The trade war-induced sell-off has caused market volatility, as measured by the Chicago Board of Options Exchange (CBOE) Volatility Index to surge by over 70% in the past two days to 24, a year-to-date high.

What sometimes gets lost in the broad discussion of VIX is the specifics of how does implied volatility get factored into individual option prices and impacts position profitability? The term volatility gets thrown around a lot and is often used interchangeably for big moves, especially down, or perceived risk.

But for option traders, volatility, or more specifically implied volatility has a very defined meaning and is crucial to understanding the probability of profitable trading.

I often use the analogy that you don’t need to be a mechanic or know how to build an engine to drive a car, just know the gas from the brake, but having a rudimentary understanding of how the parts work and are connected can help not only avoid accidents but also enhance performance.

Likewise, you don’t need to get all geeked out on the Black-Scholes model to trade options, but having a basic understanding of how options get priced and behave under a variety of conditions will go along way to successful trading.

Let’s take a look under the hood of what we mean when we talk about implied volatility.

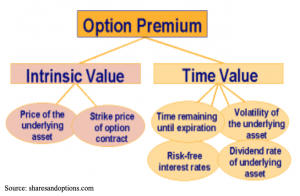

Implied volatility is a ‘plug number’ (a placeholder number used to make the calculation estimate correct) used to make the result from the commonly-used apparatus for valuing options is the Black-Scholes model, which considers 5 factors in calculating a particular option’s theoretical fair value:

1. The price of the underlying security

2. The strike price.

3. The time, or expiration date of the option

4. Interest rates * this is becoming increasingly important in a rising rate environment and with upcoming FOMC meetings.

5. Implied volatility.

The first four inputs are known variables. To get number five, we plug those four inputs into the Black-Scholes model. This would give us “theoretical” implied volatility, which helps us decide whether an option is cheap or expensive.

But given that options trade regularly, there is already an “actual” implied volatility assigned to each option based on its price, which is constantly updating in real-time.

So, what does the actual or real-time implied volatility tell us?

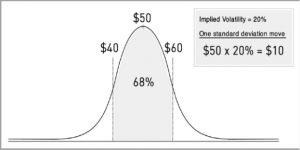

- IV is a proxy for standard deviation

- Price should remain within 1 standard deviation of 68% of the time.

So a one standard deviation move = $50 x 20% = $10. Meaning, shares are expected to stay within $40 to $60 for the year.

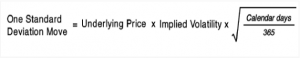

To narrow this down to shorter time frames, we use this formula.

This brings us to the ‘rule of 16’ in which you take the square root of the 256, number of trading days in a year or 16, to calculate the expected daily move.

Hence;

- 25% IV on a$100 stock remain within $75-$125 for year 68% of the time.

- 25% IV: (25/16)=1.56% daily price move.

Right now we are in an interesting place; volatility, both real and implied, are trending higher, but still are well below peaks or panic levels. This is despite the relatively high level of overall uncertainty.

With trade tariff talks and the unknown path for the Fed regarding interest rates expect both realized and implied volatility levels to increase. Knowing how this will impact your positions will help them become more profitable.

VXX shares were trading at $29.16 per share on Tuesday afternoon, down $0.14 (-0.48%). Year-to-date, VXX has declined -37.94%, versus a 15.29% rise in the benchmark S&P 500 index during the same period.

This article is brought to you courtesy of Stock News.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| VXX | Get Rating | Get Rating | Get Rating |