Arlington Asset Investment Corp. (AAIC): Price and Financial Metrics

AAIC Price/Volume Stats

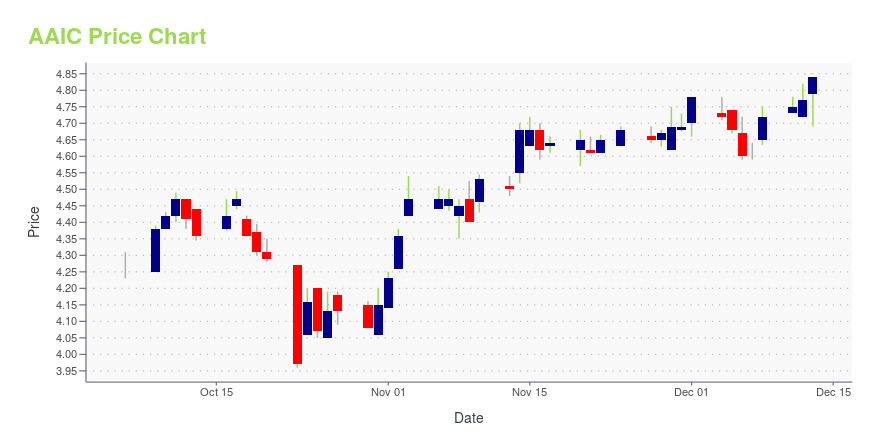

| Current price | $4.84 | 52-week high | $4.84 |

| Prev. close | $4.77 | 52-week low | $2.53 |

| Day low | $4.69 | Volume | 341,300 |

| Day high | $4.84 | Avg. volume | 180,523 |

| 50-day MA | $4.47 | Dividend yield | N/A |

| 200-day MA | $3.92 | Market Cap | 141.72M |

AAIC Stock Price Chart Interactive Chart >

Arlington Asset Investment Corp. (AAIC) Company Bio

Arlington Asset Investment Corp. (NYSE: AI) is a principal investment firm that currently invests primarily in mortgage-related and other assets. The Company is headquartered in the Washington, D.C. metropolitan area.

Latest AAIC News From Around the Web

Below are the latest news stories about ARLINGTON ASSET INVESTMENT CORP that investors may wish to consider to help them evaluate AAIC as an investment opportunity.

Arlington Asset Investment Corp. Announces Intention to Delist Notes from the NYSEArlington Asset Investment Corp. (NYSE: AAIC) ("Arlington") publicly announced today, in connection with the anticipated merger transaction with Ellington Financial Inc. (NYSE: EFC) ("Ellington Financial"), that it intends to voluntarily delist from the New York Stock Exchange (the "NYSE") Arlington's 6.75% Senior Notes due 2025 and 6.000% Senior Notes due 2026 (collectively, the "Senior Notes") and to deregister the Senior Notes under the Securities Exchange Act of 1934, as amended. |

Arlington Asset Investment Corp. Shareholders Approve Merger with Ellington Financial Inc.Arlington Asset Investment Corp. (NYSE: AAIC) ("Arlington") announced today that its shareholders have voted to approve the proposed merger transaction with Ellington Financial Inc. (NYSE: EFC) ("Ellington Financial") at a special meeting of shareholders of Arlington held today. |

Ellington (EFC) Declares Interim Dividend Before Merger CloseEllington (EFC) declares an interim monthly dividend of 6 cents per share before the closure of its merger deal with Arlington. |

Institutions own 43% of Arlington Asset Investment Corp. (NYSE:AAIC) shares but individual investors control 53% of the companyKey Insights The considerable ownership by individual investors in Arlington Asset Investment indicates that they... |

Arlington Asset Investment Corp. Reports Mixed Results Amidst Challenging Market ConditionsAAIC's Third Quarter 2023 Earnings Highlight Decreased Book Value and Net Losses |

AAIC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 4.09% |

| 3-year | 23.79% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -16.29% |

| 2021 | -7.41% |

| 2020 | -32.14% |

| 2019 | N/A |

Loading social stream, please wait...