Despite ample supply, natural gas prices are holding on to their risk premiums as geopolitical risks continue to make the market jittery, with winter approaching the northern hemisphere. Amid this, Canadian natural gas company TC Energy Corporation (TRP - Get Rating) is set to report its third-quarter financials tomorrow.

TRP is looking to sell assets and cut its debt. This year, the company divested 40% interest in its Columbia Gas Transmission and Columbia Gulf Transmission pipelines to Global Infrastructure Partners in order to spin off its oil pipeline business. TRP is expected to complete the spinoff in the second half of 2024.

Following this divestment, the company expects its fiscal 2023 comparable EBITDA to be 5%-7% higher than in 2022, while comparable earnings per common share is expected to be consistent with the prior year.

Furthermore, TRP is looking to sell a minority stake in the ANR Pipeline Co. and its Mexican operation. In July, company executives said that additional divestitures over the next 18 months would be needed to bring the company’s debt ratio to its target.

Given this backdrop, let’s look at the trends of TRP’s key financial metrics to understand why it could be wise to watch and wait for a better entry point in the stock.

Analyzing TC Energy Corporation’s Financial Performance: From Rising Revenues to Declining Net Income and Fluctuating Key Metrics (2020-2023)

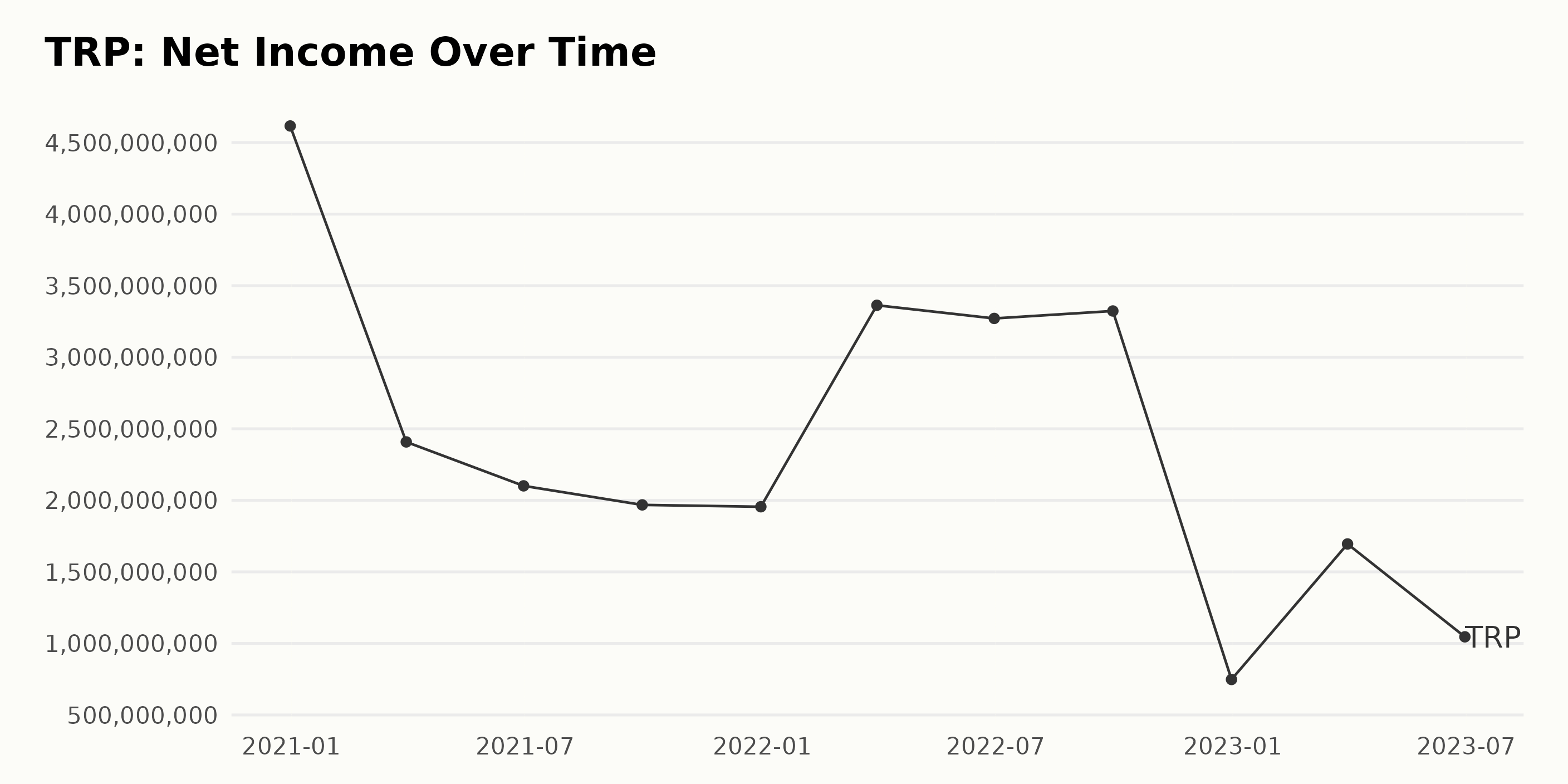

TRP has seen notable trends and fluctuations in its trailing-12-month net income from December 2020 to June 2023.

- Starting at a significant high in December 2020, the net income was up to $4.62 billion.

- A downward trend began in the following quarter, March 2021, with the net income dropping to $2.41 billion.

- Continuing this trend, June 2021 saw a further decrease to $2.10 billion, and by September of the same year, it had declined to $1.97 billion. The end of the year didn’t see much more of a decline, hovering around $1.96 billion in December 2021.

- An upward climb returned briefly in early 2022. In March, it increased to $3.36 billion and remained mostly stable through September 2022, peaking at approximately $3.32 billion.

- Unfortunately, a sharp decline ensued in December 2022, with the net income plunging to $748 million before partially recovering to $1.69 billion by March 2023. The available data as of June 2023 shows another dip to $1.05 billion.

This analysis shows a general decrease in TRP’s net income over the observed period, from initially $4.62 billion in December 2020 to $1.05 billion in June 2023. This implies a negative growth rate, highlighting a challenging period for the company, especially noting the steep drop in the last reported quarter ending December 2022. However, the first quarter of 2023 brought some recovery, indicating potential for future improvement.

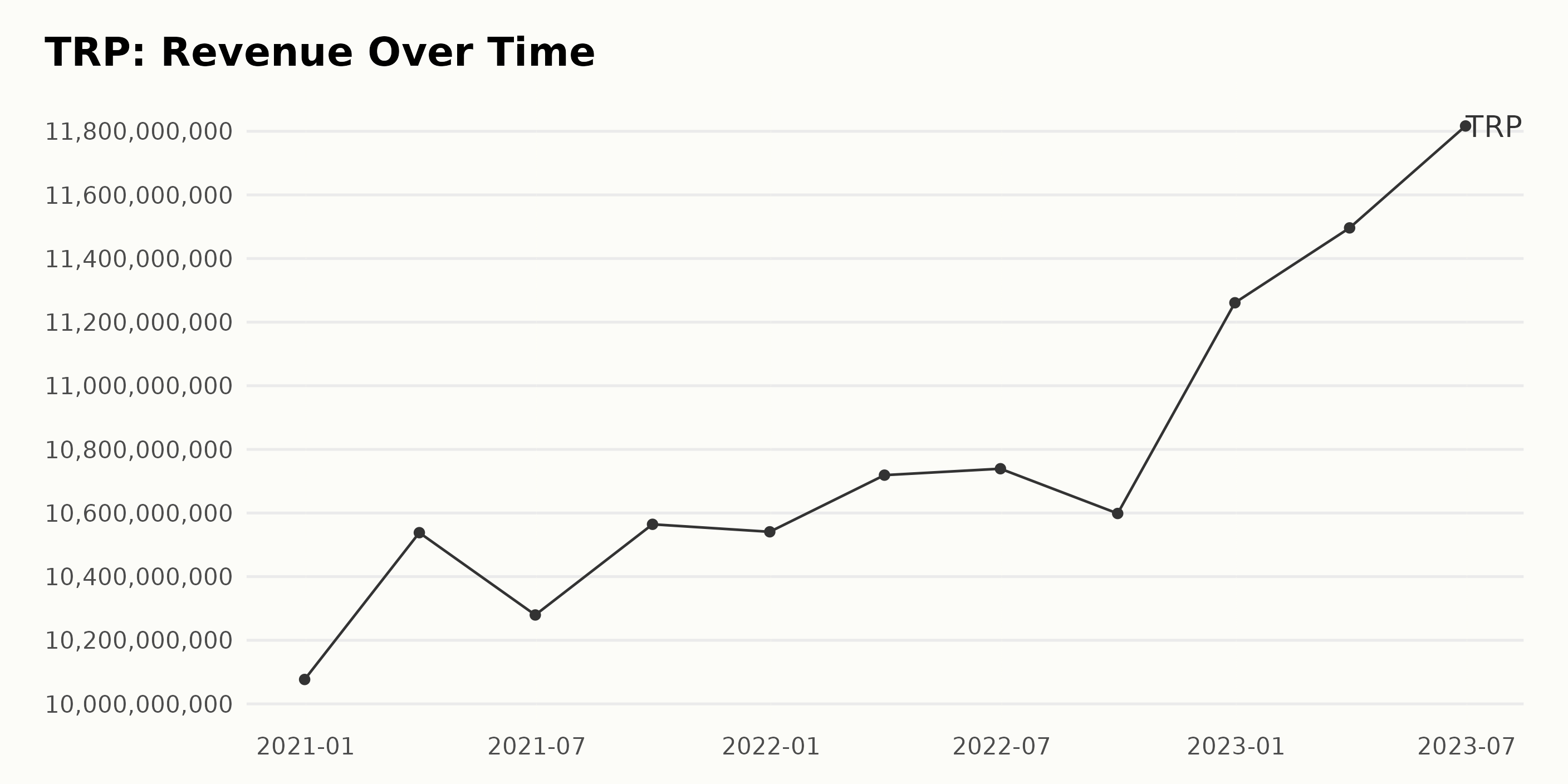

Here’s a summary of the trailing-12-month revenue trends and fluctuations for TRP based on the provided series of data:

- On December 31, 2020, TRP reported a revenue of $10.08 billion.

- The revenue showed a mild increase to $10.54 billion by March 31, 2021.

- Thereafter, in the second quarter of 2021, a slight decrease to $10.28 billion was seen on June 30.

- TRP reported revenues for the third and fourth quarters of 2021 at approximately $10.56 billion and $10.54 billion, respectively.

- Revenue rose marginally in the first half of 2022, peaking at $10.74 billion by the end of June.

- A small dip in revenue was noted in the third quarter of 2022, with the value standing at around $10.60 billion on September 30.

- By the end of 2022, a significant jump in revenue was observed, reaching $11.26 billion by December 31.

- This rising trend continued into the first half of 2023 as revenues climbed further, ending at $11.50 billion on March 31 and $11.82 billion on June 30.

By comparing the revenue at the start of the series ($10.08 billion in December 2020) with the last reported value ($11.82 billion in June 2023), it is clear that there has been a considerable increase across this period.

Based on these figures, the growth rate of TRP’s revenue stands at a respectable 17.22% over this approximately two-and-a-half-year period. This signifies a steady increase in TRP’s revenue over the years despite some minor fluctuations from quarter to quarter.

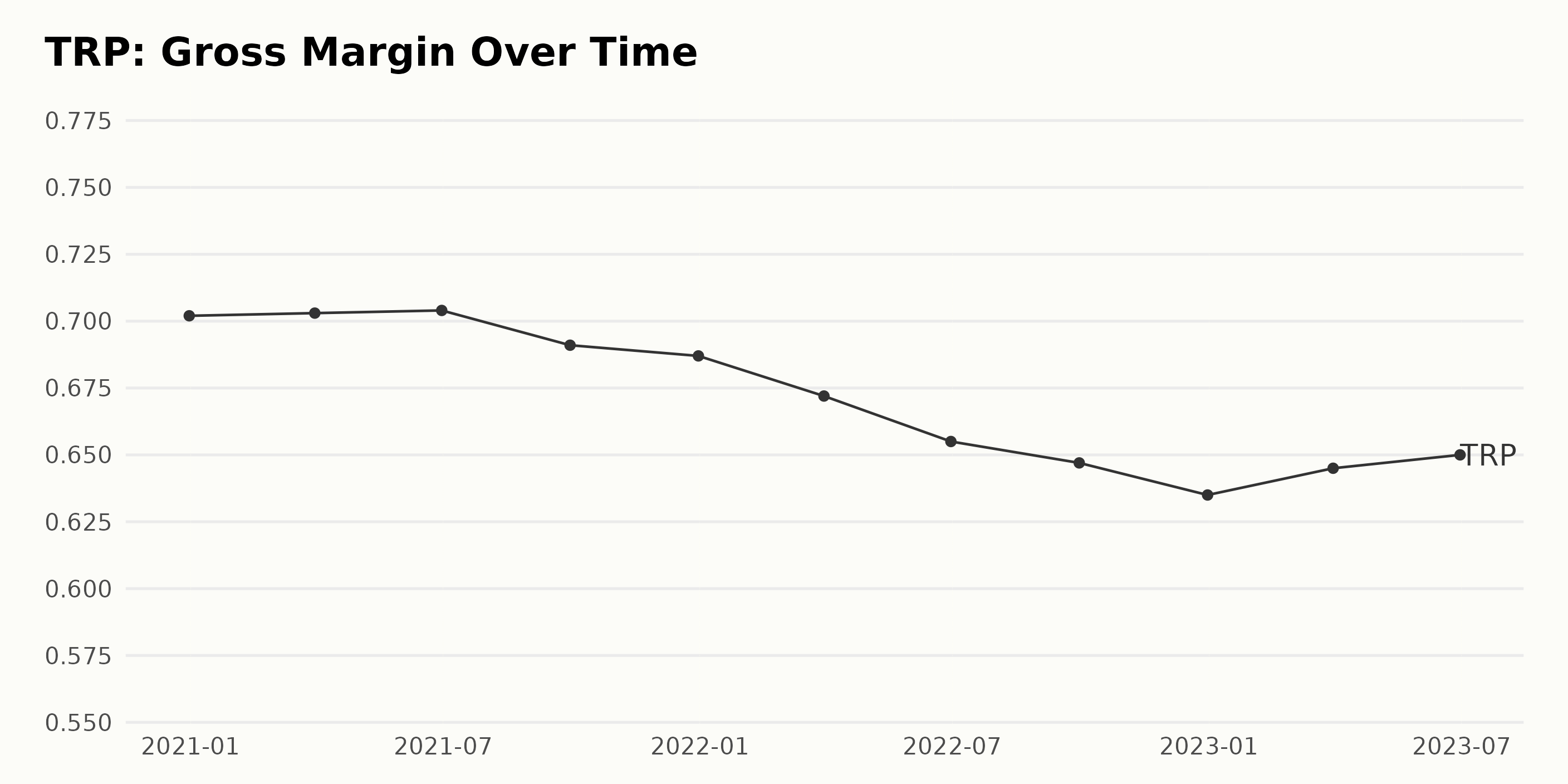

The gross margin of TRP has experienced a general downward trend over the recent years, with minor fluctuations along the way. Here’s a summary of the noted transitions:

- By the end of 2020, TRP reported a gross margin of 70.2%.

- The gross margin slightly increased to 70.3% by the end of March 2021.

- For the subsequent quarter ending June 2021, there was a minor increase as well to 70.4%.

- However, the third and fourth quarters of 2021 witnessed declines, with 69.1% in September and 68.7% in December, respectively

- In the first quarter of 2022, the gross margin continued to fall to 67.2% and proceeded to show further decrement for the next two quarters, reaching 65.5% in June and 64.7% in September

- By the end of 2022, the gross margin declined once more, settling at a three-year low of 63.5%

- Instead of extending its dropping trend into 2023, the gross margin gradually bounced back to 64.5% by the end of March and further improved to 65.0% by the end of June 2023.

When calculating the growth rate from the final value against the first value, we can see a drop of -5.7%. This signifies that while TRP has had some brief periods of increased gross margin, the overall long-term trend over the past couple of years has been toward lesser gross margin values.

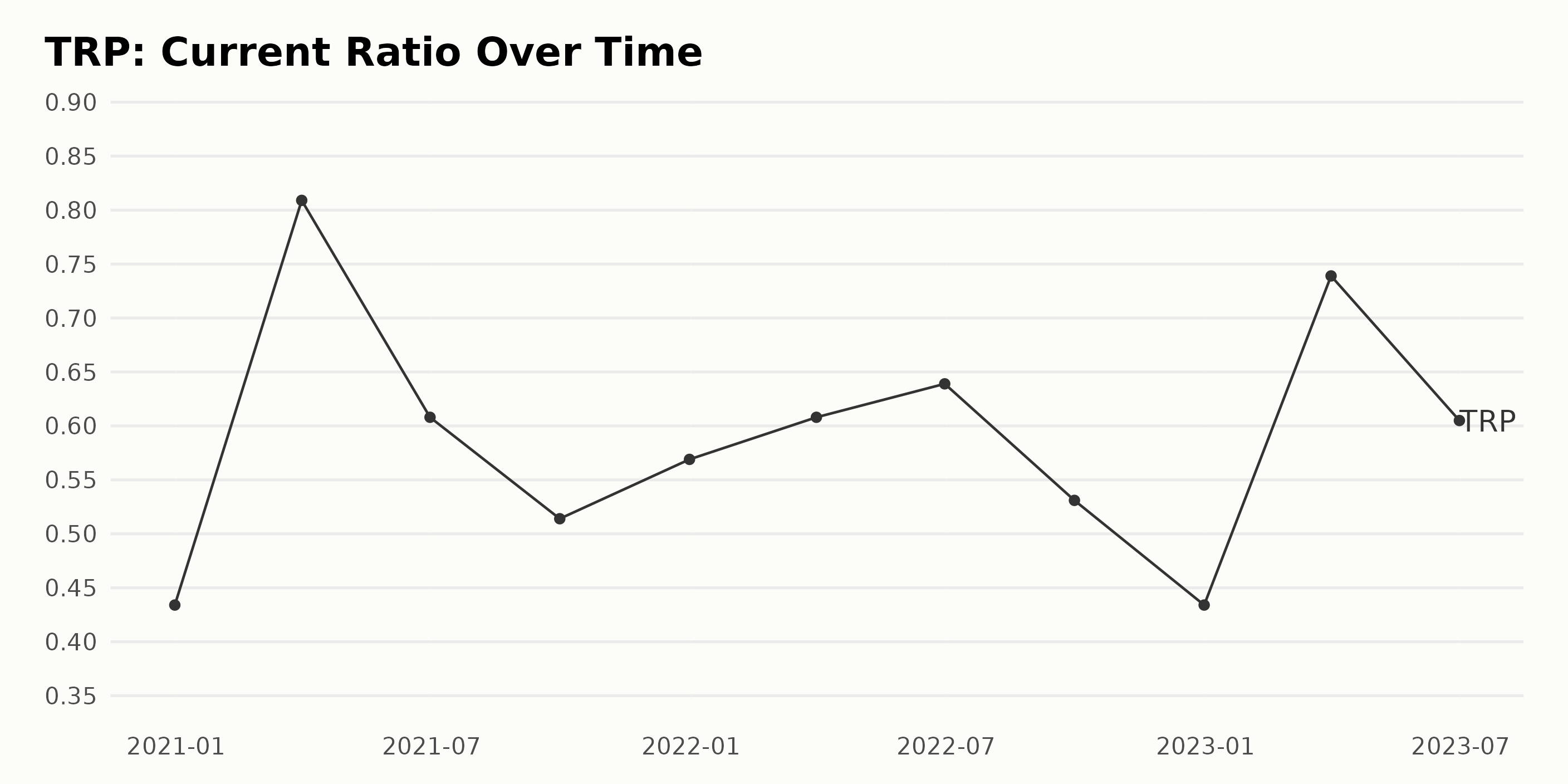

TRP’s current ratio shows substantial fluctuations from December 2020 to June 2023.

- Starting from a low of 0.43 in December 2020, the current ratio shot up to 0.81 by March 2021.

- However, this was followed by a decrease over the following two quarters, hitting 0.51 in September 2021.

- The end of 2021 witnessed a slight recovery with a value of 0.57, which further improved to 0.64 by June 2022.

- Another dip was observed in September 2022, reducing the value to 0.53. The year ended at the same point as it started, with a value of 0.43.

- The first quarter of 2023 showed a significant increase to 0.74, the highest in the series, only to fall back to 0.60 in June 2023.

Despite these ups and downs, the overall growth from December 2020 to June 2023 was approximately 40%, exhibiting a rising yet volatile trend. This reflects the company’s fluctuating ability to cover its short-term liabilities with its short-term assets over this period. The most recent data from June 2023 shows a minor decrease from the high of March 2023 but still holds considerably higher than the starting point in December 2020.

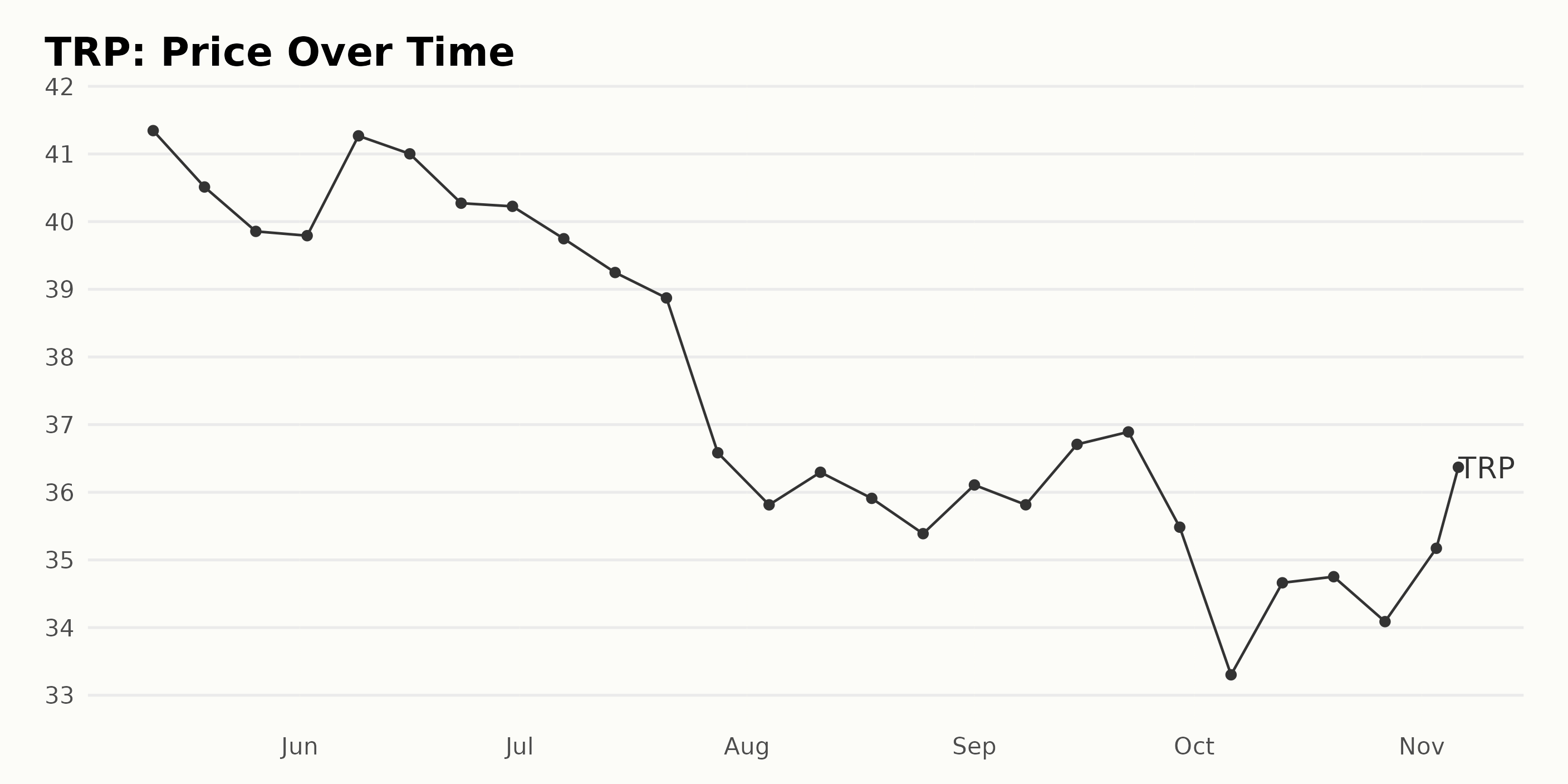

Analyzing TC Energy Corporation’s Declining Share Price from May to November 2023

The data provided tracks the share price of TRP from May to November 2023. Here’s a summary of the trend and growth rate during this period:

- The share price starts at $41.34 on May 12, 2023, and shows a decreasing trend through the end of July 2023, reaching a low of $36.58.

- There is a small recovery in August 2023, as the price rises to $36.30 on August 11, 2023, but by September 1, 2023, it drops again to $36.11.

- The price ends the period at $36.30 on November 6, 2023, showing an overall decrease over the six-month period.

This suggests a decreasing growth rate of TRP’s shares between May and November 2023. This trend was relatively consistent, with the exception of a slight recovery in August. However, this recovery wasn’t sustained. Hence, there appears to be a clear decelerating trend in the price over the examined period. Here is a chart of TRP’s price over the past 180 days.

TC Energy Corporation’s Resilient Trends: A Look at Stability, Momentum and Growth

The POWR Ratings grade for TRP, a company within the Foreign Oil & Gas category of stocks, which has a total of 44 individual stocks, has remained consistent over time. The data reflects a POWR grade of C (Neutral) across numerous weeks in 2023. Here are some key points:

- The POWR grade was C (Neutral) as of May 13, 2023, and the rank in the category was #36 out of 44 firms.

- Throughout the period between May and November 2023, there has been a slight fluctuation in the rank in the category while the POWR grade has stayed constant at C (Neutral).

- On July 1, 2023, the rank in category briefly improved to #30 but then gradually slipped back into the 30s during the months following.

- There seemed to be a more progressive decline in the rank in category from early August, where the rank stood at #37 until the end of the period under review.

- By November 7, 2023, the rank in the category further declined to #39.

In summary, TRP’s latest POWR grade value stands at C (Neutral) as of November 7, 2023. Despite persistent fluctuations, its rank within the Foreign Oil & Gas category climbed towards the higher end of the scale, indicating its relative positioning in the sector became less favorable over time.

Constant observation and review are necessary to determine if these trends persist and understand what they mean for TRP’s overall performance in the market sector.

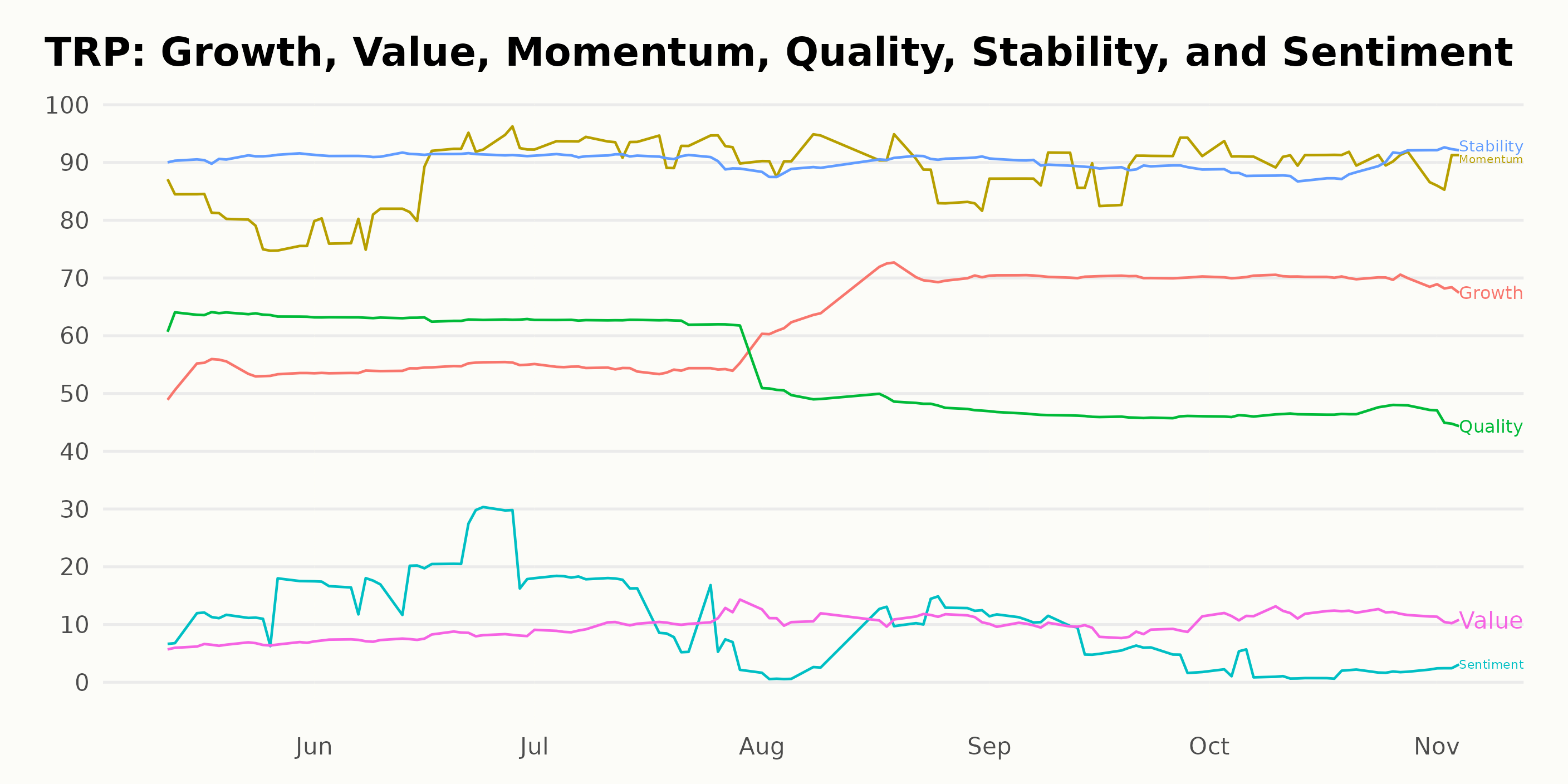

TRP has seen some noteworthy changes in the POWR Ratings over the last few months of 2023. Focusing exclusively on the three dimensions with the highest scores, we see significant insights from Stability, Momentum, and Growth.

- Stability: It consistently stands as the highest-rated dimension throughout all the measured periods. Starting at 91 in May 2023 and continuing at that level through to July, TRP’s stability then slightly declines but retains high scores of 90 in August and September and 89 in October, then increases again to 92 by November 4, 2023. This tenacity demonstrates that TRP has maintained a high level of stability in performance during this period.

- Momentum: This dimension evolves with a positive trend throughout the period. Commencing with a robust score of 80 in May 2023, it goes on an upward trajectory, ending with a solid rating of 88 as of November 4, 2023. The value peaks at 93 in July 2023, making Momentum one of the most robust and improving dimensions for TransCanada Corporation during this period.

- Growth: For the Growth dimension, a remarkable increase is observed from May to September 2023, starting at 54 and peaking at 70. However, there is a slight decrease to 68 by November 4, 2023. This shows that while there was significant growth during the middle phase of this period, the rate did slightly decline by the end of this window.

Remember, these trends expose the substantial resilience exhibited by TRP in the latter half of 2023, as evidenced by their Stability, the gradual increase in Momentum, and the sharp growth in the middle phase of the year.

How does TC Energy Corporation (TRP) Stack Up Against its Peers?

Other stocks in the Foreign Oil & Gas sector that may be worth considering are Parkland Corporation (PKIUF - Get Rating), Repsol, S.A. (REPYY - Get Rating), and Santos Limited (SSLZY - Get Rating) – they have better POWR Ratings. Click here to explore more Foreign Oil & Gas stocks.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

Want More Great Investing Ideas?

TRP shares were trading at $35.87 per share on Tuesday afternoon, down $0.43 (-1.18%). Year-to-date, TRP has declined -4.99%, versus a 15.33% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TRP | Get Rating | Get Rating | Get Rating |

| PKIUF | Get Rating | Get Rating | Get Rating |

| REPYY | Get Rating | Get Rating | Get Rating |

| SSLZY | Get Rating | Get Rating | Get Rating |