American Assets Trust, Inc. (AAT): Price and Financial Metrics

AAT Price/Volume Stats

| Current price | $25.22 | 52-week high | $25.32 |

| Prev. close | $24.61 | 52-week low | $17.15 |

| Day low | $24.74 | Volume | 181,906 |

| Day high | $25.32 | Avg. volume | 296,982 |

| 50-day MA | $22.36 | Dividend yield | 5.38% |

| 200-day MA | $21.42 | Market Cap | 1.54B |

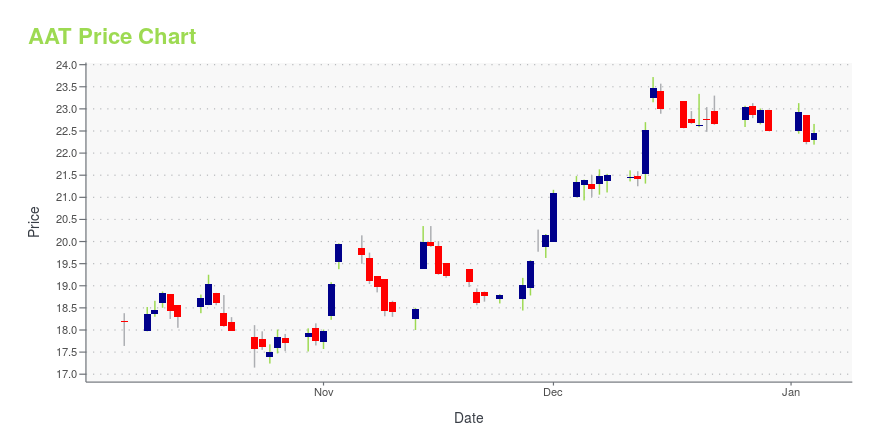

AAT Stock Price Chart Interactive Chart >

American Assets Trust, Inc. (AAT) Company Bio

American Assets Trust has been acquiring, improving, developing and managing premier retail, office and residential properties throughout the United States. The company was founded in 1967 and is based in San Diego, California.

Latest AAT News From Around the Web

Below are the latest news stories about AMERICAN ASSETS TRUST INC that investors may wish to consider to help them evaluate AAT as an investment opportunity.

Should You Buy American Assets Trust (AAT) After Golden Cross?Should investors be excited or worried when a stock's 50 -day simple moving average crosses above the 200-day simple moving average? |

Improve Your Retirement Income with These 3 Top-Ranked Dividend StocksThe traditional ways to plan for your retirement may mean income can no longer cover expenses post-employment. But what if there was another option that could provide a steady, reliable source of income in your nest egg years? |

How to Maximize Your Retirement Portfolio with These Top-Ranked Dividend StocksThe traditional retirement planning approaches no longer cover all expenses in nest egg years. So what can retirees do? Thankfully, there are alternative investments that provide steady, higher-rate income streams to replace dwindling bond yields. |

3 Top Dividend Stocks to Maximize Your Retirement IncomeThe traditional ways to plan for your retirement may mean income can no longer cover expenses post-employment. But what if there was another option that could provide a steady, reliable source of income in your nest egg years? |

3 Top-Ranked Dividend Stocks: A Smarter Way to Boost Your Retirement IncomeThe traditional retirement planning approaches no longer cover all expenses in nest egg years. So what can retirees do? Thankfully, there are alternative investments that provide steady, higher-rate income streams to replace dwindling bond yields. |

AAT Price Returns

| 1-mo | 18.02% |

| 3-mo | 20.65% |

| 6-mo | 10.24% |

| 1-year | 20.95% |

| 3-year | -20.38% |

| 5-year | -33.67% |

| YTD | 15.58% |

| 2023 | -9.58% |

| 2022 | -26.36% |

| 2021 | 34.03% |

| 2020 | -35.04% |

| 2019 | 17.11% |

AAT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AAT

Here are a few links from around the web to help you further your research on American Assets Trust Inc's stock as an investment opportunity:American Assets Trust Inc (AAT) Stock Price | Nasdaq

American Assets Trust Inc (AAT) Stock Quote, History and News - Yahoo Finance

American Assets Trust Inc (AAT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...