now is temporary, and here’s why.

Median 3-month rolling wage growth has actually been falling in recent months, though it’s basically holding steady at pre-pandemic levels.

That itself is incredible given that we lost 20 million jobs in March 2020, wiping out a decade worth of job creation.

Supply chain disruptions are also not likely to drive permanent inflation.

Consider lumber prices, which soared 400% at one point due to rocketing demand and insufficient supply.

(Source: Trading economics)

Before the pandemic lumber prices had never risen above $600 per thousand board feed. During the pandemic, they rocketed to $1700. But as sawmills started running production 24/7, supply eventually surpassed demand and lumber prices crashed 66% off their all-time highs.

Used car prices aren’t going to rise by 30% to 50%, that’s insane. In economics, we like to say “the cure for high prices is high prices”.

The same scary high prices that worry so many today, are what attract new supply, which ultimately causes prices to return to reasonable levels.

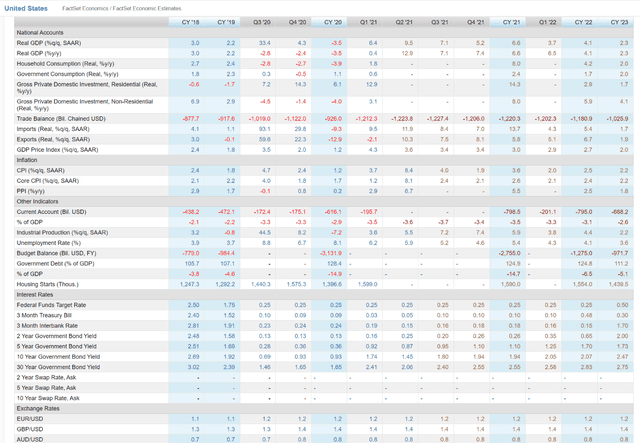

(Source: FactSet Research Terminal)

Economists expect 2.6% inflation this yea4, 2.4% in 2022 and 2.2% in 2023.

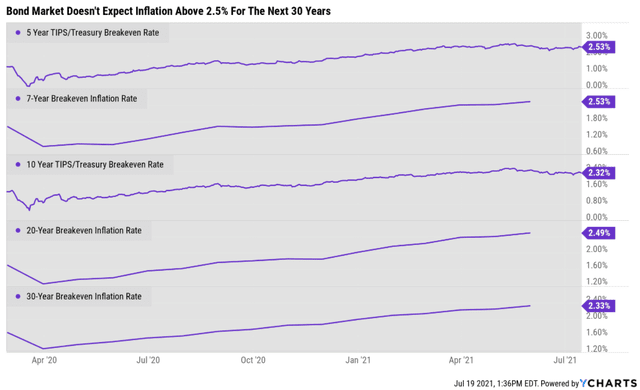

The bond market, the so-called “smart money” on Wall Street, doesn’t expect inflation to surpass 2.5% in the long term.

But what if this time is different and most experts are wrong? What if inflation is here to stay?

In part 2 of this series, we’ll examine why investors fear inflation, and how you can protect your retirement nest egg from the threat of rising prices.

Want More Great Investing Ideas?

SPY shares were trading at $434.66 per share on Thursday morning, up $0.11 (+0.03%). Year-to-date, SPY has gained 17.02%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |