- Zoom zoomed in 2020

- People miss pressing the flesh

- A bearish pattern since October 2020

- Earnings have been impressive- Is it sustainable?

- Downgrades only come after a disappointment

Markets tend to look towards the future. In early 2021, optimism that vaccines will create herd immunity to the global pandemic has lifted stocks to record highs.

In markets, the worst performers during one period often become the best during the next. Simultaneously, the highest-flying stocks often experience corrections as gravity can be a powerful force.

Zoom Video Communications (ZM) connects people via its video-first communications platform worldwide. The company’s product portfolio includes Zoom Meetings that offer HD video, voice, chat, and content sharing through mobile devices, desktops, laptops, telephones, and conference room systems. Zoom phone is an enterprise cloud phone system providing secure call routing, call quality monitoring, voicemail, switch to video, and other services.

Zoom offers additional products including, Zoom Chat, Zoom Rooms, Zoom Conference Center Connector, and Zoom Video Webinars. The company has been around since 2011. ZM’s initial public offering was in April 2019, when the stock opened at $65 per share.

Timing is everything in life. For ZM, the company went public less than one year before an event that would launch the stock and the addressable market for its services beyond its wildest dreams.

Nothing could have been more bullish for ZM shares than the 2020 COVID-19 pandemic.

Zoom zoomed in 2020

The coronavirus caused many people to work from home and social distance from colleagues, friends, and even family. While the human race had a challenging year, it was the best of times for companies like ZM as it accelerated their profile, usage, and growth.

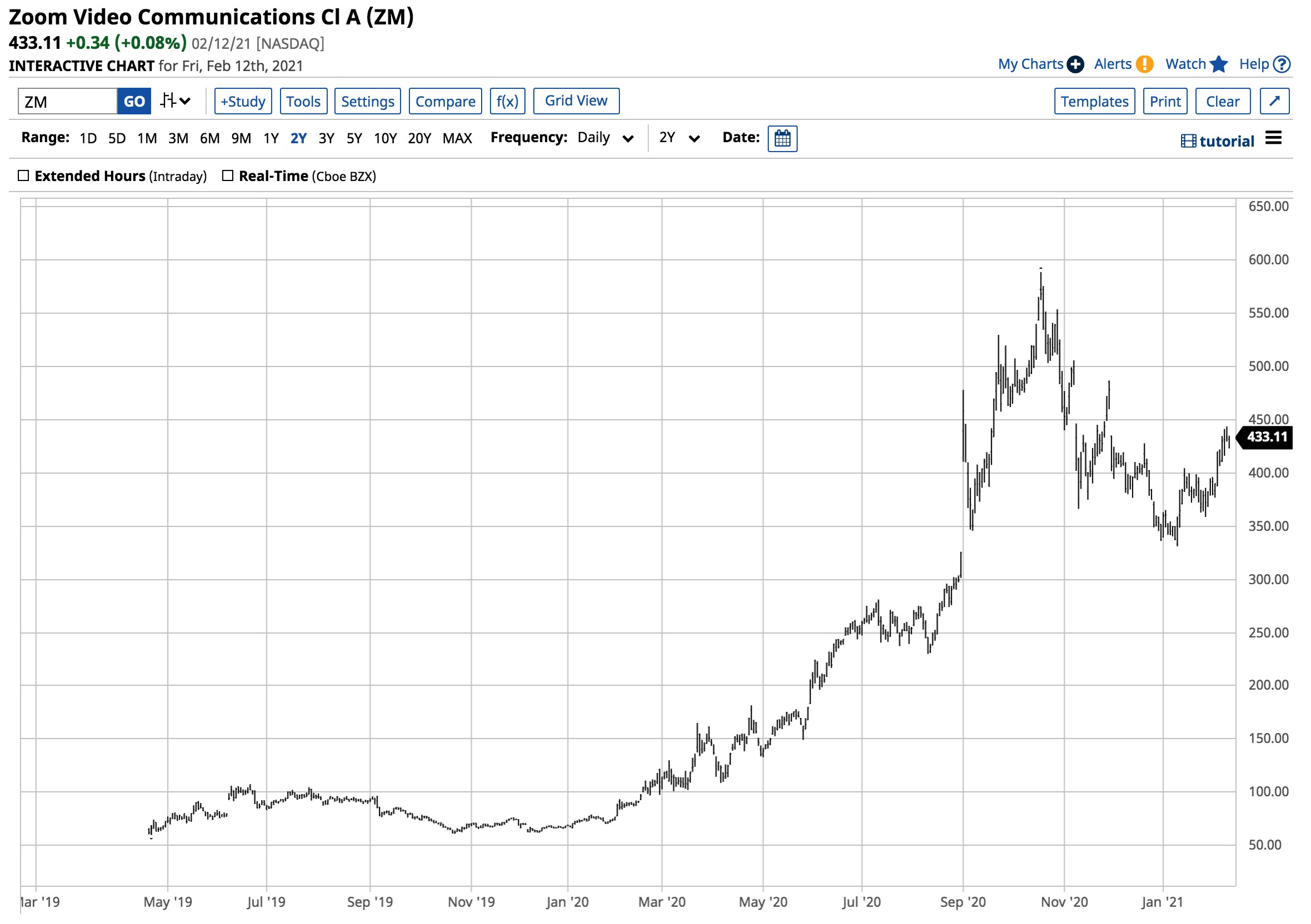

Source: Barchart

Source: Barchart

As the chart shows, ZM shares closed 2019 at $68.04. On December 31, 2020, they settled at $337.32 after reaching a high of $588.84 on October 19. The company’s share performance has been nothing short of incredible. Robust revenue and earnings growth backed up the share performance.

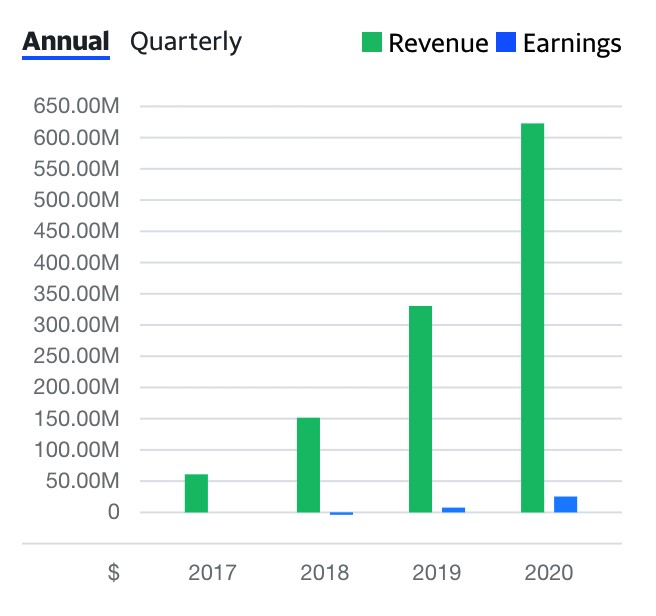

Source: Yahoo Finance

Source: Yahoo Finance

As the chart highlights, ZM’s EPS beat the consensus estimates over the past four consecutive quarters. ZM will report Q4 2020 earnings on March 1. The current forecast is for the company to report EPS of 79 cents per share.

Source: Yahoo Finance

Source: Yahoo Finance

The chart illustrates the growth trajectory of revenues and earnings from 2017 through the first three quarters of 2020.

Source: Yahoo Finance

Source: Yahoo Finance

The quarterly growth rate was as impressive as the annual. Timing is everything in markets, and ZM is the embodiment of a company in the right place at the right time.

At $433.11 at the end of last week, ZM’s market cap was at $126.42 billion. An average of 6.83 million ZM shares changes hands each day.

People miss pressing the flesh

The pandemic accelerated Zoom’s business. Aside from work applications, families and friends used the service. Zoom cocktail parties provided a way for friends to socialize. Family meetings via Zoom allowed loved ones to keep in touch. People got married on Zoom and said farewell to those who passed using the safety of the application.

As the world moves towards herd immunity in 2021, courtesy of vaccinations, we will likely see a sudden return of interpersonal contact. After being locked at home for the past year, people worldwide are itching to get back to work, visit family and friends, hug, shake hands, and enjoy the personal contact that disappeared during the pandemic. People are starving for personal connection. One of the past year’s side effects has been a rise in depression, substance abuse, and even suicides.

Optimism over the end of the coronavirus is rising in early 2021. As vaccines go into arms, there is light at the end of a dark tunnel. While ZM saw the benefits of the lockdowns, it will likely see its growth level off or begin to decline as people begin to press the flesh once again.

A bearish pattern since October 2020

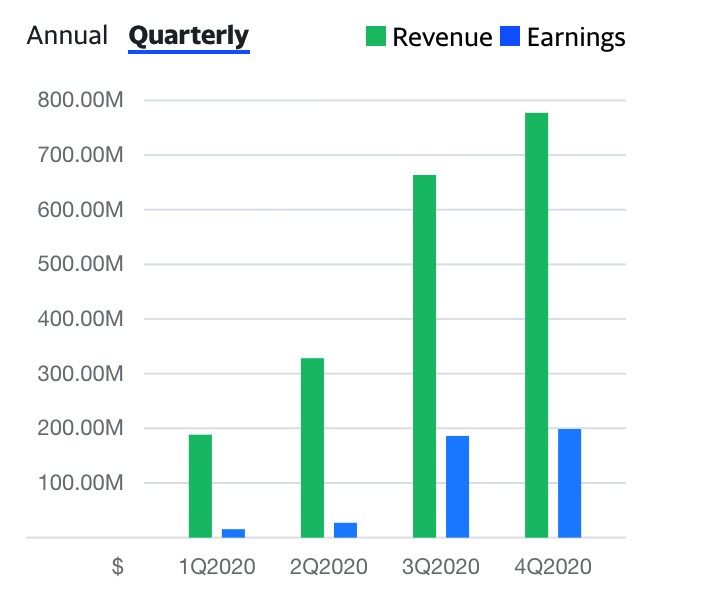

After rising to just below $590 per share in mid-October, ZM shares have been mostly trading in a bearish pattern over the past four months.

Source: Barchart

Source: Barchart

The chart shows that the shares made lower highs and lower lows from October 19 through mid-January, reaching a low of $331.10 on January 12. The low was only $5 under the closing price at the end of 2020. Since mid-January, ZM shares have reversed the pattern and have made higher lows and higher highs.

Even though vaccines are going into arms at a rising rate, the number of injections and fatalities increased in early 2021. New virus strains are creating concerns that the injections may not be effective as COVID-19 mutates.

Earnings have been impressive- Is it sustainable?

Earnings and revenues at ZM have been explosive over the past four quarters. The company has been around since 2011, but the stock went public in 2019. Maintaining revenue and earnings growth will be a challenge. However, the pandemic will change behaviors as it will dramatically increase the number of germaphobes. Moreover, 2020 proved that working from home is not only possible but preferable in many cases. It cut expenses dramatically as travel, entertainment, and office space expenditures dropped like stones for companies.

For individuals, it allowed for more time with family, less transit time to offices, and the ability to move to locations that offer a better standard of life. The migration from cities to areas where the weather is favorable, and taxes are lower sparked a housing boom.

Behavioral changes are likely to be a legacy of COVID-19, but the accelerated rate of change experienced in 2020 should decline, affecting ZM’s future growth.

Meanwhile, the pandemic allowed the company to build its brand, which bodes well for its future.

Downgrades only come after a disappointment

We could see a period where ZM experiences a slowdown in revenue and earnings growth as the world returns to some sense of normalcy. At $433.11 per share on February 12, ZM shares have already declined nearly 26.5% from the peak. Meanwhile, many of the top Wall Street analysts continue to favor the company. A survey of twenty-three analysts on Yahoo Finance has an average price target of $469.80 for ZM shares, with forecasts ranging from $340 to $610.

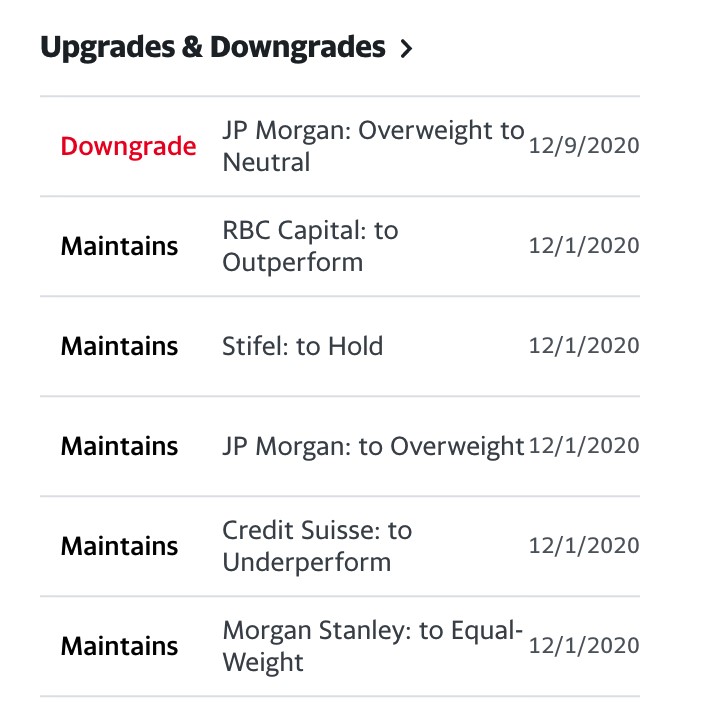

Source: Yahoo Finance

Source: Yahoo Finance

As the chart shows, five of six analysts rate the stock neutral, hold, equal-weight, or overweight for portfolios. Only Credit Suisse ranks ZM to underperform the overall stock market.

Analysts tend to abandon shares when the going gets rough, which is often the bottom of companies with growth prospects. ZM shares at $433.11 are still over six and one-half times higher than the price level at the end of 2019. I would be a buyer of ZM on price weakness as I believe in the company’s long-term prospects based on changing behavior in the workplace and our personal lives.

However, ZM came on the scene at precisely the right time to take advantage of the 2020 pandemic, proving that timing is everything. For investors, buying the shares on price weakness could be the optimal approach as ZM is no longer the no-brainer it was in 2020.

The end of the pandemic does not spell doom for Zoom, but it does mean the company could experience a far different growth rate over the coming quarters and years.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

ZM shares were trading at $449.22 per share on Tuesday morning, up $16.11 (+3.72%). Year-to-date, ZM has gained 33.17%, versus a 5.19% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| ZM | Get Rating | Get Rating | Get Rating |