Acer Therapeutics Inc. (ACER): Price and Financial Metrics

ACER Price/Volume Stats

| Current price | $0.66 | 52-week high | $4.56 |

| Prev. close | $0.80 | 52-week low | $0.55 |

| Day low | $0.66 | Volume | 574,600 |

| Day high | $0.85 | Avg. volume | 885,392 |

| 50-day MA | $0.81 | Dividend yield | N/A |

| 200-day MA | $1.00 | Market Cap | 16.15M |

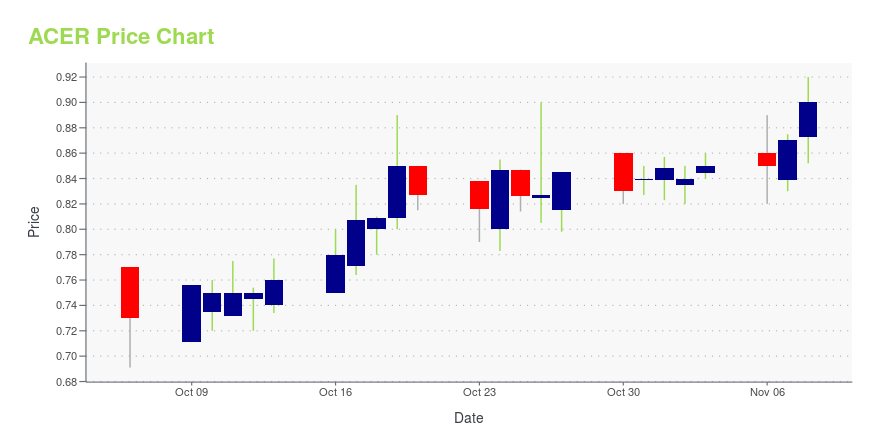

ACER Stock Price Chart Interactive Chart >

Acer Therapeutics Inc. (ACER) Company Bio

Acer Therapeutics Inc., formerly Opexa Therapeutics, develops therapies for the treatment of serious ultra-rare diseases with critical unmet medical needs. The company offers Celiprolol for vascular ehlers-danlos syndrome and ACER-001 for maple syrup urine disease. It also offers advancing ACER-001 for the treatment of urea cycle disorders. The company was founded in 2013 and is based in Cambridge, Massachusetts.

Latest ACER News From Around the Web

Below are the latest news stories about ACER THERAPEUTICS INC that investors may wish to consider to help them evaluate ACER as an investment opportunity.

Why Is Acer Therapeutics (ACER) Stock Up 85% Today?Acer Therapeutics (ACER) stock is taking off on Thursday after the company announced an acquisition deal with Zevra Therapeutics (ZVRA). |

Shopify (SHOP) Stock Jumps 6% on Amazon DealShopify (SHOP) stock is on the rise Thursday as investors react to a deal between it and e-commerce giant Amazon (AMZN). |

Why Is Axcella Health (AXLA) Stock Down 21% Today?Axcella Health (AXLA) stock is falling on Thursday following a rally from its announcement of a new Covid-19 treatment patent. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time for another breakdown of the biggest pre-market stock movers as we dive into all of the latest news for Thursday! |

Struggling Newton biotech Acer Therapeutics scooped up by Florida firmCelebration, Florida's Zevra Therapeutics Inc. is set to buy Acer Therapeutics Inc. in a deal worth up to $91 million. |

ACER Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -21.02% |

| 3-year | -72.03% |

| 5-year | -76.84% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 10.09% |

| 2021 | -12.98% |

| 2020 | -34.66% |

| 2019 | -80.07% |

Loading social stream, please wait...