In Part 1 of This Series, we explored why another big wave of the virus was likely, possibly even hammering the US one final time before the American epidemic finally ends.

Of course, just because the US suffering will likely be over by July, doesn’t mean that the virus won’t keep delivering drama for another year or two.

In part one we saw why it’s likely to be until 2023 before the pandemic is over globally. But in this conclusion, I wanted to cover the two most important facts of all about the potential 4th wave of the coronavirus.

That includes the effects on the stock market and your portfolio.

Fact 3: The Human Toll Won’t Be As Bad In A 4th Wave Of The Virus

IHME’s latest estimate is that by July 1st almost 4 million people will have died from COVID-19.

(Source: IHME)

- base-case nearly 4 million dead by July 1st

- the global pandemic is far from over

- likely this will be the deadliest pandemic in over 100 years

- surpassing the Honk Kong Flu’s 5.5 million dead

- on a per capita basis, it won’t be as bad but the human toll will be larger

However, the good news is that as horrible as the deaths have been so far, and we’ll get more in the coming year or two, even a sharp spike in cases isn’t likely to cause a tsunami of deaths as it once threatened to.

Let’s consider the IHME’s model for the US.

(Source: IHME)

- IHME estimates the worst-case scenario is 1,800 daily deaths by May 21st if B-117 really takes off in the US

- base-case deaths continue to drift lower

- no mega-spike in deaths is likely because the most at risk of death are already mostly protected

Thanks to 66% of seniors now being vaccinated, even if daily cases were to spike to over 200K per day, more than tripling from here, the rise in deaths wouldn’t be anywhere close to the 5K we saw in late January.

The vaccines aren’t 100% effective, but they are almost 100% effective at preventing serious disease and mortality.

Every day we vaccine another 2.5 million people and thus reduce the risks of a major spike in mortality from a 4th wave.

Globally it’s going to be tougher. The reality of vaccine development and distribution is that more people are going to die than was necessary.

- theoretically, we’d vaccinate the highest risk around the world before moving onto lower risk people

- which means the pandemic would end at the same time in 2023 in all countries

- obviously rich countries aren’t willing to wait 3 more years, understandably so

In the bigger context, as bad as this pandemic has been, and could still become, it’s remarkable how few people are actually likely to die.

- the 1918 Spanish flu killed 5% of humanity

- which would be about 400 million people today

- MIT estimates that 3.3 million Americans could have died

- 600K is a tragic number, but less than 20% of the worst-case scenario

So does this mean that stocks are poised for the best year ever thanks to robust economic boom times?

Not necessarily.

Fact 4: What The Potential 4th Wave Means For Stocks

There are two major risks to the stock market in 2021, and both are at the opposite end of the pandemic extreme.

First, should P1, the Brazilian variant becomes dominant around the world, then it could circumvent much of the immunity from current vaccines. Effectively, we’d need new vaccines and potentially boosters for everyone who is already vaccinated.

The UK variant, B-117, is the reason that much of Europe is locked down right now. In fact, Germany has been locked for three months, and yet B-117 is rampaging across Deutschland with such vigor that Germany fears record daily cases and deaths within a month.

P1 is the reason Brazil is the single worst country on earth when it comes to COVID-19. Unlike B-117, which is mostly 40% to 70% more contagious but not necessarily more deadly, P1 is put to 70% more lethal as well as 70% more contagious.

Obviously, it goes without saying that should a far more lethal and contagious form of COVID-19 circle the earth, and prove highly resistant to vaccines, that would suck.

Some countries would have to lock down for the 4th time. If you think it’s been mentally exhausting waiting few months for a vaccine now, imagine having to do it all over again, except without the same level of optimism we enjoyed the first time.

This brings us to the threat to a highly overvalued stock market.

(Source: FAST Graphs, FactSet Research)

Yes, corporate earnings are expected to grow 60% in 3 years. Unfortunately, all that growth is now priced in, meaning that fundamentally stocks have zero upside potential until 2024.

We also have the issue of rising interest rates that continuously threatens to send tech stocks skidding.

- Wells Fargo estimates 10-year yields will finish the year at 2.25% and “blow past 3% in 2022”

- Ned Davis Research and Society Generale both estimate that Nasdaq is at elevated risk of a 20% to 30% peak decline bear market due to rising interest rates

In other words, for stocks to keep going up, which remains the base-case for most blue-chip analyst firms, the pandemic must end on schedule, BUT the best economic growth in 40 years can’t be too good, lest interest soar too fast, too far.

What does that mean for risk management as far as the average investor is concerned?

While I love watching the big macro, I’m like Ray Dalio.

- I’ll talk all day about what the economy might do and short-term market valuations

- but I won’t actually touch my portfolios construction or asset allocation

Ray Dalio has spent the last decade warning, though not as extreme as some hedge fund managers, that overvalued markets could cause sharp corrections.

Had you actually followed his advice you’d have left a lot of profits on the table compared to buying and holding.

What Permabear Portfolio Performance Look Like: Hussman Strategic Growth, Negative Real Returns Over 20 Years

(Source: Morningstar)

(Source: Morningstar)

At least Dalio has been long stocks for the past decade. John Hussman is a famous permabear that got lucky and launched his fund in July 2000. He saw 2 50% crashes within a decade.

And yet, thanks to constantly betting that stocks will fall, he’s delivered -3.5% annual returns for the last 15 years, and just 1% annual returns since inception.

- adjusted for inflation Hussmann’s investors are down 36% over 20 years

The point is that, no matter what happens with the pandemic this year, or interest rates in 2022, it’s always smart to play the odds and stay bullish on America.

(Source: Imgflip)

Does that mean you should be 100% growth stocks? 100% US stocks? 100% value stocks? Prudent diversification and risk management means owning exposure to high quality, purchased at reasonable valuations, in many areas.

- I’m 35% growth and 65% value

- I’m 75% US stocks and 25% foreign stocks

- I’m very heavily invested in consumer discretionary, energy, and finance, the top 3 sectors for reopening of the economy

- but I have exposure to all 11 sectors

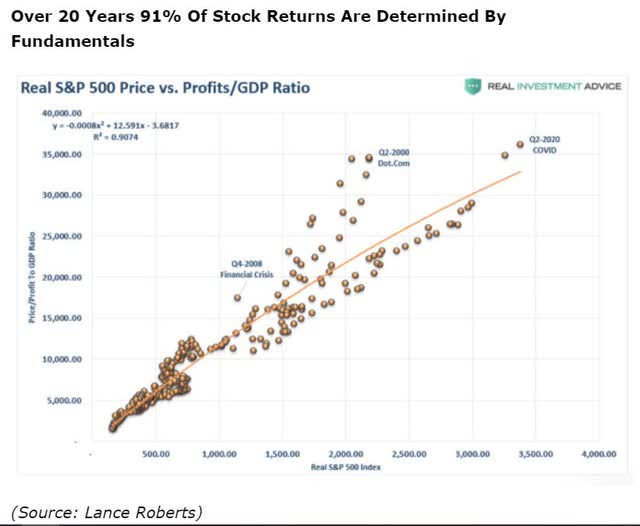

Ultimately what drives success is just three fundamentals.

Yield, growth, and value are the holy trinity of total returns. Embrace them like a lover and you’ll die rich, assuming you can avoid unforced errors.

Errors, such as becoming too trigger happy to “do something” when your portfolio rises or falls fast and hard. Remember that while individual companies can rise or fall as much as 20% in a single day, the intrinsic value of that company doesn’t move anywhere near as much.

This is where disciplined investors, who practice sound financial science, can make a killing.

And not through rampant speculation like the latest red hot SPAC, NFT, or cryptocurrency. Buying top-quality blue-chips that provide a good mix of yield, growth, and value, is literally all you need to achieve long-term success.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the NEW Stock Bubble?

5 WINNING Stocks Chart Patterns

Why Are Stocks Struggling with 4,000?

SPY shares were trading at $392.56 per share on Friday afternoon, up $2.86 (+0.73%). Year-to-date, SPY has gained 5.34%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |