ARCA biopharma, Inc. (ABIO): Price and Financial Metrics

ABIO Price/Volume Stats

| Current price | $3.14 | 52-week high | $4.49 |

| Prev. close | $3.07 | 52-week low | $1.56 |

| Day low | $3.01 | Volume | 124,700 |

| Day high | $3.29 | Avg. volume | 672,792 |

| 50-day MA | $3.41 | Dividend yield | N/A |

| 200-day MA | $2.40 | Market Cap | 45.55M |

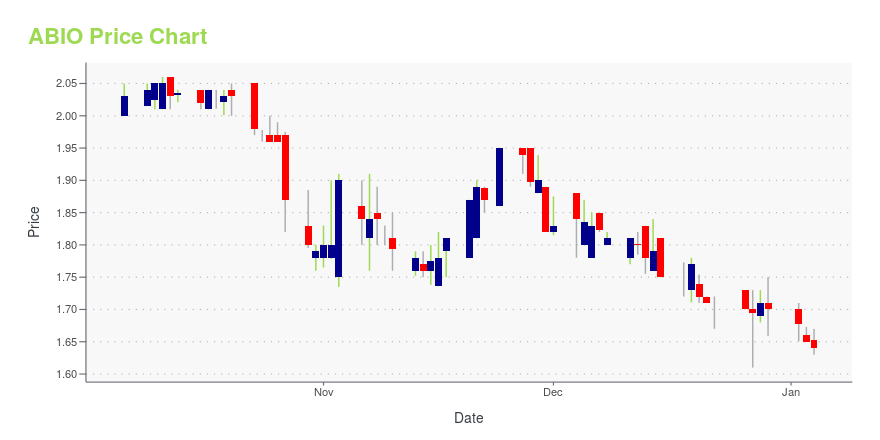

ABIO Stock Price Chart Interactive Chart >

ARCA biopharma, Inc. (ABIO) Company Bio

ARCA biopharma, Inc. operates as a biopharmaceutical company applying a precision medicine approach to developing and commercializing genetically targeted therapies for cardiovascular diseases. Its lead product candidate, Gencaro (bucindolol hydrochloride) is pharmacogenetically-targeted beta-adrenergic receptor antagonist, which is in the development for the treatment of atrial fibrillation in certain patients who also have heart failure (HF). The company also engages in the development of AB171, a thiol-substituted isosorbide mononitrate for the treatment of HF and peripheral arterial disease. ARCA biopharma, Inc. is headquartered in Westminster, Colorado.

Latest ABIO News From Around the Web

Below are the latest news stories about ARCA BIOPHARMA INC that investors may wish to consider to help them evaluate ABIO as an investment opportunity.

ARCA biopharma Announces Third Quarter 2023 Financial ResultsCompany is currently engaged in a strategic review process, evaluating additional development of its assets, collaborations and other strategic options WESTMINSTER, Colo., Oct. 18, 2023 (GLOBE NEWSWIRE) -- ARCA biopharma, Inc. (Nasdaq: ABIO), a biopharmaceutical company applying a precision medicine approach to developing genetically targeted therapies for cardiovascular diseases, today reported third quarter 2023 financial results and provided a corporate update. In April 2022, the Board of Dir |

ARCA biopharma Announces Second Quarter 2023 Financial ResultsCompany is currently engaged in a strategic review process, evaluating additional development of its assets, collaborations and other strategic options WESTMINSTER, Colo., July 21, 2023 (GLOBE NEWSWIRE) -- ARCA biopharma, Inc. (Nasdaq: ABIO), a biopharmaceutical company applying a precision medicine approach to developing genetically targeted therapies for cardiovascular diseases, today reported second quarter 2023 financial results and provided a corporate update. In April 2022, the Board of Di |

We're Not Very Worried About ARCA biopharma's (NASDAQ:ABIO) Cash Burn RateThere's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com... |

ARCA biopharma Announces First Quarter 2023 Financial ResultsCompany is currently engaged in a strategic review process, evaluating additional development of its assets, collaborations and other strategic optionsWESTMINSTER, Colo., April 24, 2023 (GLOBE NEWSWIRE) -- ARCA biopharma, Inc. (Nasdaq: ABIO), a biopharmaceutical company applying a precision medicine approach to developing genetically targeted therapies for cardiovascular diseases, today reported first quarter 2023 financial results and provided a corporate update. In April 2022, the Board of Dir |

ARCA biopharma Announces 2022 Financial Results and Provides Corporate UpdateCompany is currently engaged in a strategic review process, evaluating additional development of its assets, collaborations and other strategic optionsWESTMINSTER, Colo., Feb. 24, 2023 (GLOBE NEWSWIRE) -- ARCA biopharma, Inc. (Nasdaq: ABIO), a biopharmaceutical company applying a precision medicine approach to developing genetically targeted therapies for cardiovascular diseases, today reported 2022 financial results and provided a corporate update. In May 2022, the Company retained Ladenburg Th |

ABIO Price Returns

| 1-mo | -12.78% |

| 3-mo | -12.29% |

| 6-mo | 84.71% |

| 1-year | 53.92% |

| 3-year | 3.29% |

| 5-year | -52.50% |

| YTD | 84.71% |

| 2023 | -28.27% |

| 2022 | 10.23% |

| 2021 | -46.38% |

| 2020 | -29.78% |

| 2019 | -3.86% |

Loading social stream, please wait...