In part 1 of this series, I explained why analysts expect Tesla to become one of the greatest and highest quality car makers on earth.

However, that doesn’t mean you can just buy it right now and hope to become rich. That’s because there is one final fact about Tesla that is the most important of all.

Fact 3: Tesla’s Valuation Today Makes It A Gamble, Not An Investment

There is an important difference between rampant speculation and sound long-term investing.

An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.” – Ben Graham, Securities Analysis

Pure speculation involves buying an asset purely with the short-term goal of selling it to some “greater fool” who you hope will pay more than you did.

Now valuing a hyper-growth company that only recently became profitable isn’t always easy.

(Source: Gurufocus Premium)

This is why I let the market tell me the intrinsic value of a company based on the most appropriate fundamental valuation metric.

In the case of non-profitable or recently profitable companies that is the price/sales ratio over a statistically significant period of time.

- over 13 years there is a 90% probability that the median P/S ratio represents a reasonable estimate of intrinsic value for a company

- 2021 fair values: $329 = $48.4 sales/share X 6.8 13-year median P/S

- equals 52x 2021 consensus operating cash flow

- and 40X EBITDA

- Morningstar estimate $306 based on their proprietary DCF model

- current price: $824

- 150% overvalued

- Dividend Kings rating: potential trim/sell

- potential good buy price: $214 or less (35% margin of safety)

- 5-year CAGR total return potential range: -21% to 8% CAGR

- long-term growth consensus: 35% CAGR

- the margin of error adjusted long-term growth consensus range: 9% to 36% CAGR

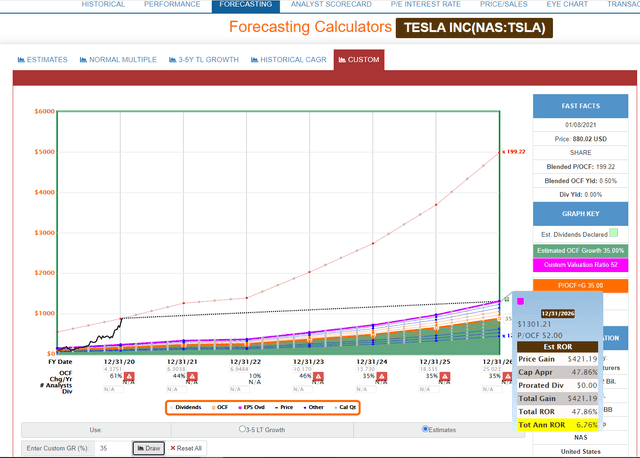

What does paying a 150% premium for Tesla get you? Incredible valuation risk.

Tesla 2022 Consensus Return Potential

Tesla 2026 Consensus Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

The good news is that IF Tesla grows at the 35% CAGR analysts expect over time, then over the next five years, investors might make about 7% CAGR total returns.

Along the way, they risk a 59% decline by the end of 2022, and that’s if TSLA grows as analysts expect, which it almost never does.

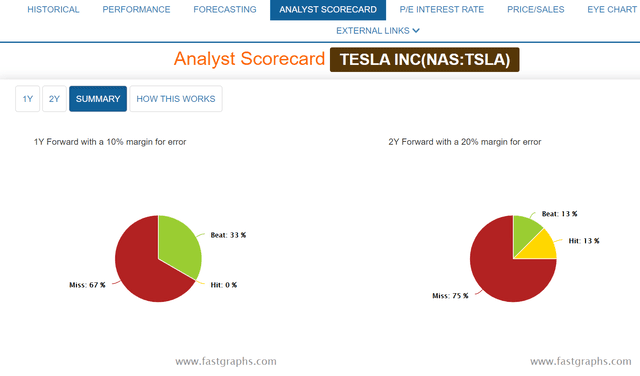

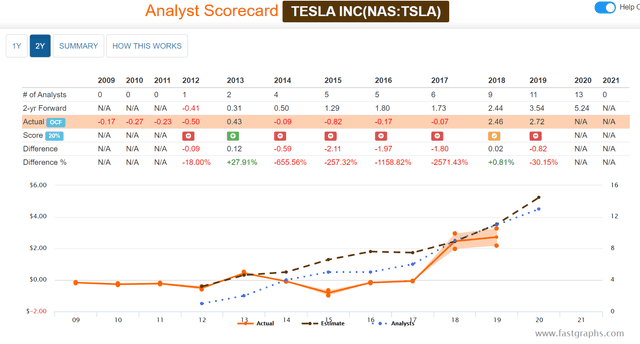

Note that operating cash flow is the most accurate fundamental metric Tesla has.

- on EPS and EBTIDA TSLA has historically missed 100% of the time

- by at least 20% for two-year forecasts

In other words, the margins of error are sky-high on this speculative hyper-growth investment.

My Reasonable And Prudent Plan For Buying Tesla For My Retirement Portfolio In 2021

As I explained in part one of this series, within 12 months (or slightly less) Tesla’s balance sheet will strengthen enough to make it an above-average (though still speculative) quality company.

- the minimum quality I’m willing to buy for my retirement portfolio

This means that the next time Tesla suffers a significant correction, which analysts expect to be a nasty bear market, I may be able to buy a starter position at a reasonable price.

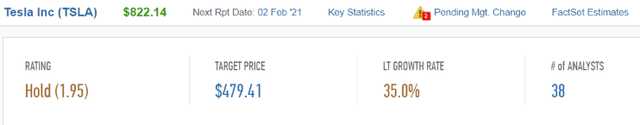

(Source: FactSet Research Terminal)

- the 38 analysts who cover Tesla are very bullish forecasting a median 35% CAGR long-term growth rate

- and yet their median 12-month price target (an educated guess based on forecasting sentiment) is a 41% price decline

- no margin of safety

- priced as if God himself were running the company and infallible

- Elon Musk is the inspiration for Iron Man (Robert Downey Jr’s character in Avengers)

- he is not God Almighty and has struggled with plenty of execution issues

- not to mention has made many questionable corporate governance decisions

- according to MSCI, Morningstar, and Reuters

Don’t overpay for Tesla, or you’ll very likely regret it.

But if Tesla is worth $329 in 2021, and analysts expect it to fall to $479 within the next 12 months, doesn’t that mean I’d have to overpay for Tesla if I bought it this year?

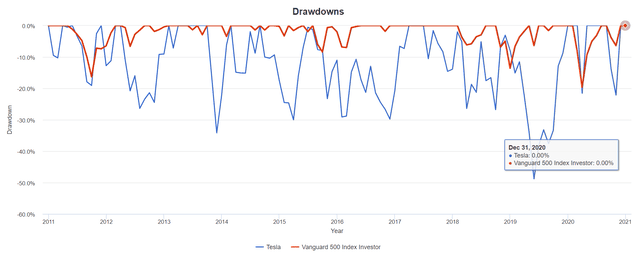

- stocks almost never JUST revert to fair value, they usually overshoot to the upside and downside

- Tesla’s historical annual volatility is 65% vs 15.7% for the S&P 500

- this company’s bear markets can be swift, nasty, and brutal

- and offer patient and disciplined long-term investors great entry points

Tesla Peak Declines Since 2011

(Source: Portfolio Visualizer)

In just nine years Tesla has suffered six bear markets, including a peak decline of almost 50%.

And remember that highly bullish analysts, that expect Tesla’s growth to stupendous over the long-term, are predicting the 2nd worst bear market in its history over the next 12 months.

By September, when I begin the 2022 Dividend Kings DK 500 Master List update, I anticipate Tesla may be within a reasonable buying range.

- 2022 sales/share consensus is currently $62.7

- assuming that remains the same by September Tesla’s 2022 fair value would grow to $426

- and if it’s in a nasty bear market I could be able to get it at that price or slightly better

What if Tesla doesn’t hit $329 or $426 in 2021? Here are the historical market-determined fair values based on analyst median consensus estimates for 2022 through 2026.

- 2022: $426

- 2023: $569

- 2024: $692

- 2025: $811

- 2026: $1,070

(Source: Imgflip)

For a company that’s as volatile as Tesla, capable of swinging up or down 65% in a single year, buying at a reasonable price, based on the best available facts and evidence we have, is the best way to get rich owning Tesla.

Bottom Line: Tesla Can Make You Rich…If You Buy It At The Right Price

The reason to avoid paying absurd valuations for Tesla, such as almost 30X sales, is because there are no guarantees it will grow as fast as analysts expect.

In fact, its historical margins of error on analysts’ forecasts show that it will almost certainly not grow at 35% CAGR over time. It will grow faster or slower, and that means that those paying today’s bubble multiples have no margin of safety.

The fair value estimates I’ve provided for Tesla today are based on the current consensus estimates. Those will almost certainly change in the coming months and years.

But the approach I’ve outlined, of paying no more than the market-determined historical fair value for any company, even the most popular one on Wall Street today, is sound, reasonable, and prudent.

6.8X sales is not my opinion of Tesla’s fair value. It’s the median multiple that hundreds of millions of investors have determined to be objective fair value over the last nine years.

It’s still just an estimate, but a reasonable and prudent one.

(Source: Imgflip)

Buying Tesla for $329 in 2021 is a classic Munger “not stupid” decision.

Buying Tesla at $214 in 2021, a 35% discount to fair value, represents a potentially good buy because there is a sufficient margin of safety to compensate you for the company’s risk profile.

I can’t tell you exactly when Tesla will return to fair value, or become 35% undervalued. But I can tell you that this hyper-volatile growth legend is very likely to in the coming years.

And when it does, I look forward to starting and building a Tesla position in my retirement portfolio. But not as a speculative gamble, as today’s buyers are doing, but as a disciplined and rational long-term investment.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

Is This ANOTHER Stock Market Bubble?

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

TSLA shares were trading at $858.61 per share on Thursday morning, up $4.20 (+0.49%). Year-to-date, TSLA has gained 21.67%, versus a 1.80% rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TSLA | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating |