Berkshire Hathaway (BRK.B) disclosed last quarter that it bought a sizable stake in Taiwan Semiconductor (TSM) stock. How sizeable? How about just over 60 million shares at just under $69 per share. This equates to roughly a $4.1 billion dollar outlay for Berkshire and famed chairman and CEO Warren Buffett.

The news of the acquisition on November 15 sent TSM stock soaring over 10% on the day. Shares moved from under $73 pre-announcement to close above $80 post-announcement. Taiwan Semiconductor has since pulled back somewhat to the $78 area.

Buying Taiwan Semi stock at current levels means paying close to the highest price TSM has been in several months. It also is well above the price Mr. Buffett paid for his large stake in the company.

Luckily, a covered call options strategy provides a way to get into TSM stock at a discount close to the Buffett Buy price while pre-positioning to be a seller of the shares on a big move higher.

A covered call trade involves buying 100 shares of the underlying stock and simultaneously selling 1 call option against those shares. It is sometimes referred to as a buy-write since it entails buying the stock and writing the call options.

Effectively, you receive the premium of the call option sold to help reduce the net cost of the trade and provide a downside cushion. That’s the good part.

For having a much lower initial cost on the trade, however, your upside is capped off at the strike price of the call sold.

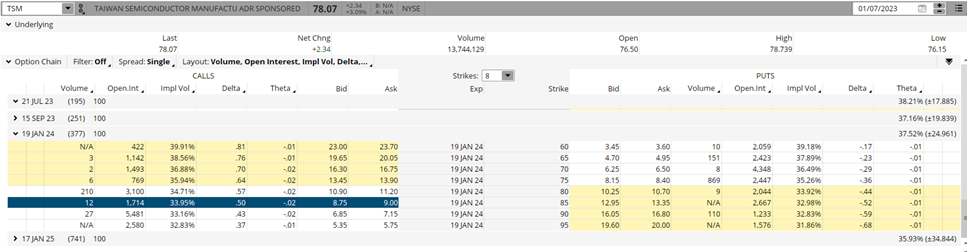

An example of a covered call strategy in TSM stock would be to buy shares at current prices ($78.10) and sell the January $85 calls at $8.80 to reduce the cost of the stock purchase by the amount of the call sale.

The table below shows that selling the TSM Jan $85 call reduces the net purchase price by the premium received for the call sale of $8.80. This puts the net cost for the trade at $69.30 ($78.10 minus $8.80), providing an 11.27% downside cushion until break-even on the stock.

![]()

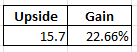

Of course, there is no free lunch in trading. The upside is limited to the strike price of the covered call sold of $85. That, however, still leaves potential upside gain of $15.70 points ($85 short strike price less $69.30 initial cost). This amounts to a 22.66% potential gain on the trade if the stock closes higher than $85 on January 19, 2024 expiration.

This trade certainly fits into the Warren Buffett philosophy of being fearful when others are greedy and greedy when others are fearful. You are willing to be a buyer of TSM stock on a 11.27% drop when others would likely be getting fearful. You are also willing to sell TSM on a 22.66% rally when others would probably be getting greedy.

Plus, TSM sports a solid dividend yield of 1.83% and a low payout ratio of about 25% which would further boost the overall return or lower the risk for the covered call trade.

Investors could use different call strikes or expiration months to sell to fit their risk/return profile. Selling lower strike calls would bring in more premium to lower the risk on the trade but it also lowers the return as well.

2022 was a tough year for stocks. The S&P 500 was down 19% while the NASDAQ 100 did even worse. Luckily, my POWR Options program returned well over 50%.

Many experts expect a difficult market environment in 2023. Investors and traders looking to hedge the downside while still allowing for realistic upside would be wise to consider an option-based covered call strategy.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

TSM shares closed at $78.07 on Friday, up $2.34 (+3.09%). Year-to-date, TSM has gained 4.81%, versus a 1.48% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TSM | Get Rating | Get Rating | Get Rating |