Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM): Price and Financial Metrics

TSM Price/Volume Stats

| Current price | $161.94 | 52-week high | $193.47 |

| Prev. close | $160.28 | 52-week low | $84.01 |

| Day low | $159.19 | Volume | 13,089,172 |

| Day high | $164.59 | Avg. volume | 15,841,397 |

| 50-day MA | $168.42 | Dividend yield | 1% |

| 200-day MA | $129.83 | Market Cap | 839.89B |

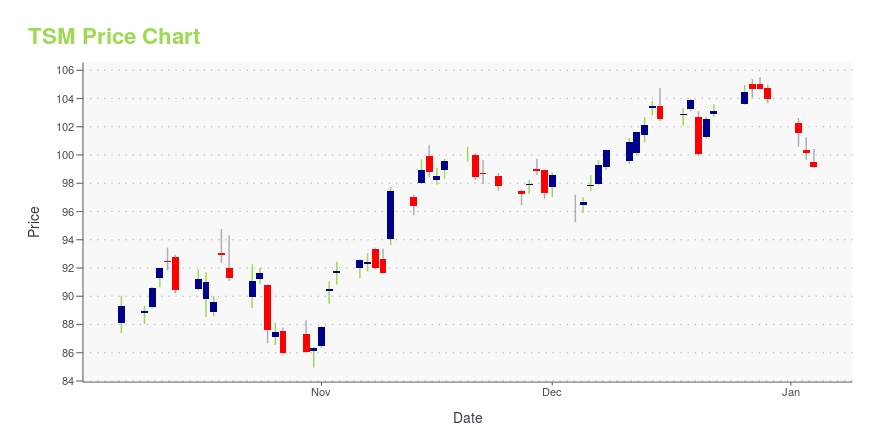

TSM Stock Price Chart Interactive Chart >

Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM) Company Bio

Taiwan Semiconductor Manufacturing Company, Limited (TSMC; also called Taiwan Semiconductor) is a Taiwanese multinational semiconductor contract manufacturing and design company. It is the world's most valuable semiconductor company, the world's largest dedicated independent (pure-play) semiconductor foundry, and one of Taiwan's largest companies, with its headquarters and main operations located in the Hsinchu Science Park in Hsinchu. It is majority owned by foreign investors. (Source:Wikipedia)

Latest TSM News From Around the Web

Below are the latest news stories about TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD that investors may wish to consider to help them evaluate TSM as an investment opportunity.

Can Nvidia Repeat Its Incredible 2023 Performance in 2024?NVDA stock set the pace tech stocks on the strength of AI's push but keeping the momentum going may be difficult. |

Top 7 Semiconductor Stock Picks for the New YearSemiconductors are in the early stages of a super cycle and these seven semiconductor stock picks are expected to stand out in 2024 |

2024 Market Predictions: 2 Trends Destined to Crash, One Set to SoarTrends come and go on Wall Street, so two of this years hottest growth opportunities may fall flat next year. |

3 Stocks to Buy Now Before They Become Tomorrow’s Trillion-Dollar CompaniesThese future trillion dollar stocks can solidify portfolio growth for long-term investors. |

2 Super Stocks That Are Screaming Buys Right NowThe market has been rallying, but there are still some good buys available. |

TSM Price Returns

| 1-mo | -5.89% |

| 3-mo | 17.39% |

| 6-mo | 38.89% |

| 1-year | 65.21% |

| 3-year | 49.08% |

| 5-year | 304.49% |

| YTD | 56.60% |

| 2023 | 41.75% |

| 2022 | -37.03% |

| 2021 | 11.72% |

| 2020 | 91.60% |

| 2019 | 63.27% |

TSM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TSM

Here are a few links from around the web to help you further your research on Taiwan Semiconductor Manufacturing Co Ltd's stock as an investment opportunity:Taiwan Semiconductor Manufacturing Co Ltd (TSM) Stock Price | Nasdaq

Taiwan Semiconductor Manufacturing Co Ltd (TSM) Stock Quote, History and News - Yahoo Finance

Taiwan Semiconductor Manufacturing Co Ltd (TSM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...