Valero Energy Corp. (VLO): Price and Financial Metrics

VLO Price/Volume Stats

| Current price | $159.12 | 52-week high | $184.79 |

| Prev. close | $157.00 | 52-week low | $119.88 |

| Day low | $154.88 | Volume | 3,151,175 |

| Day high | $160.16 | Avg. volume | 3,079,113 |

| 50-day MA | $153.82 | Dividend yield | 2.91% |

| 200-day MA | $145.03 | Market Cap | 52.03B |

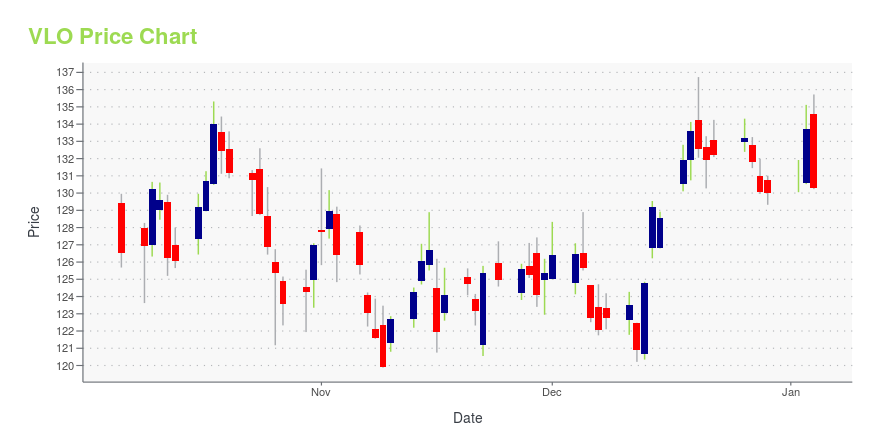

VLO Stock Price Chart Interactive Chart >

Valero Energy Corp. (VLO) Company Bio

Valero Energy operates as an independent petroleum refining and marketing company in the United States, Canada, the Caribbean, the United Kingdom, and Ireland. It operates through two segments, Refining and Ethanol. The company was founded in 1955 and is based in San Antonio, Texas.

Latest VLO News From Around the Web

Below are the latest news stories about VALERO ENERGY CORP that investors may wish to consider to help them evaluate VLO as an investment opportunity.

In 2024 The US Will Sell CITGO Petroleum And Pay Out Two Canadian JuniorsVenezuela owns Citgo Petroleum. This is a big company – the 7th largest refiner in North America. By July, a US court may make Venezuela liquidate to pay its debts, and some miners may get unexpected windfalls. |

Why Investors Need to Take Advantage of These 2 Oils-Energy Stocks NowWhy investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates. |

Valero Energy (VLO) Rises Higher Than Market: Key FactsValero Energy (VLO) concluded the recent trading session at $132.20, signifying a +0.21% move from its prior day's close. |

Valero Energy (VLO) Stock Slides as Market Rises: Facts to Know Before You TradeValero Energy (VLO) reachead $131.92 at the closing of the latest trading day, reflecting a -0.47% change compared to its last close. |

13 Most Profitable Oil Stocks in the WorldIn this article, we discuss the 13 most profitable oil stocks in the world. To skip our detailed analysis of the oil and gas sector, go directly to the 5 Most Profitable Oil Stocks in the World. Oil stocks experienced a remarkable performance in 2022, but their fortunes took a downturn in 2023. Despite the […] |

VLO Price Returns

| 1-mo | 3.61% |

| 3-mo | -3.40% |

| 6-mo | 17.02% |

| 1-year | 30.70% |

| 3-year | 170.53% |

| 5-year | 135.00% |

| YTD | 24.14% |

| 2023 | 5.86% |

| 2022 | 74.95% |

| 2021 | 40.25% |

| 2020 | -35.69% |

| 2019 | 30.27% |

VLO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching VLO

Want to see what other sources are saying about Valero Energy Corp's financials and stock price? Try the links below:Valero Energy Corp (VLO) Stock Price | Nasdaq

Valero Energy Corp (VLO) Stock Quote, History and News - Yahoo Finance

Valero Energy Corp (VLO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...