Accolade Inc. (ACCD): Price and Financial Metrics

ACCD Price/Volume Stats

| Current price | $4.08 | 52-week high | $15.36 |

| Prev. close | $3.85 | 52-week low | $3.35 |

| Day low | $3.92 | Volume | 1,481,554 |

| Day high | $4.11 | Avg. volume | 1,032,516 |

| 50-day MA | $5.51 | Dividend yield | N/A |

| 200-day MA | $8.62 | Market Cap | 326.43M |

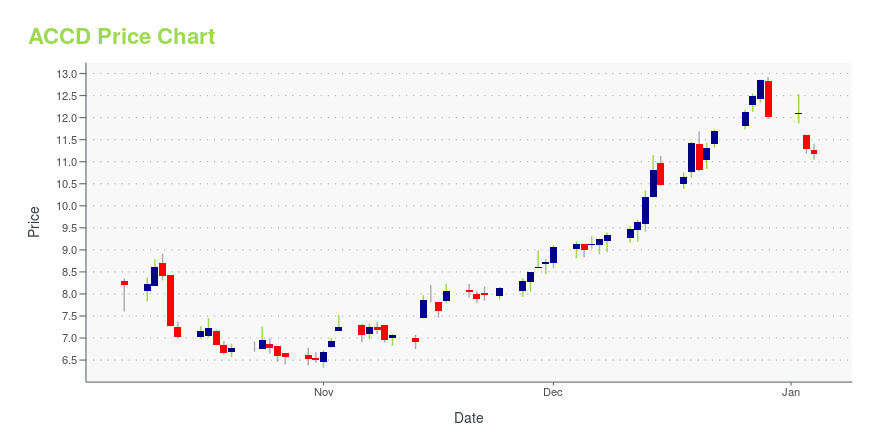

ACCD Stock Price Chart Interactive Chart >

Accolade Inc. (ACCD) Company Bio

Accolade, Inc. is an emerging growth company, which engages in the provision of personalized, technology-enabled solutions through a technology platform. It offers Accolade Total Benefits and Accolade Total Care. Accolade Total Benefits focuses on member benefits engagement and Accolade Total Care help guides members to healthcare providers. The company was founded by Thomas K. Spann and J. Michael Cline in 2007 and is headquartered in Seattle, WA.

Latest ACCD News From Around the Web

Below are the latest news stories about ACCOLADE INC that investors may wish to consider to help them evaluate ACCD as an investment opportunity.

Market Participants Recognise Accolade, Inc.'s (NASDAQ:ACCD) Revenues Pushing Shares 30% HigherAccolade, Inc. ( NASDAQ:ACCD ) shareholders are no doubt pleased to see that the share price has bounced 30% in the... |

Accolade to Announce Fiscal Third Quarter 2024 Financial ResultsSEATTLE, Dec. 11, 2023 (GLOBE NEWSWIRE) -- Accolade, Inc. (NASDAQ: ACCD) today announced that it will release fiscal third quarter 2024 financial results on Monday, January 8, 2024, after the market closes. In conjunction, the company will host a conference call to review results at 4:30 p.m. E.T. on the same day. Conference Call Details To Listen via Telephone: Pre-registration is required by the conference call operator. Please pre-register by clicking here (https://register.vevent.com/registe |

Is Accolade (ACCD) Stock Outpacing Its Business Services Peers This Year?Here is how Accolade (ACCD) and Adecco SA (AHEXY) have performed compared to their sector so far this year. |

Accolade To Present at Piper Sandler 35th Annual Healthcare ConferenceSEATTLE, Nov. 27, 2023 (GLOBE NEWSWIRE) -- Accolade, Inc. (NASDAQ: ACCD), a healthcare provider that serves millions of members, today announced that it will be presenting at the Piper Sandler 35th Annual Healthcare Conference in New York on Wednesday, November 29, 2023 at 10:00 am ET. A webcast of the company’s fireside chat will be available at ir.accolade.com and a replay will be available for 90 days. About Accolade, Inc. Accolade (Nasdaq: ACCD) is a Personalized Healthcare company that prov |

Accolade Announces Repurchase of $76.5 Million of 0.50% Convertible Senior Notes Due 2026SEATTLE, Nov. 16, 2023 (GLOBE NEWSWIRE) -- Accolade, Inc. (NASDAQ: ACCD) today announced that it has entered into separate, privately negotiated transactions with certain holders of its outstanding 0.50% Convertible Senior Notes due 2026 (the “Notes”) to repurchase (the “Repurchases”) approximately $76.5 million aggregate principal amount of the Notes for an aggregate cash repurchase price of approximately $65.8 million. “We are strategically improving our net cash position and strengthening our |

ACCD Price Returns

| 1-mo | -33.44% |

| 3-mo | -48.29% |

| 6-mo | -66.42% |

| 1-year | -71.13% |

| 3-year | -91.37% |

| 5-year | N/A |

| YTD | -66.03% |

| 2023 | 54.17% |

| 2022 | -70.45% |

| 2021 | -39.40% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...