Abcm Corporation (ABCM): Price and Financial Metrics

ABCM Price/Volume Stats

| Current price | $23.99 | 52-week high | $25.32 |

| Prev. close | $23.98 | 52-week low | $12.48 |

| Day low | $23.98 | Volume | 7,430,200 |

| Day high | $24.00 | Avg. volume | 3,080,005 |

| 50-day MA | $23.15 | Dividend yield | N/A |

| 200-day MA | $19.98 | Market Cap | 5.50B |

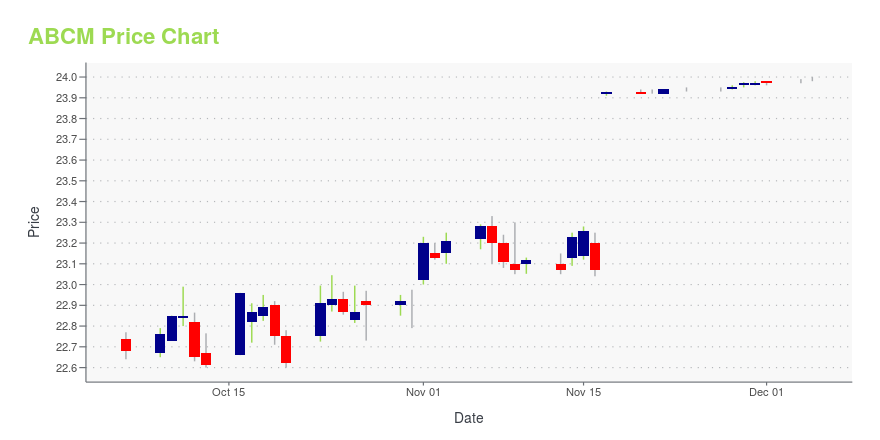

ABCM Stock Price Chart Interactive Chart >

Abcm Corporation (ABCM) Company Bio

Abcm Corporation operates rehabilitation centers, long-term care facilities, and independent and assisted living communities. The Company offers out-patient therapy, independent and assisted living, skilled nursing and rehabilitative care, dementia care, family respite care, respite services, and home care. ABCM serves patients throughout the United States.

Latest ABCM News From Around the Web

Below are the latest news stories about ABCAM PLC that investors may wish to consider to help them evaluate ABCM as an investment opportunity.

Acquisition of Abcam by Danaher Approved by the High Court of Justice of England and WalesCAMBRIDGE, England & WALTHAM, Mass., December 04, 2023--Abcam plc (Nasdaq: ABCM) (‘Abcam’, the ‘Group’ or the ‘Company’), a global leader in the supply of life science research tools, entered into a definitive agreement on August 26, 2023 relating to its proposed acquisition by Danaher Corporation (NYSE: DHR) (‘Danaher’) for $24.00 per share in cash (the ‘Transaction’), to be implemented by way of a Court-sanctioned scheme of arrangement under Part 26 of the Companies Act 2006 (the ‘Scheme‘). Th |

Abcam Acquisition by Danaher Has Received All Identified Clearances; Transaction Expected to Close on December 6, 2023CAMBRIDGE, England & WALTHAM, Mass., November 17, 2023--Abcam today announced that all Identified Clearances required in connection with the acquisition of the company by Danaher have been obtained. |

Here’s Headwaters Capital’s Perspective on Abcam plc (ABCM) AcquisitionHeadwaters Capital Management, an investment management company, released its third-quarter 2023 investor letter. A copy of the same can be downloaded here. The fund declined -7.6% (-7.8% net) in the third quarter compared to a -4.7% return for the Russell Mid Cap Index. The YTD results stand at +14.2% (+13.5% net) compared to a +3.9% […] |

Here’s Why Baron Discovery Fund Sold Abcam plc (ABCM)Baron Funds, an investment management company, released its “Baron Discovery Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. Baron Discovery Fund (the Fund) reached its 10-year anniversary on September 30, 2023. Since inception, on a cumulative basis, the fund was up 195.3% (Institutional Shares) compared to the Russell 2000 […] |

UPDATE 1-Abcam shareholders approve $5.7 billion Danaher dealAbcam shareholders on Monday approved the proposal from Danaher Corp to acquire all outstanding shares of the company for $24 per share in cash. Danaher agreed to buy Abcam in September in a $5.7 billion all-cash deal, including debt, in a bid to expand its portfolio of products and services. Abcam founder Jonathan Milner had said at the time he would vote against the acquisition of the company, as the offer price undervalues the protein consumables maker. |

ABCM Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 2.13% |

| 3-year | 27.88% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -33.93% |

| 2021 | 9.28% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...