U.S stocks are enjoying an unprecedented outperformance over emerging markets. Can it continue, or is now the time to rotate money overseas? There is beginning to be the belief that if the trade tensions get resolved, and tariffs removed, it will renew global growth of which the biggest beneficiaries would be emerging markets.

Historically when stocks are in bull mode, bullish money managers will take on more speculative positions such as higher beta names, including increasing exposure to emerging markets. On the other hand, investors are positioning themselves for lower stock prices, riskier assets such as emerging market stocks tend to underperform, particularly relative to developed markets.

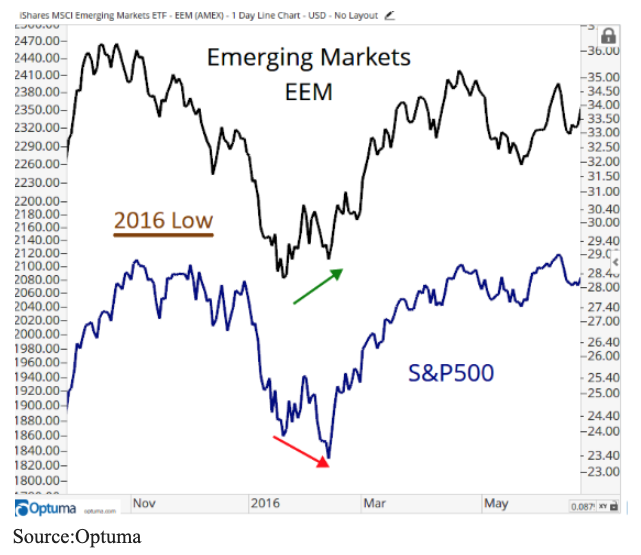

You can see the relative performance from two prior periods in which after the S&P makes a new low, but then emerging market then goes on to outperform the U.S.

Essentially, when the S&P 500 is making lower lows but Emerging Markets are simultaneously making higher lows, it’s been evidence of risk appetite for stocks and markets have continued to rally for years after the divergence. But, what we have seen over the past year is not quite following the pattern.

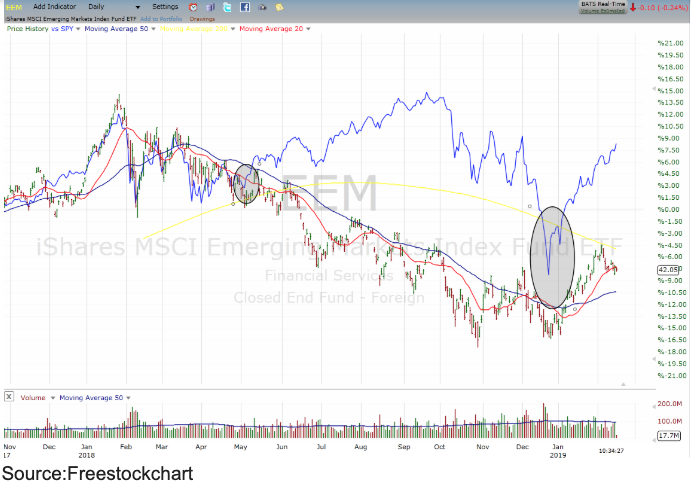

You can see the extreme decoupling that occurred between the S&P 500 Index (blue line) and Emerging Market Index (EEM) that began in May, but then the sell-off last fall was far steeper in U.S. stocks, causing a brief convergence in performance.

Like past patterns, emerging markets did not make a new low, which would suggest that when the U.S. rebounded emerging markets would outperform.

But instead, the recent rebound has sent U.S. stocks sprinting away and well ahead of emerging markets.

One difference from prior periods is that through it’s growing economy, China now represents over 35% of the emerging market index, and it’s stock market has done very poorly, dropping some 30% over the past six months and not showing much of a rebound of late, which creates a big drag on the overall index.

It appears that negative sentiment may overshoot, as emerging markets currencies have sold off by more than debt and equity outflows would generally imply.

On the other side of the coin, the flows into emerging market equities recorded outflows from June through November but turned positive in January.

Emerging markets equities now have the lowest valuations of any major asset class and free cash flow yields estimated at 5%–7% over the next 12–15 months. Their discount to developed markets has deepened to the 30% range.

Some individual emerging markets, bottomed before the U.S. and are enjoying a bigger rebound.

For example, Brazil is some 45% since the October low, well ahead of the S&P 500’s 20% rebound from it’s December low.

If we resume historical patterns, I would expect other emerging markets, from India and eventually China, to begin outperforming the U.S.

SPY shares were trading at $319.74 per share on Tuesday morning, up $0.24 (+0.08%). Year-to-date, SPY has gained 29.72%, versus a 29.72% rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |