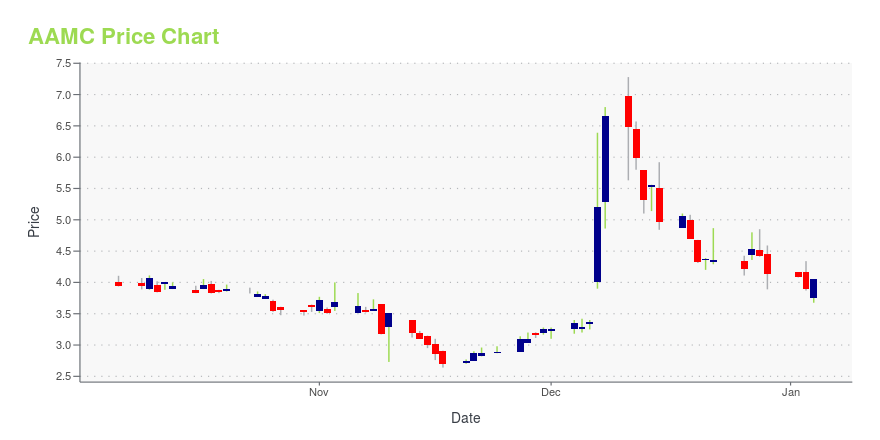

Altisource Asset Management Corp Com (AAMC): Price and Financial Metrics

AAMC Price/Volume Stats

| Current price | $2.87 | 52-week high | $14.52 |

| Prev. close | $2.87 | 52-week low | $1.68 |

| Day low | $2.85 | Volume | 2,619 |

| Day high | $2.87 | Avg. volume | 16,159 |

| 50-day MA | $2.39 | Dividend yield | N/A |

| 200-day MA | $3.51 | Market Cap | 7.33M |

AAMC Stock Price Chart Interactive Chart >

Latest AAMC News From Around the Web

Below are the latest news stories about ALTISOURCE ASSET MANAGEMENT CORP that investors may wish to consider to help them evaluate AAMC as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayPre-market stock movers are a hot topic on Wednesday and we're starting the day with a breakdown of the biggest ones worth watching! |

Rivian (RIVN) Stock Just Scored a New ‘Buy’ RatingRivian stock is gaining on Thursday after Stifel weighed in on RIVN shares with a buy rating and set a price target of $23 per share. |

Why Is Altisource Asset Management (AAMC) Stock Up 24% Today?Altisource Asset Management stock is up Thursday as AAMC investors celebrate it making progress in a legal battle with Blackrock and PIMCO. |

Why Is Troika Media Group (TRKA) Stock Down 77% Today?Troika Media Group stock is falling hard on Thursday as investors in TRKA react to the company filing for Chapter 11 bankruptcy. |

Why Is ZyVersa Therapeutics (ZVSA) Stock Down 44% Today?ZyVersa Therapeutics stock is falling hard on Thursday after the company priced a public offering for shares of ZVSA this morning. |

AAMC Price Returns

| 1-mo | 53.89% |

| 3-mo | -1.37% |

| 6-mo | -41.31% |

| 1-year | -74.22% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -30.68% |

| 2023 | -30.49% |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Continue Researching AAMC

Want to see what other sources are saying about Altisource Asset Management Corp's financials and stock price? Try the links below:Altisource Asset Management Corp (AAMC) Stock Price | Nasdaq

Altisource Asset Management Corp (AAMC) Stock Quote, History and News - Yahoo Finance

Altisource Asset Management Corp (AAMC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...