Aurora Cannabis Inc. (ACB): Price and Financial Metrics

ACB Price/Volume Stats

| Current price | $5.90 | 52-week high | $11.50 |

| Prev. close | $5.79 | 52-week low | $2.84 |

| Day low | $5.81 | Volume | 665,400 |

| Day high | $5.97 | Avg. volume | 4,077,032 |

| 50-day MA | $5.86 | Dividend yield | N/A |

| 200-day MA | $5.06 | Market Cap | 321.82M |

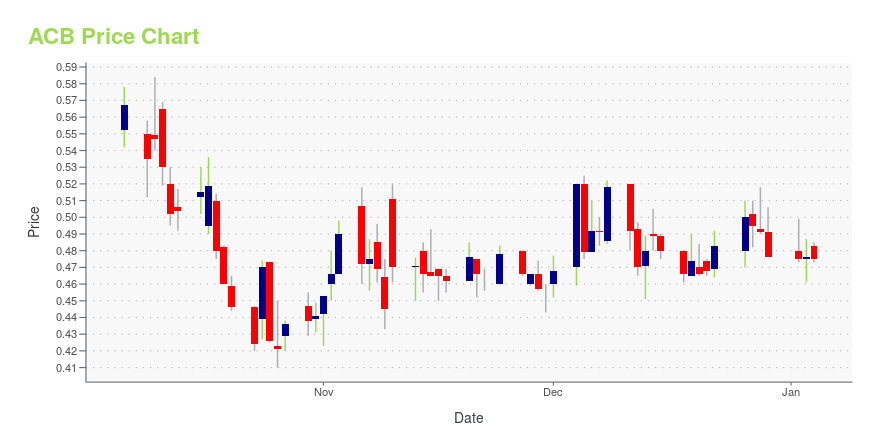

ACB Stock Price Chart Interactive Chart >

Aurora Cannabis Inc. (ACB) Company Bio

Aurora Cannabis, Inc. engages in the production, distribution and sale of cannabis products as is headquartered in Calgary, Canada. Aurora is a vertically integrated company, owning all aspects of the cannabis production process from scientific research and cultivation to product branding and distribution. The company’s marketing strategy focuses on three main segments of the cannabis market: Canadian, EU, and select global medical markets, Canadian recreational cannabis market, and the US hemp-driven market. Aurora operates licensed production facilities in Alberta, Ontario, British Columbia, and Denmark and maintains a workforce of over 2,700 employees. Miguel Martin serves as Aurora’s Chief Executive Officer.

Latest ACB News From Around the Web

Below are the latest news stories about AURORA CANNABIS INC that investors may wish to consider to help them evaluate ACB as an investment opportunity.

Where Will Aurora Cannabis Be in 5 Years?If it can start producing cash, its stock could start to run. |

12 Most Profitable Pot Stocks NowIn this piece, we will take a look at the 12 most profitable pot stocks now. If you want to skip our overview of the pot and cannabis industry, then you can skip ahead to 5 Most Profitable Pot Stocks Now. Pot, marijuana, or cannabis is one of the oldest drugs in the world. Since […] |

Better Marijuana Stock: Aurora Cannabis or Tilray Brands?Which of these top Canadian licensed producers is the better buy? |

An Atrocious Year For Canadian Cannabis LP Stocks Index: Down 64% YTDThe Canadian Cannabis LP Stocks Index is DOWN 1% so far in December and is now down 64% YTD on top of a 71% decline in 2022 and a 61% decline in 2021. |

Aurora Cannabis: Bull vs. BearIts transformation is shaping up nicely, but tough challenges remain. |

ACB Price Returns

| 1-mo | 24.47% |

| 3-mo | -11.94% |

| 6-mo | 47.83% |

| 1-year | 19.80% |

| 3-year | -91.37% |

| 5-year | -99.23% |

| YTD | 23.90% |

| 2023 | -48.38% |

| 2022 | -82.95% |

| 2021 | -34.90% |

| 2020 | -67.94% |

| 2019 | -56.45% |

Continue Researching ACB

Here are a few links from around the web to help you further your research on Aurora Cannabis Inc's stock as an investment opportunity:Aurora Cannabis Inc (ACB) Stock Price | Nasdaq

Aurora Cannabis Inc (ACB) Stock Quote, History and News - Yahoo Finance

Aurora Cannabis Inc (ACB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...