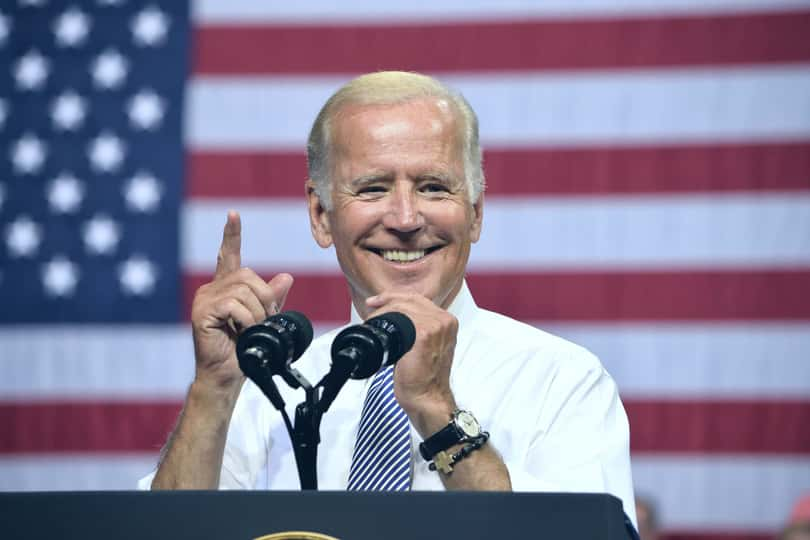

On March 31, President Biden introduced an infrastructure spending package that totaled more than $2 trillion with the goal of rehabilitating U.S. infrastructure and the U.S. economy. Biden has characterized the fiscal stimulus package as a “once-in-a-generation” investment that would upgrade the country’s existing infrastructure base and bring “transformational progress” to the economy. The proposed plan is currently being negotiated in the U.S. Senate, where the Republican party made a $928 billion counteroffer to Biden’s proposal on May 27.

The United States’ infrastructure sector is looking at a potential trillion-dollar investment over the next eight years. The steel industry, which is currently witnessing soaring prices given the high global demand, should hit fresh highs soon. Section 232 tariffs placed on steel imports by the previous administration have led to nearly $15.70 billion in new capacity investments, allowing the domestic steel industry to improve. On the global front, steel production had increased 23% year-over-year in April.

The steel industry boom is expected to increase if an infrastructure bill is passed, given steel’s use in construction. Given this backdrop, we think small-cap steel stocks Usinas Siderúrgicas de Minas Gerais S.A. (USNZY - Get Rating), Schnitzer Steel Industries, Inc. (SCHN - Get Rating), and Insteel Industries, Inc. (IIIN - Get Rating) could be attractive additions to one’s portfolio, based on their immense growth potential.

Usinas Siderúrgicas de Minas Gerais S.A. (USNZY - Get Rating)

Based in Brazil, USNZY is a manufacturer and global distributor of flat steel products. The company operates through four segments: Mining and Logistics, Steel Metallurgy, Steel Transformation, and Capital Assets. USNZY markets stamped steel parts for the automobile industry and construction and capital goods industry. It has a $4.69 billion market capitalization.

USNZY’s net revenue increased 85.6% year-over-year to R$7.07 billion ($1.38 billion) in the quarter ended March 31. Its profit from continuing operations grew 414% from its year-ago value to R$1.79 billion ($350 million). USNZY’s net income came in at R$1.20 billion (240 million), indicating a 385.7% rise year-over-year. Its cash and cash equivalents balance rose 122.2% from the prior year quarter to R$4.60 billion ($897.45 million) over this period.

A $4.83 billion consensus revenue estimate for the current year indicates a 68.6% increase year-over-year. The Street expected the company’s EPS to rise 1,450% from the prior year to $0.54 in the current year.

Shares of USNZY have gained 202.4% over the past year, and 49.4% year-to-date.

It’s no surprise that USNZY has an overall B rating, which equates to Buy in our proprietary POWR Ratings system. The POWR Ratings are calculated considering 118 different factors, with each factor weighted to an optimal degree.

USNZY has an A grade for Growth, and a B for Momentum and Quality. Among the 33 stocks in the A-rated Steel industry, USNZY is ranked #13.

Beyond what we’ve stated above, we have also rated USNZY for Value, Sentiment and Stability. Click here to view all USNZY Ratings.

Schnitzer Steel Industries, Inc. (SCHN - Get Rating)

With a market capitalization of $1.57 billion, SCHN specializes in recycling scrap metal and in the production and sale of finished steel products. SCHN operates through two segments: Auto and Metals Recycling (AMR), and Cascade Steel and Scrap (CSS). The AMR segment recycles different types of metals, while the CSS segment produces various steel products using the recycled metal scrap.

On February 23, SCHN for the seventh time appeared on the list of the world’s most ethical companies published by Ethisphere. CEO and Chairman Tamara Lundgren recognized the award as a “a testament to our ongoing commitment to operating according to our core values and in support of our stakeholders.”

On February 10, the company announced that it has been named a 2021 Sustainability Yearbook Member and recognized as an Industry Mover by S&P Global (S&P). Given the rising popularity of ESG investing, SCHN’s global recognition makes it an attractive stock in that domain.

SCHN’s revenue increased 36.7% year-over-year to $600 million in its fiscal second quarter, ended February 28. Its operating profit grew 661.7% from its year-ago value to $58.58 million, while its net income improved 820% year-over-year to $46 million. The company’s EPS increased 1,000% year-over-year to $1.54.

Analysts expect SCHN’s revenues to increase 105.9% year-over-year to $759.07 million in its fiscal third quarter, ended May 2021. A $2.08 consensus EPS estimate for the about-to-be-reported quarter indicates a 4,060% rise from the same period last year. The company has an impressive earnings surprise history; it beat the consensus EPS estimates in each of the trailing four quarters.

Shares of SCHN have gained 252.3% over the past year, and 79.4% year-to-date.

SCHN has an overall B rating, which equates to Buy in our proprietary POWR Ratings system. The stock has an A grade for Growth, and a B grade for Momentum and Sentiment. SCHN is ranked #19 in the same industry. To see additional SCHN Ratings for Value, Stability and Quality, click here.

Insteel Industries, Inc. (IIIN - Get Rating)

IIIN manufactures steel wire reinforcing products for concrete construction applications. The company also offers prestressed concrete strand (“PC strand”) and welded wire reinforcement, including engineered structural mesh (“ESM”), concrete pipe reinforcement and standard welded wire reinforcement. IIIN basically sells its products to the manufacturers of concrete products, rebar fabricators, distributors, and contractors. It has a $672.30 million market capitalization.

IIIN is scheduled to pay a $0.03 per share quarterly dividend on June 25.

On March 3, the company announced the transfer of its common stock listing to NYSE from the NASDAQ. Regarding the transfer, the company’s CEO said, “We are pleased to return our share listing to the New York Stock Exchange where Insteel was previously listed from 1992 to 2002 and to join the preeminent companies listed there as we continue to focus on delivering long-term value for our shareholders.”

IIIN’s net sales increased 21% year-over-year to $139 million in its fiscal second quarter, ended April 3. Its net earnings stood at $14.92 million, up 241.9% from the same period last year. Its cash and cash equivalents balance rose 46% from the prior year quarter to $59 million over this period. The company’s EPS increased 230.4% year-over-year to $0.76.

Analysts expect IIIN’s revenues to increase 24.3% year-over-year to $171.77 million in the fiscal fourth quarter, ending September 2021. A $0.69 consensus EPS estimate for the next quarter indicates a 68.3% rise from the same period last year. The company has an impressive earnings surprise history also; it beat consensus EPS estimates in each of the trailing four quarters. IIIN has gained 27.9% over the past six months, and 59% year-to-date.

IIIN has an overall A rating, which equates to Strong Buy in our proprietary POWR Ratings system. IIIN has a B grade of B for Quality, Growth, Value, Sentiment and Momentum. It is ranked #8 in the Steel industry. Click here to view additional IIIN Ratings.

Want More Great Investing Ideas?

USNZY shares were unchanged in after-hours trading Thursday. Year-to-date, USNZY has gained 47.47%, versus a 12.37% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| USNZY | Get Rating | Get Rating | Get Rating |

| SCHN | Get Rating | Get Rating | Get Rating |

| IIIN | Get Rating | Get Rating | Get Rating |