- Crack spreads have been volatile- They are the key for refining companies

- Valero bounces on optimism and a rising gasoline crack

- Marathon is the leader in refining

In the world of crude oil, the crack spread measures the price difference between the raw energy commodity and oil products. Most consumers do not purchase crude oil for their energy needs; they are direct or indirect buyers of gasoline and distillates. Gasoline is the most ubiquitous oil product. Anytime we fill up our automobile with gas, we are a direct consumer of the oil product. Heating oil futures that trade on the NYMEX division of the Chicago Mercantile Exchange are a proxy for other distillate fuels like jet and diesel fuels.

Refiners like Valero Energy Corporation (VLO) and Marathon Petroleum Corporation (MPC) operate refineries that process petroleum into oil products. For refiners, the processors do not take a direct price risk when purchasing crude oil or selling gasoline or distillates. The refiners make substantial capital investments to build their refineries, and it is the differential between the oil they buy and the products they sell that determines profits or losses. Therefore, processors take the risk of the crack spread instead of the individual prices of the energy commodities.

After significant price declines that took the prices of VLO and MRO shares to the lowest prices in many years, both VLO and MRO have made comebacks, as the shares have tracked the processing spreads.

Crack spreads have been volatile- They are the key for refining companies

The gasoline crack spread measures the refining margin for processing crude oil into the fuel. The gasoline crack spread is a barometer for the demand for crude oil as the energy commodity is the primary ingredient in the production of the fuel. At the same time, then processing spread is a real-time indicator for the profitability of refining companies.

(Source: CQG)

The daily chart of the June gasoline crack spread on NYMEX shows that the refining margin rose from negative $3.55 per barrel in late March to a high of $18.67 in late April. The gasoline processing spread was trading at the $12.50 level late last week.

At a negative reading, refiners lose money processing petroleum into the fuel. Higher levels in the crack spread suggest more significant profits for refining companies. Therefore, the shares tend to rise and fall with the crack spread.

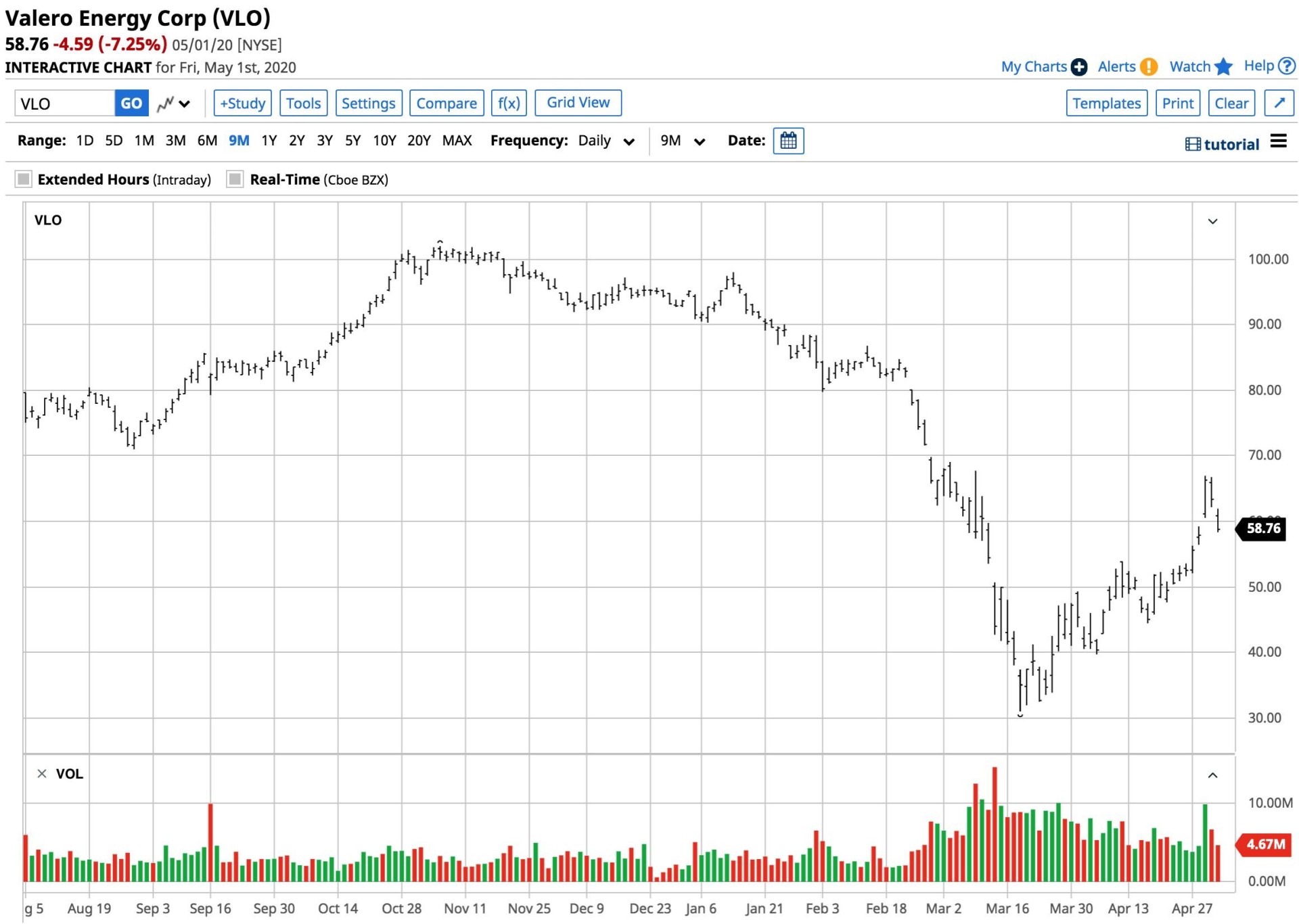

Valero bounces on optimism and a rising gasoline crack

At around the same time, when the gasoline crack spread fell into negative territory, Valero (VLO) shares hit their low for 2020.

(Source: Barchart)

The chart shows that VLO fell to a low of $31 per share on March 18, which was the lowest level since 2012. The shares more than doubled in value at the high on April 29, when VLO reached $66.94, the day after the gasoline crack spread hit $18.67 per barrel.

The gasoline processing spread bounced on optimism that the impact of the virus will decline. At the same time, we are now at a time of the year when drivers tend to put more mileage on their automobiles in the US. An easing of social distancing guidelines during the peak season for gasoline demand would support share prices for companies like VLO. The shares closed at $58.76 on May 1 as selling hit the stock market, and the crack spread dropped to the $12.50 per barrel level. VLO reported higher than expected profits of 34 cents per share for Q1 last week.

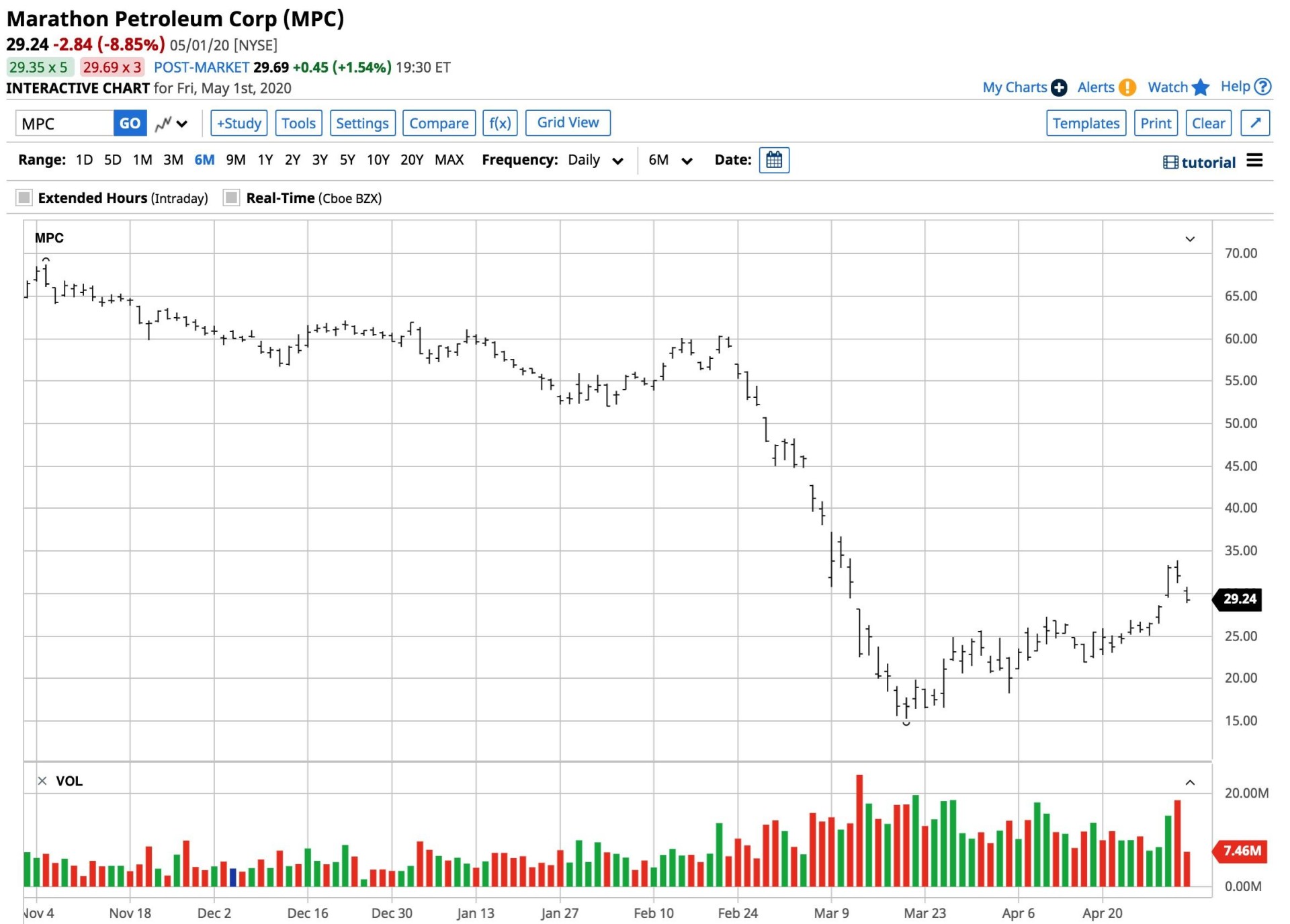

Marathon is the leader in refining

Marathon Petroleum Corporation (MPC) is the leading crude oil refiner in the United States. MPC operates two of the three top oil refineries, including Galveston Bay and Garyville. Both have a capacity of over 500,000 barrels per day. The largest refinery in the US Port Arthur, owned by the leading oil company in the world, Saudi Aramco.

Like VLO, MPC shares are highly sensitive to the ups and downs of crack spreads.

(Source: Barchart)

MPC shares fell to a low of $15.26 on March 19, the lowest level since 2012, and rose to a high of $33.91 on April 30, more than double the level six weeks earlier. MPC will report Q1 earnings on May 5.

Crack spreads can be highly volatile, and shares of refining companies follow the processing margins like obedient puppies. Running an oil refinery is a capital-intensive business that rises and falls with the margin for cracking crude oil into gasoline and distillate products.

Refineries take the risk of the crack spread, not of the prices of crude oil or oil products.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

REVISED 2020 Stock Market Outlook– Discover why there is more downside ahead and the Top 10 picks for the bear market.

9 Simple Strategies to REGROW Your Portfolio – Learn the 9 strategies employed by Steve Reitmeister to generate consistent outperformance…even during bear markets.

VLO shares were trading at $61.73 per share on Monday afternoon, up $2.97 (+5.05%). Year-to-date, VLO has declined -33.31%, versus a -12.11% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| VLO | Get Rating | Get Rating | Get Rating |