Altisource Asset Management Corp Com (AAMC): Price and Financial Metrics

AAMC Price/Volume Stats

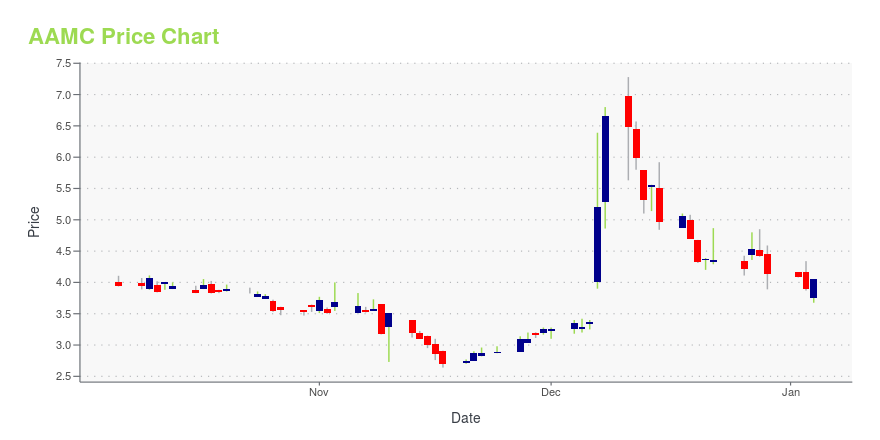

| Current price | $1.25 | 52-week high | $7.28 |

| Prev. close | $1.31 | 52-week low | $1.05 |

| Day low | $1.21 | Volume | 20,100 |

| Day high | $1.34 | Avg. volume | 30,816 |

| 50-day MA | $2.26 | Dividend yield | N/A |

| 200-day MA | $3.28 | Market Cap | 3.19M |

AAMC Stock Price Chart Interactive Chart >

AAMC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -56.45% |

| 1-year | -75.54% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | N/A |

| 2024 | 0.00% |

| 2023 | -30.49% |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

Continue Researching AAMC

Want to see what other sources are saying about Altisource Asset Management Corp's financials and stock price? Try the links below:Altisource Asset Management Corp (AAMC) Stock Price | Nasdaq

Altisource Asset Management Corp (AAMC) Stock Quote, History and News - Yahoo Finance

Altisource Asset Management Corp (AAMC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...