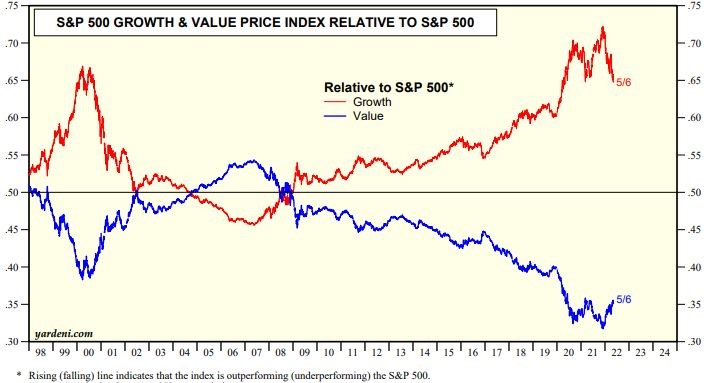

2022 continues to shape up as a year where value will finally out-perform growth. You can see from the chart below that the performance gap is beginning to close, but still has a long way to go. The differential between growth and value got to historic extremes during the latest Fed uber-easing cycle, even surpassing the dot-com bubble of 1999-2000. Now that the Fed has embarked on a tightening path this spread should continue to converge. Look for value to be an out-performer to growth over the coming quarters. The value names also tend to have a much higher and safer dividend yield to help during these tumultuous times.

Many of the value names have been spared the brunt of the recent selling. Some, though, have not. These were the names I wanted to uncover as best potential candidates going forward. The StockNews screener is the ideal tool to use to identify these types of stocks. Here is how I set up this particular screen:

- POWR Rating of A or B- Strong Buy or Buy Rated stocks only

- Industry Rating of A or B – Strong Buy or Buy Rated industries

- Value Grade Component of A -Top Rated Value Stocks Only

That gave me a list of 104 potential candidates. I narrowed the search further by restricting it to stocks trading above $20. Nothing at all wrong with lower priced stocks, but I just have usually shyed away from those names. As an options guy, these cheaper stocks tend to present less opportunity from a strategy standpoint. This is especially true for stocks under $10. For those who like lower priced stocks POWR Stocks Under $10 is the perfect choice.

This narrowed the list down to just 47 stocks trading over $20 that met the criteria. Then I looked at those 47 stocks and further drilled down to find those stocks that already reported earnings this quarter and beat expectations. Finally, I wanted only those stocks that were hovering near major support and trading near 52-week lows. So highly rated value stocks over $20 that beat earnings but sold off anyways and trading near major support. The combination of better earnings and a lower stock price leads to a lower and more attractive P/E multiple.

That left only three candidates.

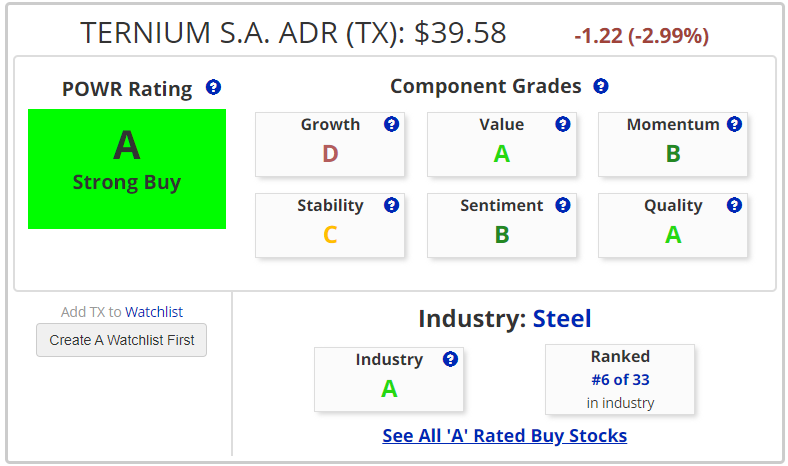

Ternium

TX stock is an A Rated Strong Buy stock. It is also number 6 out of 33 in the A Rated Steel Industry. It carries an A Component Grade for Value.

Ternium (TX) reported earnings on April 26 that beat expectations by more than $1.00 per share. Yet the stock is now lower. Shares are getting to oversold levels near horizontal support at $38.50 that has signaled intermediate term lows in the past. A dividend yield of over 4.5% along with a payout ratio under 25% makes Ternium a very attractive income stock as well.

Longer-term investors should consider adding TX to the portfolio. Shorter-term option traders might want to consider selling the June $36/$34 put spread for around 50 cents net credit. Maximum gain is $50 per spread with maximum risk of $150 per spread. Return on risk is 33%. The short $36 strike price provides an 8.75% downside cushion to the $39.58 closing price for TX.

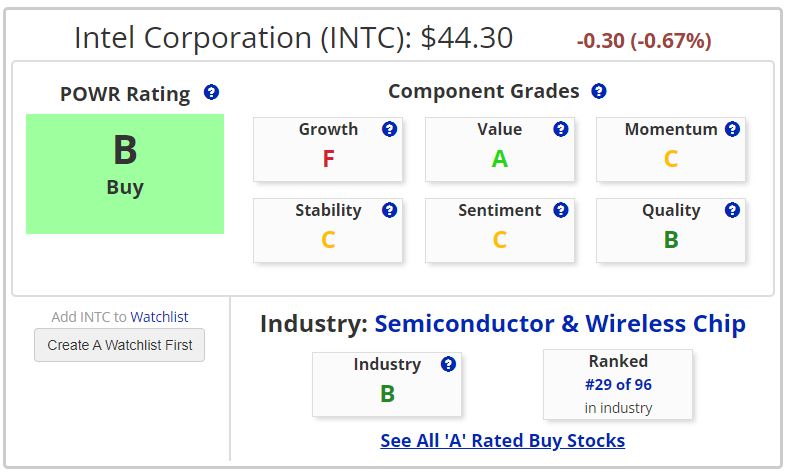

Intel

Intel is a B rated Buy stock. It is number 29 out of 96 in the B Rated Semiconductor Industry. It has an A Rating Value Component Grade.

Intel reported earnings on April 28 that beat by 7 cents per share. This marked the fourth straight quarter of earnings beats yet the stock is down over 20% in that time frame. Shares are nearing oversold readings at the $44 major support level. Previous times it was this oversold were prescient times to buy. A dividend yield of 3.3% along with a payout ratio under 30% makes INTC a solid income/value stock.

Longer-term investors should consider adding INTC to the portfolio. Shorter-term option traders might want to consider selling the June $42.50/$40 put spread for around 50 cents net credit. Maximum gain is $50 per spread with maximum risk of $200 per spread. Return on risk is 25%. The short $42.50 strike price provides a 4% downside cushion to the $44.30 closing price for INTC.

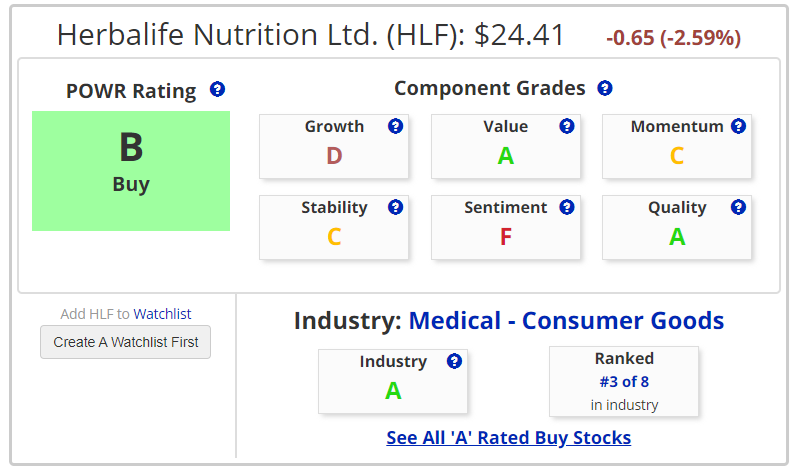

Herbalife

HLF stock is an B Rated Buy stock. It is also number 3 out of 8 in the A Rated Medical-Consumer Goods Industry. A Component Grade for Value as well.

Herbalife reported earnings on May 3 that beat by 13.79%. Shares are nearing oversold readings at the $24 major support level. Previous time it was this low was during the height of the Covid Crisis. No dividends, but an historically low P/E ratio now under 7 makes HLF an enticing value proposition.

Longer-term investors should consider adding HLF to the portfolio. Shorter-term option traders might want to consider selling the June $22.50/$20 put spread for around 45 cents net credit. Maximum gain is $45 per spread with maximum risk of $205 per spread. Return on risk is 21.95%. The short $22.50 strike price provides a 7.82% downside cushion to the $24.41 closing price for HLF.

Volatility equals opportunity in this current market environment for long-term investors and short-term traders alike. Using the StockNews screener to uncover quality value stocks at an attractive entry point provides the edge you need to best navigate the short-term uncertainty.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

shares fell $6.81 (-1.66%) in premarket trading Monday. Year-to-date, has declined -13.13%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TX | Get Rating | Get Rating | Get Rating |

| HLF | Get Rating | Get Rating | Get Rating |