- Gasoline continues to trend higher

- Vaccines leading to herd immunity could push gasoline even higher

- Crack spreads are firm

- Valero reported earnings on April 22- the stock has been climbing- Continuing to beating EPS forecasts

- VLO pays an attractive dividend

Refining crude oil into gasoline and distillates is a capital-intensive business. When the gasoline crack spread fell to negative territory in March 2020, and the distillate processing margin reached the lowest level in a decade, refineries struggled. Companies that process petroleum into products purchase the raw crude oil at market prices and sell the products at market prices. They only have exposure to the refining margin.

Valero Energy Corporation (VLO - Get Rating) is a leading US refining company. Higher oil and oil product prices have led to more attractive refining margins. Since reaching a low of $31 per share in March 2020 and a higher low of $35.44 in late October 2020, the shares more than doubled at the recent high and were trading above the $70 level at the end of last week.

An attractive dividend and the prospects for rising gasoline demand could push VLO shares a lot high over the coming weeks and months as the US heads into the peak driving season. The gasoline market has made a substantial comeback from the pandemic-stricken period in 2020, and that trend is likely to continue. Higher gasoline demand in the post-pandemic period is bullish for Valero shares, which are back in the buy zone.

Gasoline continues to trend higher

Gasoline prices fell to the lowest price of this century in March 2020 when they reached a bottom at 37.6 cents per gallon wholesale.

Source: CQG

Source: CQG

The weekly chart of NYMEX gasoline futures highlights the steady climb in the gasoline futures arena that took the price to a high of $2.17 per gallon in March 2021, nearly six times higher than the previous year’s low. After pulling back to below the $2 level, the price crawling back to the level at the end of last week.

Source: CQG

Source: CQG

The monthly chart shows that above $2.17 per gallon, the next upside target stands at $2.2855, the May 2018 high. A break above the 2018 could be a gateway to $3, a level not seen since 2014.

Vaccines leading to herd immunity could push gasoline even higher

Gasoline prices are rising as vaccines are creating herd immunity to COVID-19. As of the end of last week, over one-third of the US population has received the Pfizer, Moderna, or Johnson and Johnson vaccines. At this time last year, social distancing and rising infections and fatalities had people working from home, unemployed, or just hiding to remain healthy. Gasoline demand slumped as people only ventured outside of their homes to purchase supplies.

The winter is now over, and the season of hibernation caused by the virus is fading into our rearview mirrors. People are returning to work, venturing outside, and putting many more miles on their automobiles. Gasoline demand is rising, and that is likely to continue over the coming months. The summer vacation season is on the horizon, with many people itching to get, as Willy Nelson sang, “On the road again.”

Crack spreads are firm

Refining companies purchase crude oil, the primary input in gasoline processing, at market prices. They sell the oil product at the current market. Therefore, they are not exposed to the oil or the oil product’s prices. Processing spreads between crude oil and gasoline or the crack spread determine their earnings. The gasoline crack spread is a real-time barometer of earnings as well as demand for petroleum. Consumers purchase oil products, so demand shows up in the processing margins.

Source: CQG

Source: CQG

The weekly gasoline crack spread chart shows the rise from $6.43 per barrel at the start of the 2020/2021 winter season. Since gasoline demand tends to decline during the coldest months, the spread hit a seasonal low in November and December 2020. In March, the crack spreads rose to a high of $24.86 per barrel, the highest level since April 2018. At the $22.09 level at the end of last week, the refining margin was at a level where refiners can make a healthy profit.

Valero reported earnings on April 22- the stock has been climbing- Continuing to beating EPS forecasts

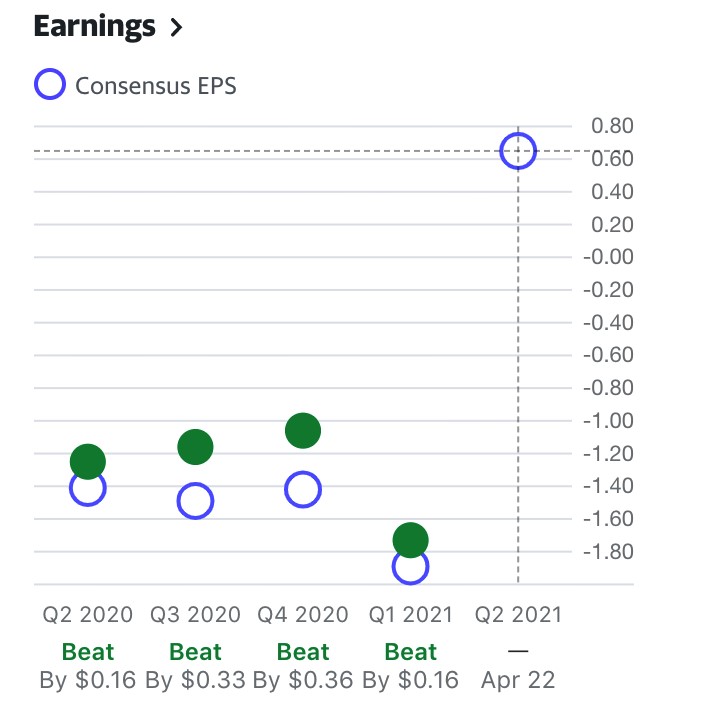

VLO tends to report EPS above consensus forecasts. It did not disappoint last week when it said the company only lost $1.73 per share compared to consensus projections of a $1.89 per share loss.

Source: Yahoo Finance

Source: Yahoo Finance

The chart shows that VLO beat analyst estimates over the past four consecutive quarters. The company’s record goes back even further. In Q1 2020, VLO earned EPS of 34 cents compared to projections of a 15 cents loss. The current forecasts for Q2 are for EPS of 65 cents, given the rise in crude oil and the gasoline crack spread.

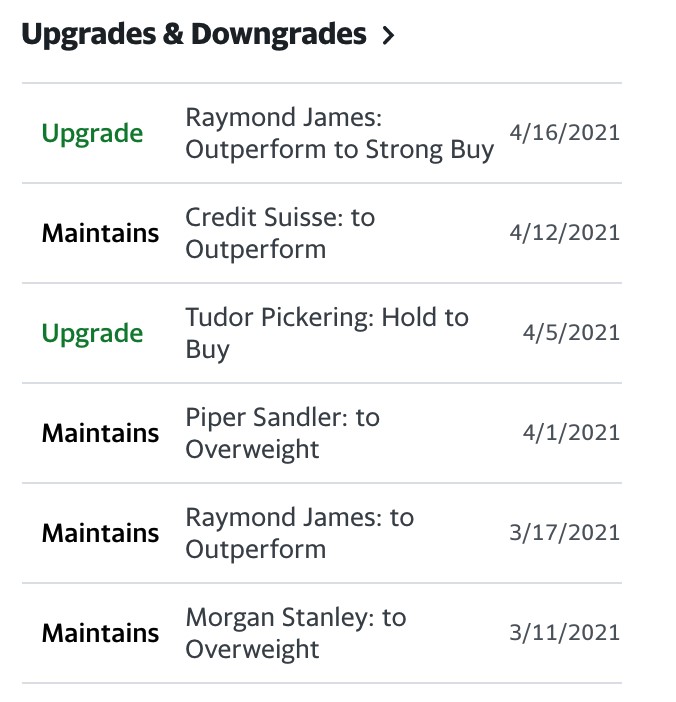

A survey of sixteen analysts on Yahoo Finance has an average price target of $88.13 for VLO shares, with forecasts ranging from $74 to $110. At $70.18 per share at the end of last week, VLO was below the bottom end of the range.

Source: Yahoo Finance

Source: Yahoo Finance

The chart shows that Wall Street analysts are bullish on VLO shares.

Source: Barchart

Source: Barchart

After reaching a low of $35.44 on October 29, 2020, VLO shares reached a high of $84.39 on March 11, 2021. The shares have pulled back to the $70 level and are in the buy zone. Meanwhile, VLO pays its shareholders a handsome dividend while they wait for capital appreciation.

VLO pays an attractive dividend

Early last week, before VLO reported its latest earnings, the company declared its latest regular quarterly cash dividend of 98 cents per share. The $3.92 dividend equates to $3.92 or 5.6%, with the shares at the $70.18 level on April 23.

Rising gasoline demand, a refining spread over the $22 per barrel level, and the prospects for the most robust driving season in years in the wake of the pandemic are bullish for VLO shares. The first upside target is just above $84 per share. If gasoline is heading for the $3 per gallon level, a level not seen since 2014, VLO could reach $100, which is still below the top end of the current analyst range for the stock.

As drivers get “On the road again,” VLO’s earnings are likely to reflect increased gasoline requirements.

Want More Great Investing Ideas?

VLO shares rose $0.33 (+0.47%) in premarket trading Tuesday. Year-to-date, VLO has gained 26.58%, versus a 12.12% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| VLO | Get Rating | Get Rating | Get Rating |