ACADIA Pharmaceuticals Inc. (ACAD): Price and Financial Metrics

ACAD Price/Volume Stats

| Current price | $19.14 | 52-week high | $32.59 |

| Prev. close | $18.55 | 52-week low | $14.55 |

| Day low | $18.55 | Volume | 2,358,400 |

| Day high | $19.21 | Avg. volume | 1,767,580 |

| 50-day MA | $16.10 | Dividend yield | N/A |

| 200-day MA | $21.18 | Market Cap | 3.16B |

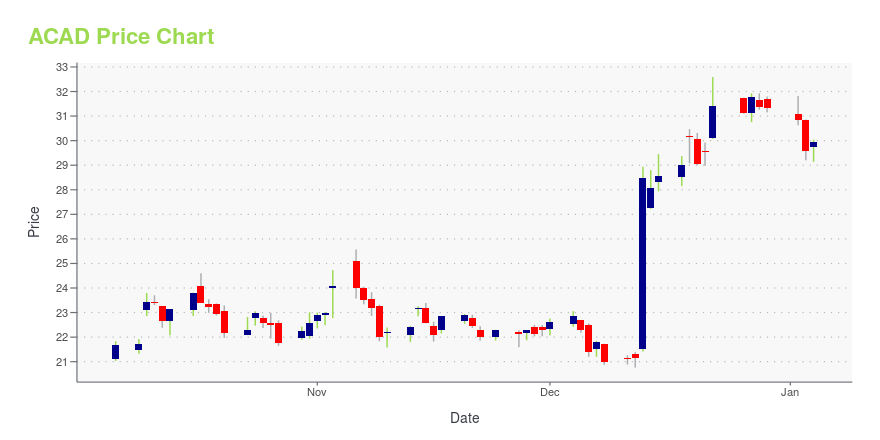

ACAD Stock Price Chart Interactive Chart >

ACADIA Pharmaceuticals Inc. (ACAD) Company Bio

Acadia Pharmaceuticals Inc is a biotechnology company which develops and commercializes biopharmaceutical products to address central nervous system disorders. The firm aims to discover small molecule drugs to address Parkinson's, Alzheimer's and schizophrenia. The company was founded in 1993 by Mark Brann, PhD., a professor at the University of Vermont, under the name Receptor Technologies. By 1997, the company established its headquarters in San Diego, California and changed its name to Acadia Pharmaceuticals Inc and currently employs over 400 people. Since 2015, Stephen R. Davis serves as Acadia’s Chief Executive Officer and member of the board of directors. Competition for Acadia includes Otsuka Pharmaceutical Co., Ltd., H. Lundbeck A/S, and off-label branded and generic antipsychotics.

Latest ACAD News From Around the Web

Below are the latest news stories about ACADIA PHARMACEUTICALS INC that investors may wish to consider to help them evaluate ACAD as an investment opportunity.

Acadia Pharmaceuticals to Present at the 42nd Annual J.P. Morgan Healthcare Conference on January 9, 2024SAN DIEGO, December 21, 2023--Acadia Pharmaceuticals Inc. (Nasdaq: ACAD) today announced that it will present at the 42nd Annual J.P. Morgan Healthcare Conference on Tuesday, January 9, 2024, at 9:00 a.m. Pacific Time, followed by a question and answer session. |

Acadia Pharmaceuticals Reports Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)SAN DIEGO, December 18, 2023--Acadia Pharmaceuticals Inc. (Nasdaq: ACAD) today announced that on December 13, 2023, the Compensation Committee of Acadia’s Board of Directors (the "Committee") granted inducement awards consisting of non-qualified stock options to purchase 33,647 shares of common stock and 20,146 restricted stock units ("RSUs") to eight new employees under Acadia’s 2023 Inducement Plan. The Compensation Committee approved the awards as an inducement material to the new employees’ |

ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) Shares Fly 25% But Investors Aren't Buying For GrowthACADIA Pharmaceuticals Inc. ( NASDAQ:ACAD ) shareholders would be excited to see that the share price has had a great... |

Delaware District Court Rules in Favor of Acadia on Formulation Patent Construction (Markman) Claims Regarding NUPLAZID® (pimavanserin)SAN DIEGO, December 14, 2023--Acadia Pharmaceuticals Inc. (Nasdaq: ACAD) today announced that the U.S. District Court for the District of Delaware has issued a Claim Construction Order in favor of Acadia regarding its ‘721 formulation patent for NUPLAZID® (pimavanserin), Acadia’s drug for the treatment of Parkinson’s Disease Psychosis. In today’s Order, the Court ruled in favor of Acadia on all of the disputed claim construction points. |

Acadia Soars To A Four-Month High After Winning A Patent Battle For Its Biggest DrugAcadia notched a win in a patent battle Wednesday pertaining to its Parkinson's drug and ACAD stock soared to a four-month high. |

ACAD Price Returns

| 1-mo | 23.48% |

| 3-mo | 14.54% |

| 6-mo | -28.95% |

| 1-year | -34.05% |

| 3-year | -9.50% |

| 5-year | -17.99% |

| YTD | -38.87% |

| 2023 | 96.67% |

| 2022 | -31.79% |

| 2021 | -56.34% |

| 2020 | 24.96% |

| 2019 | 164.56% |

Continue Researching ACAD

Here are a few links from around the web to help you further your research on Acadia Pharmaceuticals Inc's stock as an investment opportunity:Acadia Pharmaceuticals Inc (ACAD) Stock Price | Nasdaq

Acadia Pharmaceuticals Inc (ACAD) Stock Quote, History and News - Yahoo Finance

Acadia Pharmaceuticals Inc (ACAD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...